sndl Investor Presentation

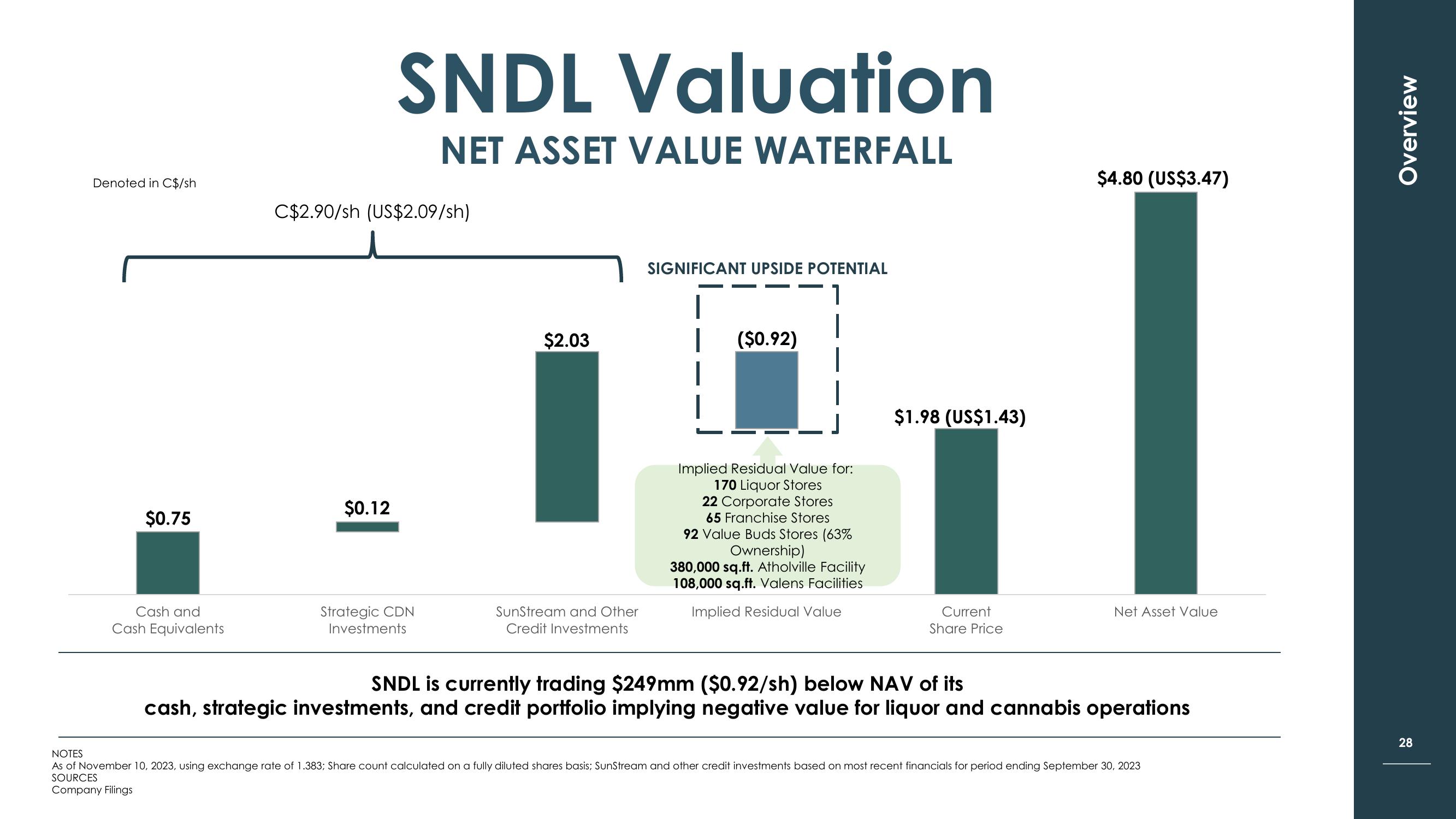

Denoted in C$/sh

$0.75

Cash and

Cash Equivalents

SNDL Valuation

NET ASSET VALUE WATERFALL

C$2.90/sh (US$2.09/sh)

$0.12

Strategic CDN

Investments

$2.03

SunStream and Other

Credit Investments

SIGNIFICANT UPSIDE POTENTIAL

1

($0.92)

Implied Residual Value for:

170 Liquor Stores

22 Corporate Stores

65 Franchise Stores

92 Value Buds Stores (63%

Ownership)

380,000 sq.ft. Atholville Facility

108,000 sq.ft. Valens Facilities

Implied Residual Value

$1.98 (US$1.43)

Current

Share Price

$4.80 (US$3.47)

Net Asset Value

SNDL is currently trading $249mm ($0.92/sh) below NAV of its

cash, strategic investments, and credit portfolio implying negative value for liquor and cannabis operations

NOTES

As of November 10, 2023, using exchange rate of 1.383; Share count calculated on a fully diluted shares basis; SunStream and other credit investments based on most recent financials for period ending September 30, 2023

SOURCES

Company Filings

Overview

28View entire presentation