BlackRock Investor Conference Presentation Deck

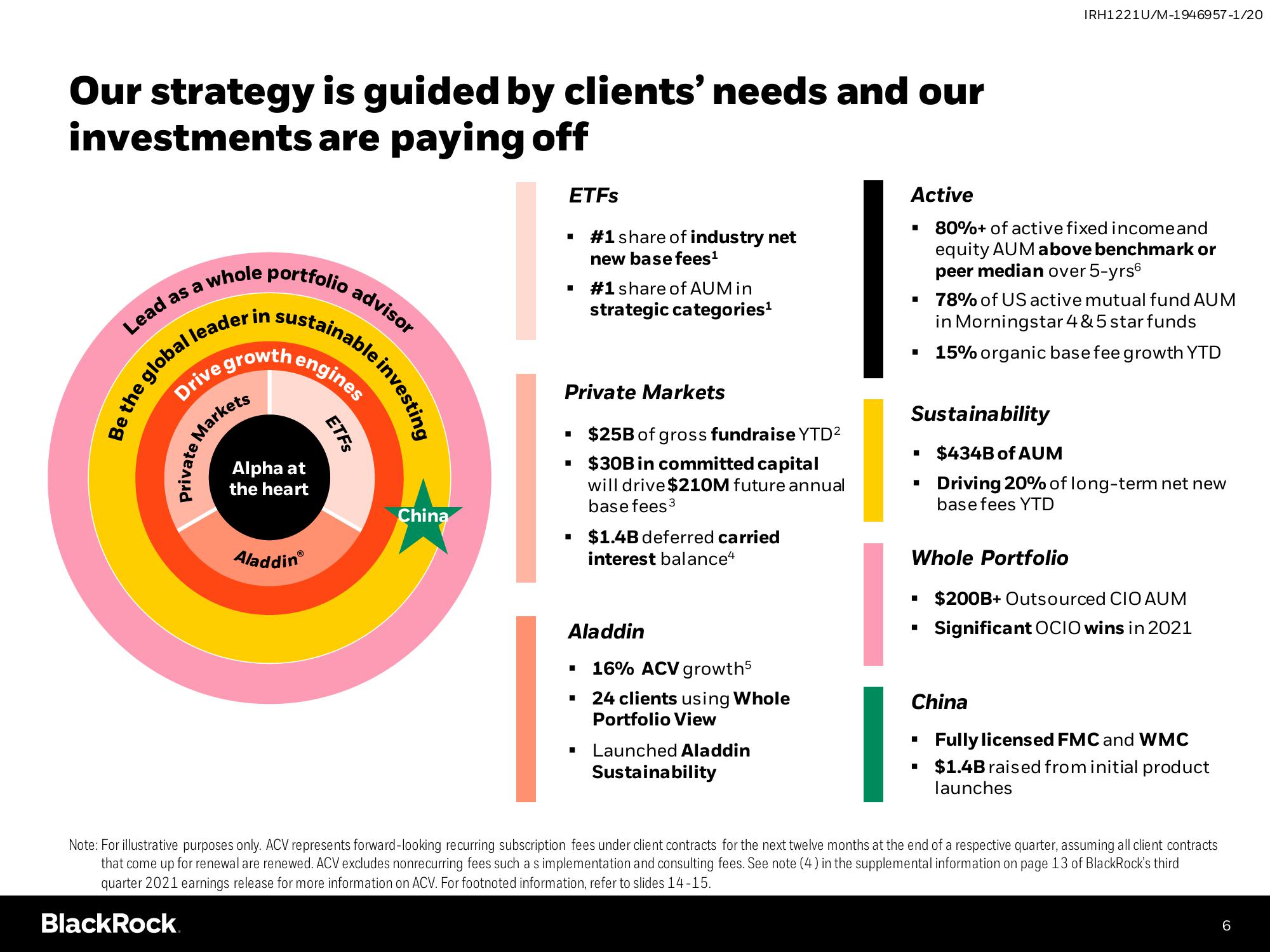

Our strategy is guided by clients' needs and our

investments are paying off

l leader in sustainable i

engines

whole

Lead as a

Be the global

growth

Drive g

portfolio

ate Mal

Alpha at

the heart

Aladdin

Ⓡ

ETFS

advisor

investing

China

ETFs

#1 share of industry net

new base fees¹

■

■ #1 share of AUM in

strategic categories¹

Private Markets

▪ $25B of gross fundraise YTD²

■ $30B in committed capital

will drive $210M future annual

base fees ³

■ $1.4B deferred carried

interest balance4

Aladdin

16% ACV growth5

24 clients using Whole

Portfolio View

■ Launched Aladdin

Sustainability

Active

80%+ of active fixed income and

equity AUM above benchmark or

peer median over 5-yrs6

IRH1221U/M-1946957-1/20

▪ 78% of US active mutual fund AUM

in Morningstar 4&5 star funds

15% organic base fee growth YTD

Sustainability

▪ $434B of AUM

▪ Driving 20% of long-term net new

base fees YTD

Whole Portfolio

■

$200B+ Outsourced CIO AUM

Significant OCIO wins in 2021

China

Fully licensed FMC and WMC

▪ $1.4B raised from initial product

launches

Note: For illustrative purposes only. ACV represents forward-looking recurring subscription fees under client contracts for the next twelve months at the end of a respective quarter, assuming all client contracts

that come up for renewal are renewed. ACV excludes nonrecurring fees such as implementation and consulting fees. See note (4) in the supplemental information on page 13 of BlackRock's third

quarter 2021 earnings release for more information on ACV. For footnoted information, refer to slides 14-15.

BlackRock

6View entire presentation