Presentation to Vermont Pension Investment Committee

Correlation Analysis: Private Asset-Focused Investments

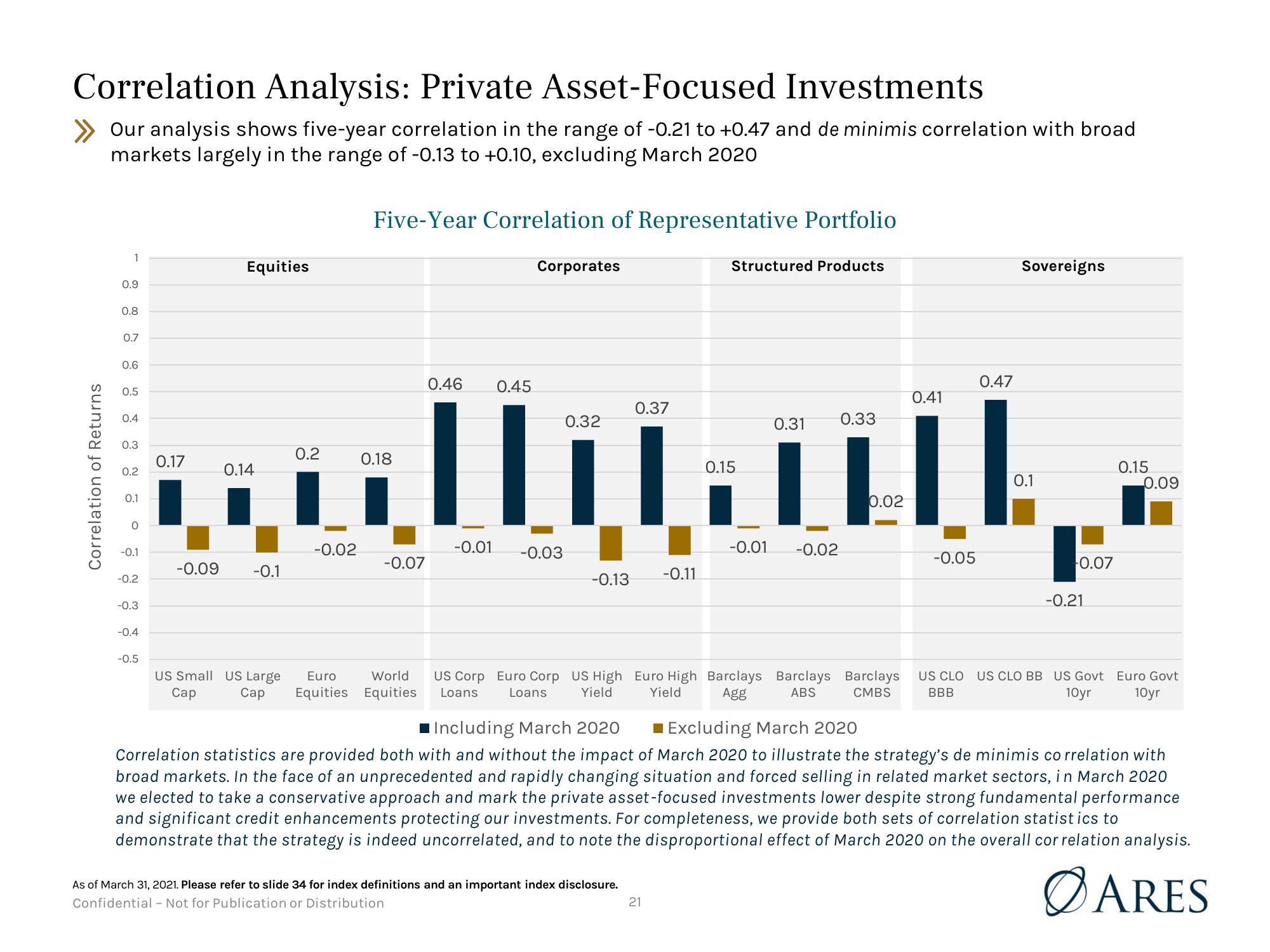

Our analysis shows five-year correlation in the range of -0.21 to +0.47 and de minimis correlation with broad

markets largely in the range of -0.13 to +0.10, excluding March 2020

Correlation of Returns

1

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

O

-0.1

-0.2

-0.3

-0.4

-0.5

0.17

Equities

0.14

-0.09 -0.1

0.2

-0.02

Five-Year Correlation of Representative Portfolio

0.18

0.45

0.32

111

-0.01

-0.03

-0.07

World

US Small US Large Euro

Cap Cap Equities Equities

Corporates

0.46

-0.13

0.37

As of March 31, 2021. Please refer to slide 34 for index definitions and an important index disclosure.

Confidential - Not for Publication or Distribution

-0.11

Structured Products

21

0.15

0.31 0.33

-0.01 -0.02

US Corp Euro Corp US High Euro High Barclays Barclays Barclays

Loans Loans Yield

ABS

CMBS

Yield

Agg

0.02

0.47

0.41

||

-0.05

Sovereigns

0.1

-0.07

-0.21

0.15

0.09

Including March 2020

■ Excluding March 2020

Correlation statistics are provided both with and without the impact of March 2020 to illustrate the strategy's de minimis correlation with

broad markets. In the face of an unprecedented and rapidly changing situation and forced selling in related market sectors, in March 2020

we elected to take a conservative approach and mark the private asset-focused investments lower despite strong fundamental performance

and significant credit enhancements protecting our investments. For completeness, we provide both sets of correlation statistics to

demonstrate that the strategy is indeed uncorrelated, and to note the disproportional effect of March 2020 on the overall cor relation analysis.

ARES

US CLO US CLO BB US Govt Euro Govt

BBB

10yr 10yrView entire presentation