BlackRock Global Long/Short Credit Absolute Return Credit

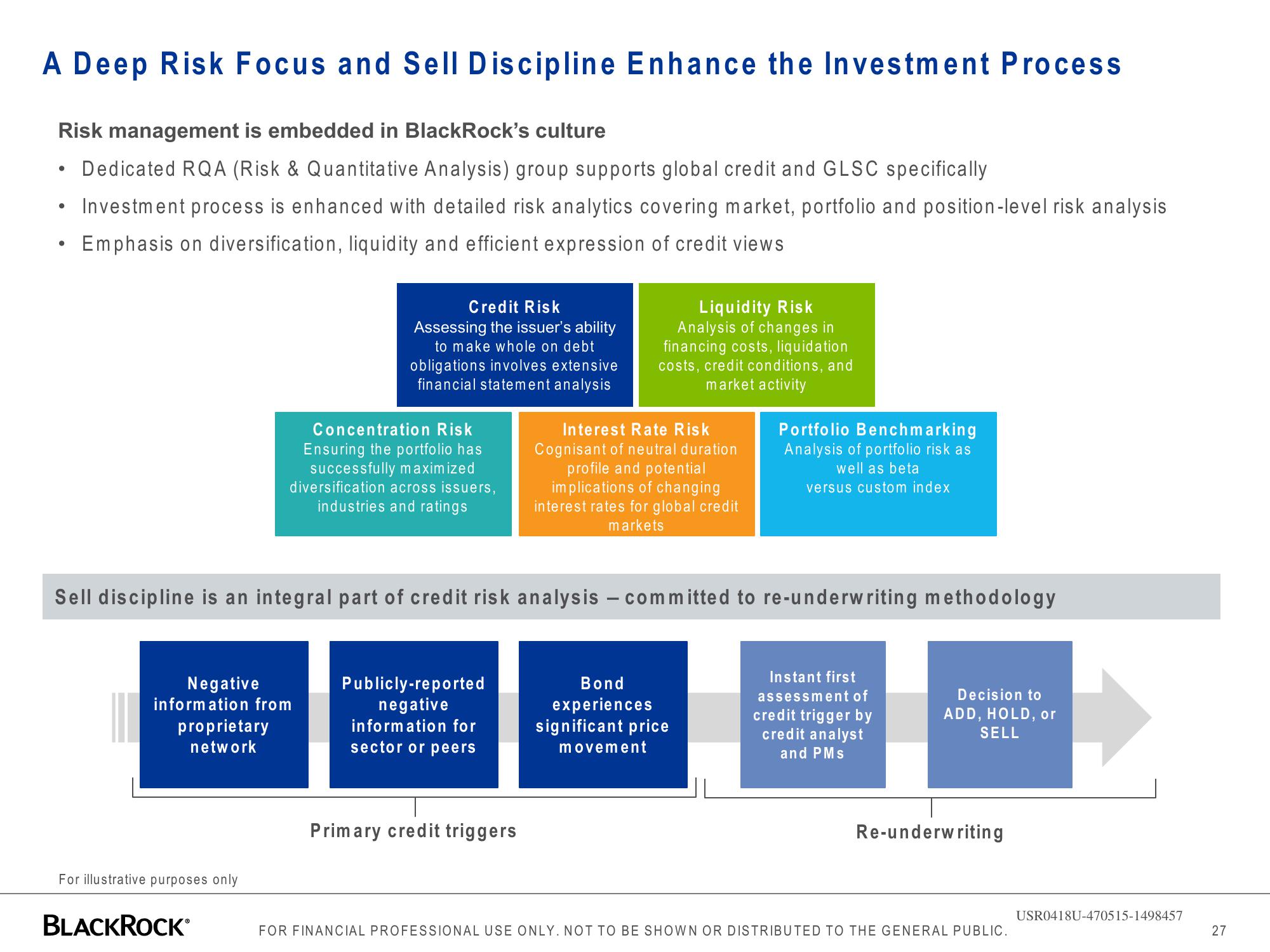

A Deep Risk Focus and Sell Discipline Enhance the Investment Process

Risk management is embedded in BlackRock's culture

Dedicated RQA (Risk & Quantitative Analysis) group supports global credit and GLSC specifically

Investment process is enhanced with detailed risk analytics covering market, portfolio and position-level risk analysis

Emphasis on diversification, liquidity and efficient expression of credit views

●

Negative

information from

proprietary

network

For illustrative purposes only

Credit Risk

Assessing the issuer's ability

to make whole on debt

obligations involves extensive

financial statement analysis

Concentration Risk

Ensuring the portfolio has

successfully maximized

diversification across issuers,

industries and ratings

BLACKROCK*

Sell discipline is an integral part of credit risk analysis - committed to re-underwriting methodology

Publicly-reported

negative

information for

sector or peers

Liquidity Risk

Analysis of changes in

financing costs, liquidation

costs, credit conditions, and

market activity

Primary credit triggers

Interest Rate Risk

Cognisant of neutral duration

profile and potential

implications of changing

interest rates for global credit

markets

Portfolio Benchmarking

Analysis of portfolio risk as

well as beta

versus custom index

Bond

experiences

significant price

movement

Instant first

assessment of

credit trigger by

credit analyst

and PMs

Decision to

ADD, HOLD, or

SELL

Re-underwriting

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

USR0418U-470515-1498457

27View entire presentation