Freshworks Investor Day Presentation Deck

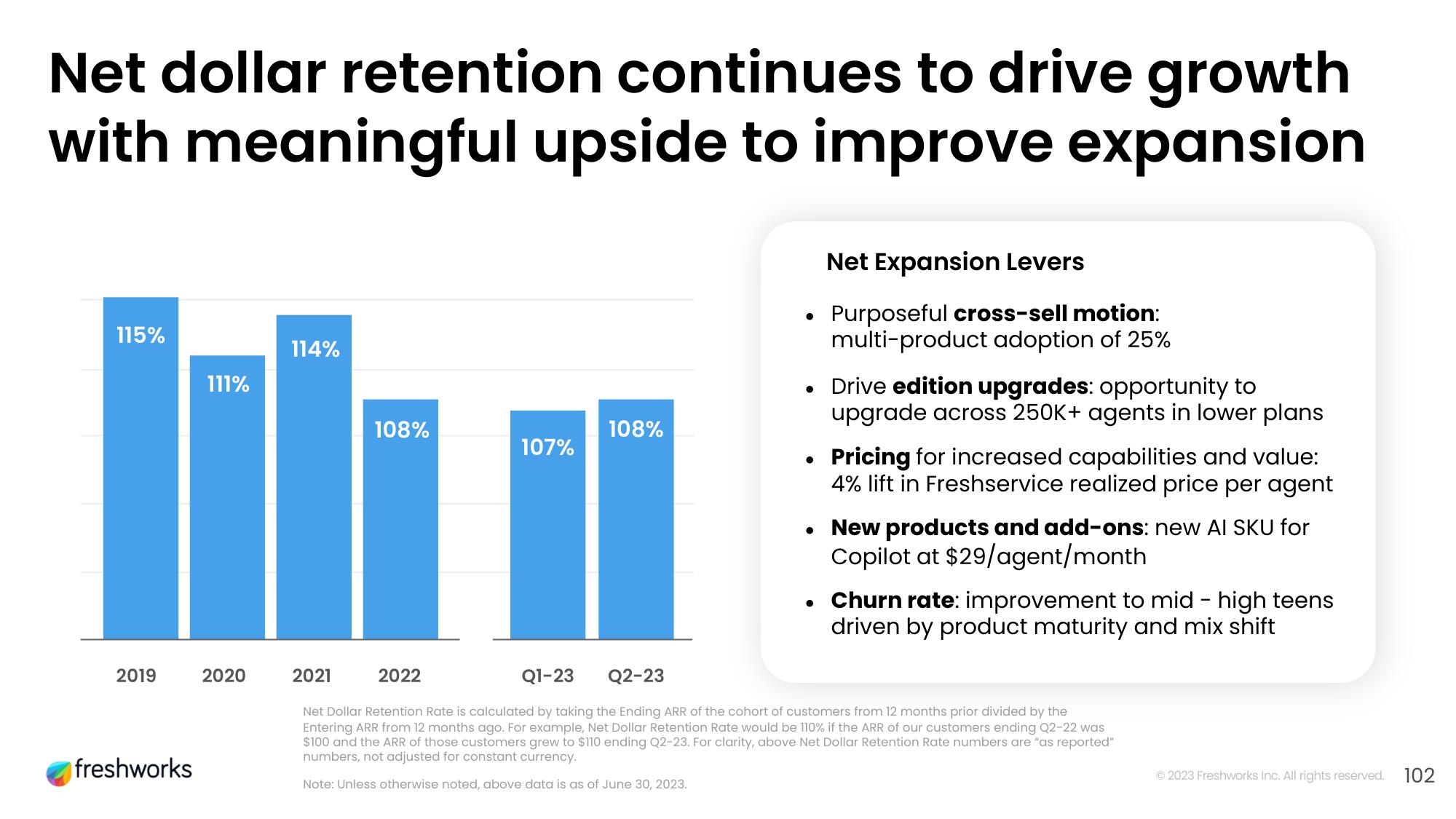

Net dollar retention continues to drive growth

with meaningful upside to improve expansion

115%

2019

freshworks

111%

2020

114%

108%

107%

2022

108%

Net Expansion Levers

Purposeful cross-sell motion:

multi-product adoption of 25%

• Drive edition upgrades: opportunity to

upgrade across 250K+ agents in lower plans

●

Pricing for increased capabilities and value:

4% lift in Freshservice realized price per agent

• New products and add-ons: new AI SKU for

Copilot at $29/agent/month

Churn rate: improvement to mid - high teens

driven by product maturity and mix shift

2021

Q1-23

Q2-23

Net Dollar Retention Rate is calculated by taking the Ending ARR of the cohort of customers from 12 months prior divided by the

Entering ARR from 12 months ago. For example, Net Dollar Retention Rate would be 110% if the ARR of our customers ending Q2-22 was

$100 and the ARR of those customers grew to $110 ending Q2-23. For clarity, above Net Dollar Retention Rate numbers are "as reported"

numbers, not adjusted for constant currency.

Note: Unless otherwise noted, above data is as of June 30, 2023.

Ⓒ2023 Freshworks Inc. All rights reserved.

102View entire presentation