HBT Financial Results Presentation Deck

Capital and Liquidity Overview

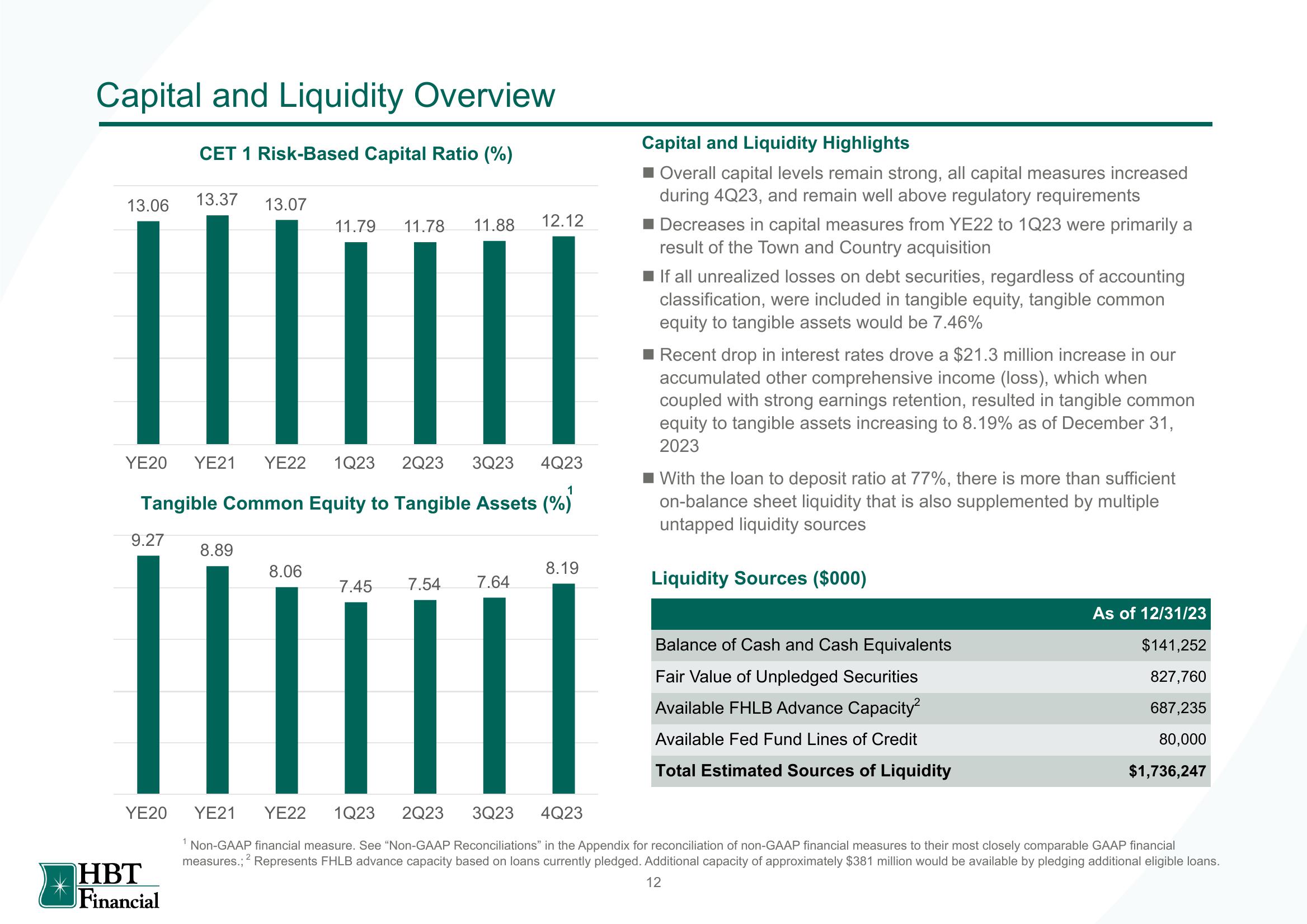

CET 1 Risk-Based Capital Ratio (%)

13.06

9.27

13.37

YE20 YE21 YE22 1Q23 2Q23 3Q23 4Q23

Tangible Common Equity to Tangible Assets (%)

1

HBT

Financial

13.07

8.89

1

11.79 11.78 11.88

12.12

8.06

7.45 7.54 7.64

|||||||

8.19

Capital and Liquidity Highlights

■ Overall capital levels remain strong, all capital measures increased

during 4Q23, and remain well above regulatory requirements

Decreases in capital measures from YE22 to 1Q23 were primarily a

result of the Town and Country acquisition

If all unrealized losses on debt securities, regardless of accounting

classification, were included in tangible equity, tangible common

equity to tangible assets would be 7.46%

Recent drop in interest rates drove a $21.3 million increase in our

accumulated other comprehensive income (loss), which when

coupled with strong earnings retention, resulted in tangible common

equity to tangible assets increasing to 8.19% as of December 31,

2023

With the loan to deposit ratio at 77%, there is more than sufficient

on-balance sheet liquidity that is also supplemented by multiple

untapped liquidity sources

Liquidity Sources ($000)

Balance of Cash and Cash Equivalents

Fair Value of Unpledged Securities

Available FHLB Advance Capacity²

Available Fed Fund Lines of Credit

Total Estimated Sources of Liquidity

YE20 YE21 YE22 1Q23

2Q23 3Q23 4Q23

Non-GAAP financial measure. See "Non-GAAP Reconciliations" in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial

measures.; 2 Represents FHLB advance capacity based on loans currently pledged. Additional capacity of approximately $381 million would be available by pledging additional eligible loans.

12

As of 12/31/23

$141,252

827,760

687,235

80,000

$1,736,247View entire presentation