Palantir Results Presentation Deck

Appendix B

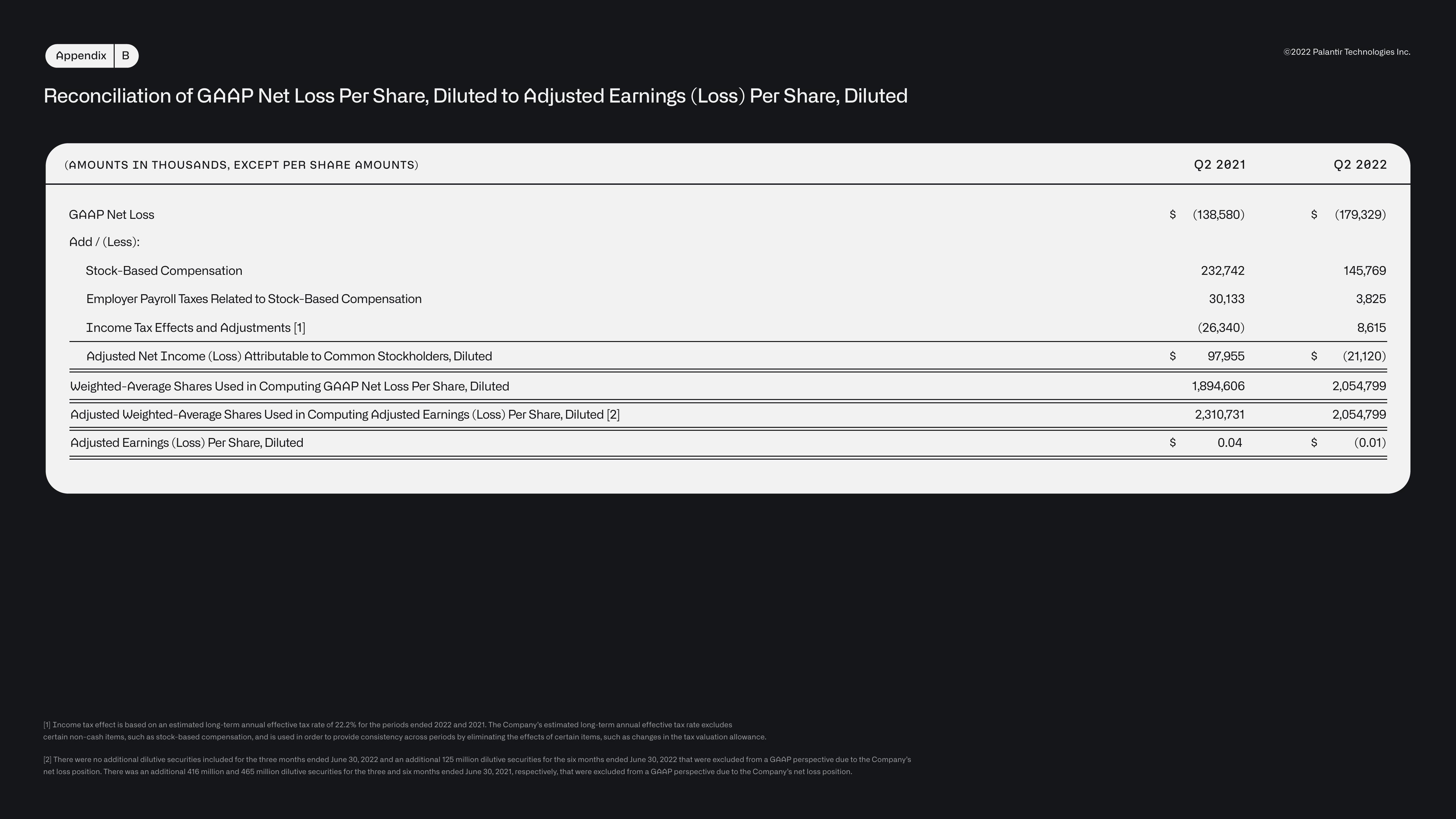

Reconciliation of GAAP Net Loss Per Share, Diluted to Adjusted Earnings (Loss) Per Share, Diluted

(AMOUNTS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

GAAP Net Loss

Add / (Less):

Stock-Based Compensation

Employer Payroll Taxes Related to Stock-Based Compensation

Income Tax Effects and Adjustments [1]

Adjusted Net Income (Loss) Attributable to Common Stockholders, Diluted

Weighted-Average Shares Used in Computing GAAP Net Loss Per Share, Diluted

Adjusted Weighted-Average Shares Used in Computing Adjusted Earnings (Loss) Per Share, Diluted [2]

Adjusted Earnings (Loss) Per Share, Diluted

[1] Income tax effect is based on an estimated long-term annual effective tax rate of 22.2% for the periods ended 2022 and 2021. The Company's estimated long-term annual effective tax rate excludes

certain non-cash items, such as stock-based compensation, and is used in order to provide consistency across periods by eliminating the effects of certain items, such as changes in the tax valuation allowance.

[2] There were no additional dilutive securities included for the three months ended June 30, 2022 and an additional 125 million dilutive securities for the six months ended June 30, 2022 that were excluded from a GAAP perspective due to the Company's

net loss position. There was an additional 416 million and 465 million dilutive securities for the three and six months ended June 30, 2021, respectively, that were excluded from a GAAP perspective due to the Company's net loss position.

$

$

$

Q2 2021

(138,580)

232,742

30,133

(26,340)

97,955

1,894,606

2,310,731

0.04

Ⓒ2022 Palantir Technologies Inc.

$

$

$

Q2 2022

(179,329)

145,769

3,825

8,615

(21,120)

2,054,799

2,054,799

(0.01)View entire presentation