Satellogic SPAC

TRANSACTION SUMMARY

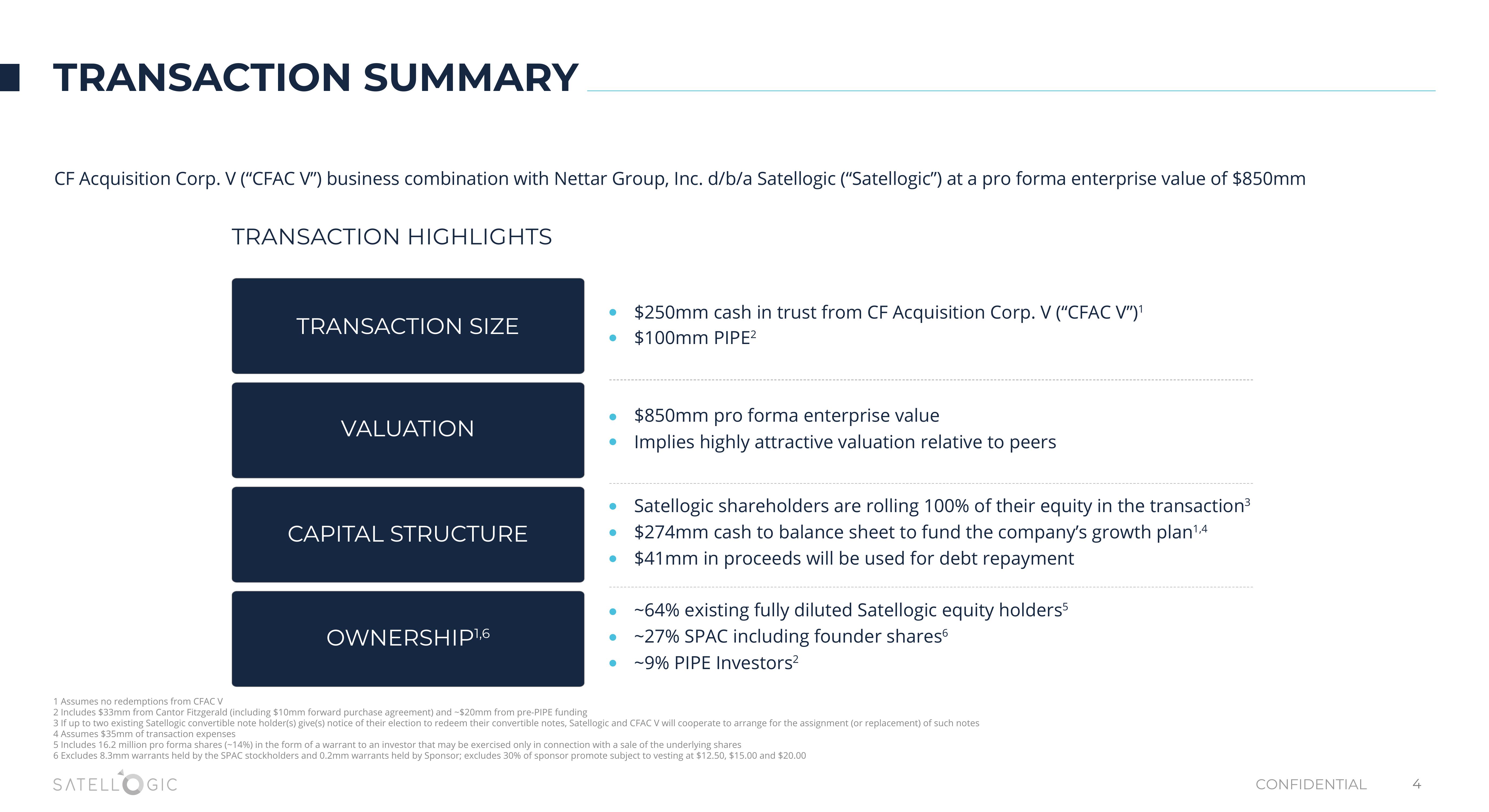

CF Acquisition Corp. V ("CFAC V") business combination with Nettar Group, Inc. d/b/a Satellogic ("Satellogic") at a pro forma enterprise value of $850mm

TRANSACTION HIGHLIGHTS

TRANSACTION SIZE

VALUATION

CAPITAL STRUCTURE

OWNERSHIP¹,6

$250mm cash in trust from CF Acquisition Corp. V ("CFAC V")¹

● $100mm PIPE²

●

●

●

●

●

●

●

$850mm pro forma enterprise value

Implies highly attractive valuation relative to peers

Satellogic shareholders are rolling 100% of their equity in the transaction³

$274mm cash to balance sheet to fund the company's growth plan¹4

$41mm in proceeds will be used for debt repayment

-64% existing fully diluted Satellogic equity holders5

-27% SPAC including founder shares

-9% PIPE Investors²

1 Assumes no redemptions from CFAC V

2 Includes $33mm from Cantor Fitzgerald (including $10mm forward purchase agreement) and -$20mm from pre-PIPE funding

3 If up to two existing Satellogic convertible note holder(s) give(s) notice of their election to redeem their convertible notes, Satellogic and CFAC V will cooperate to arrange for the assignment (or replacement) of such notes

4 Assumes $35mm of transaction expenses

5 Includes 16.2 million pro forma shares (-14%) in the form of a warrant to an investor that may be exercised only in connection with a sale of the underlying shares

6 Excludes 8.3mm warrants held by the SPAC stockholders and 0.2mm warrants held by Sponsor; excludes 30% of sponsor promote subject to vesting at $12.50, $15.00 and $20.00

SATELLOGIC

CONFIDENTIAL

4View entire presentation