Trian Partners Activist Presentation Deck

Despite Achieving ~100% of Annual Bonuses Over Time, Management Rarely Achieves

Many of The Long-Term Performance Targets...Does the Board See the Disconnect?

■

■

■

I

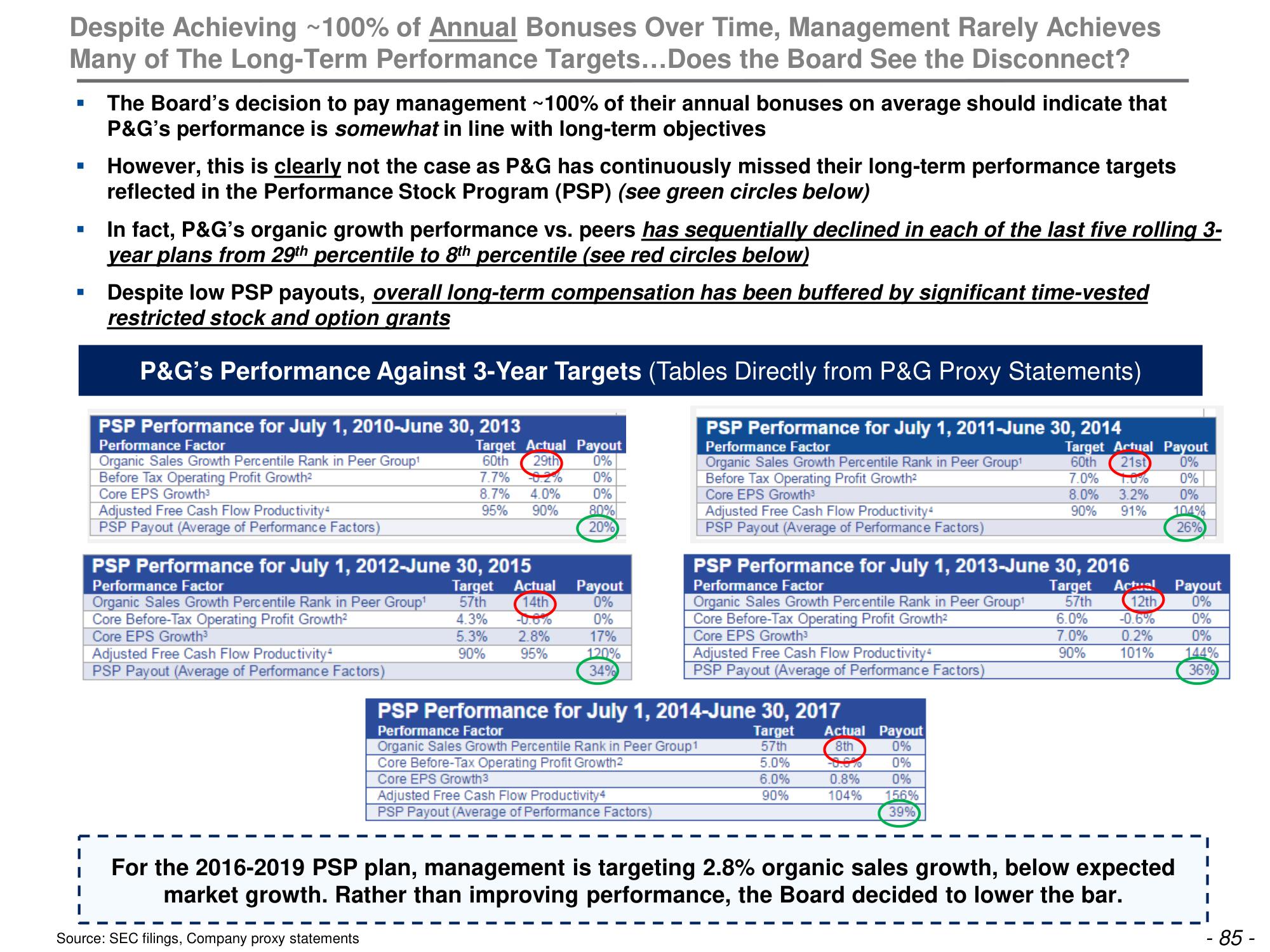

The Board's decision to pay management ~100% of their annual bonuses on average should indicate that

P&G's performance is somewhat in line with long-term objectives

However, this is clearly not the case as P&G has continuously missed their long-term performance targets

reflected in the Performance Stock Program (PSP) (see green circles below)

In fact, P&G's organic growth performance vs. peers has sequentially declined in each of the last five rolling 3-

year plans from 29th percentile to 8th percentile (see red circles below)

Despite low PSP payouts, overall long-term compensation has been buffered by significant time-vested

restricted stock and option grants

P&G's Performance Against 3-Year Targets (Tables Directly from P&G Proxy Statements)

PSP Performance for July 1, 2010-June 30, 2013

Performance Factor

Organic Sales Growth Percentile Rank in Peer Group¹

Before Tax Operating Profit Growth²

Core EPS Growth³

Adjusted Free Cash Flow Productivity4

PSP Payout (Average of Performance Factors)

Target Actual Payout

60th 29th 0%

7.7%

0%

0%

8.7%

95%

80%

20%

Adjusted Free Cash Flow Productivity

PSP Payout (Average of Performance Factors)

-0.2%

4.0%

90%

PSP Performance for July 1, 2012-June 30, 2015

Performance Factor

Organic Sales Growth Percentile Rank in Peer Group¹

Core Before-Tax Operating Profit Growth²

Core EPS Growth³

Target Actual Payout

57th

14th

0%

4.3%

0%

5.3%

17%

90%

120%

34%

-0.0%

2.8%

95%

PSP Performance for July 1, 2011-June 30, 2014

Performance Factor

Organic Sales Growth Percentile Rank in Peer Group¹

Before Tax Operating Profit Growth²

Core EPS Growth³

Adjusted Free Cash Flow Productivity4

PSP Payout (Average of Performance Factors)

Adjusted Free Cash Flow Productivity

PSP Payout (Average of Performance Factors)

Organic Sales Growth Percentile Rank in Peer Group 1

Core Before-Tax Operating Profit Growth2

Core EPS Growth3

Adjusted Free Cash Flow Productivity4

PSP Payout (Average of Performance Factors)

PSP Performance for July 1, 2014-June 30, 2017

Performance Factor

PSP Performance for July 1, 2013-June 30, 2016

Performance Factor

Organic Sales Growth Percentile Rank in Peer Group¹

Core Before-Tax Operating Profit Growth²

Core EPS Growth³

Target Actual

57th 12th

6.0% -0.6%

7.0%

0.2%

90%

101%

Target Actual Payout

57th

8th

0%

5.0%

0%

6.0%

0%

90%

156%

39%

Target Artual Payout

60th 21st

0%

-0.0 10

0.8%

104%

7.0% 1.0%

8.0% 3.2%

90% 91%

0%

0%

104%

26%

For the 2016-2019 PSP plan, management is targeting 2.8% organic sales growth, below expected

market growth. Rather than improving performance, the Board decided to lower the bar.

Source: SEC filings, Company proxy statements

Payout

0%

0%

0%

144%

36%

- 85 -View entire presentation