Grab Results Presentation Deck

Q1 2023 Results

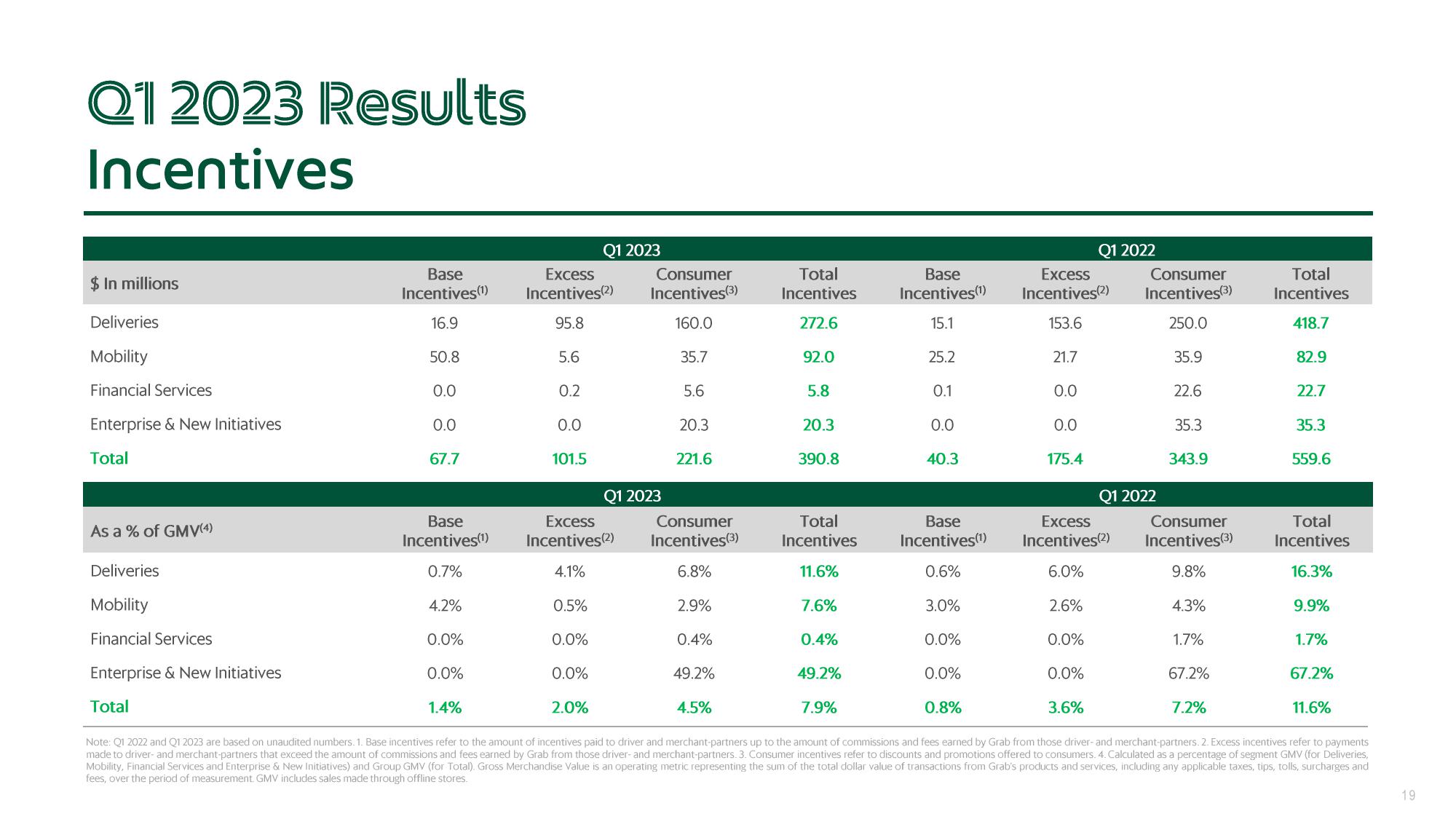

Incentives

$ In millions

Deliveries

Mobility

Financial Services

Enterprise & New Initiatives

Total

As a % of GMV(4)

Deliveries

Mobility

Financial Services

Enterprise & New Initiatives

Total

Base

Incentives (1)

16.9

50.8

0.0

0.0

67.7

Base

Incentives(¹)

0.7%

4.2%

0.0%

0.0%

1.4%

Excess

Incentives (2)

95.8

5.6

0.2

0.0

101.5

0.5%

Q1 2023

Excess

Incentives (2)

4.1%

0.0%

0.0%

2.0%

Consumer

Incentives (3)

160.0

35.7

5.6

Q1 2023

20.3

221.6

Consumer

Incentives (3)

6.8%

2.9%

0.4%

49.2%

Total

Incentives

272.6

4.5%

92.0

5.8

20.3

390.8

Total

Incentives

11.6%

7.6%

0.4%

Base

Incentives (1)

15.1

25.2

0.1

0.0

40.3

Base

Incentives (1)

0.6%

3.0%

0.0%

0.0%

0.8%

Q1 2022

Excess

Incentives(2)

153.6

21.7

0.0

0.0

175.4

Excess

Incentives (2)

6.0%

2.6%

0.0%

0.0%

3.6%

Consumer

Incentives (3)

250.0

Q1 2022

35.9

22.6

35.3

343.9

Consumer

Incentives (3)

9.8%

4.3%

49.2%

7.9%

Note: Q1 2022 and Q1 2023 are based on unaudited numbers. 1. Base incentives refer to the amount of incentives paid to driver and merchant-partners up to the amount of commissions and fees earned by Grab from those driver- and merchant-partners. 2. Excess incentives refer to payments

made to driver- and merchant-partners that exceed the amount of commissions and fees earned by Grab from those driver- and merchant-partners. 3. Consumer incentives refer to discounts and promotions offered to consumers. 4. Calculated as a percentage of segment GMV (for Deliveries,

Mobility, Financial Services and Enterprise & New Initiatives) and Group GMV (for Total). Gross Merchandise Value is an operating metric representing the sum of the total dollar value of transactions from Grab's products and services, including any applicable taxes, tips, tolls, surcharges and

fees, over the period of measurement GMV includes sales made through offline stores.

1.7%

Total

Incentives

418.7

82.9

22.7

67.2%

7.2%

35.3

559.6

Total

Incentives

16.3%

9.9%

1.7%

67.2%

11.6%

19View entire presentation