Vici Investor Presentation

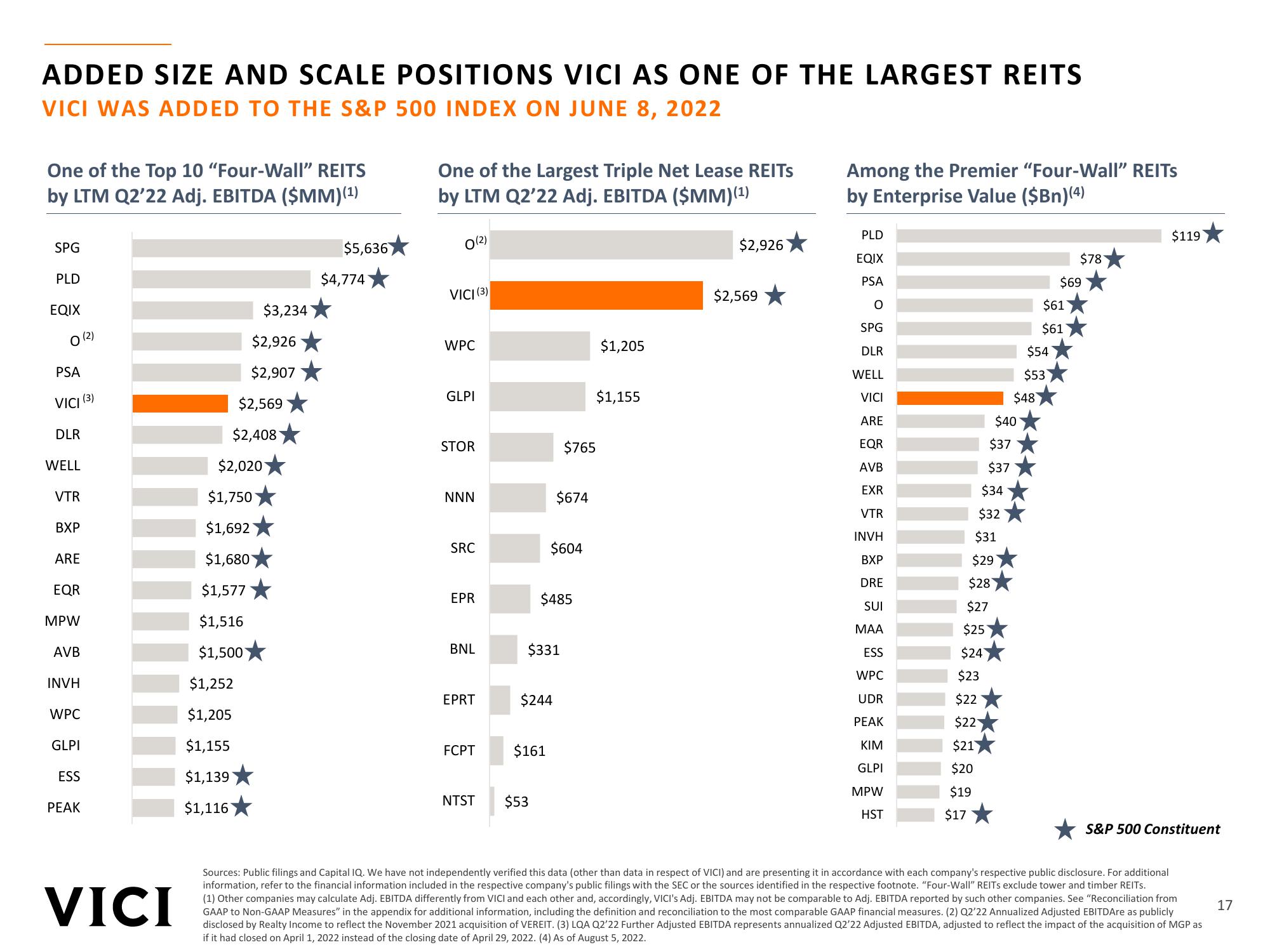

ADDED SIZE AND SCALE POSITIONS VICI AS ONE OF THE LARGEST REITS

VICI WAS ADDED TO THE S&P 500 INDEX ON JUNE 8, 2022

One of the Top 10 "Four-Wall" REITS

by LTM Q2'22 Adj. EBITDA ($MM) (¹)

SPG

PLD

EQIX

O

PSA

VICI

DLR

WELL

VTR

BXP

ARE

EQR

MPW

AVB

INVH

WPC

GLPI

ESS

PEAK

(2)

(3)

VICI

$2,926

$2,907

$3,234

$2,569

$2,408

$2,020

$1,252

$1,205

$1,155

$1,139

$1,1167

$1,750

$1,692

$1,680

$1,577

$1,516

$1,500

$5,636

$4,774

One of the Largest Triple Net Lease REITS

by LTM Q2'22 Adj. EBITDA ($MM)(¹)

0(2)

VICI (3)

WPC

GLPI

STOR

NNN

SRC

EPR

BNL

EPRT

FCPT

NTST

$331

$244

$161

$53

$674

$604

$485

$765

$1,205

$1,155

$2,926

$2,569

Among the Premier "Four-Wall" REITs

by Enterprise Value ($Bn)(4)

PLD

EQIX

PSA

O

SPG

DLR

WELL

VICI

ARE

EQR

AVB

EXR

VTR

INVH

BXP

DRE

SUI

MAA

ESS

WPC

UDR

PEAK

KIM

GLPI

MPW

HST

$19

$17

$37

$37

$34

$32

$28

$27

$25

$24

$23

$22

$22

$21

$20

$31

$29

$40

$48

$54

$53

$61

$61

$78

$69

$119

S&P 500 Constituent

Sources: Public filings and Capital IQ. We have not independently verified this data (other than data in respect of VICI) and are presenting it in accordance with each company's respective public disclosure. For additional

information, refer to the financial information included in the respective company's public filings with the SEC or the sources identified in the respective footnote. "Four-Wall" REITs exclude tower and timber REITs.

(1) Other companies may calculate Adj. EBITDA differently from VICI and each other and, accordingly, VICI's Adj. EBITDA may not be comparable to Adj. EBITDA reported by such other companies. See "Reconciliation from

GAAP to Non-GAAP Measures" in the appendix for additional information, including the definition and reconciliation to the most comparable GAAP financial measures. (2) Q2'22 Annualized Adjusted EBITDAre as publicly

disclosed by Realty Income to reflect the November 2021 acquisition of VEREIT. (3) LQA Q2'22 Further Adjusted EBITDA represents annualized Q2'22 Adjusted EBITDA, adjusted to reflect the impact of the acquisition of MGP as

if it had closed on April 1, 2022 instead of the closing date of April 29, 2022. (4) As of August 5, 2022.

17View entire presentation