a16z: Crypto Applications

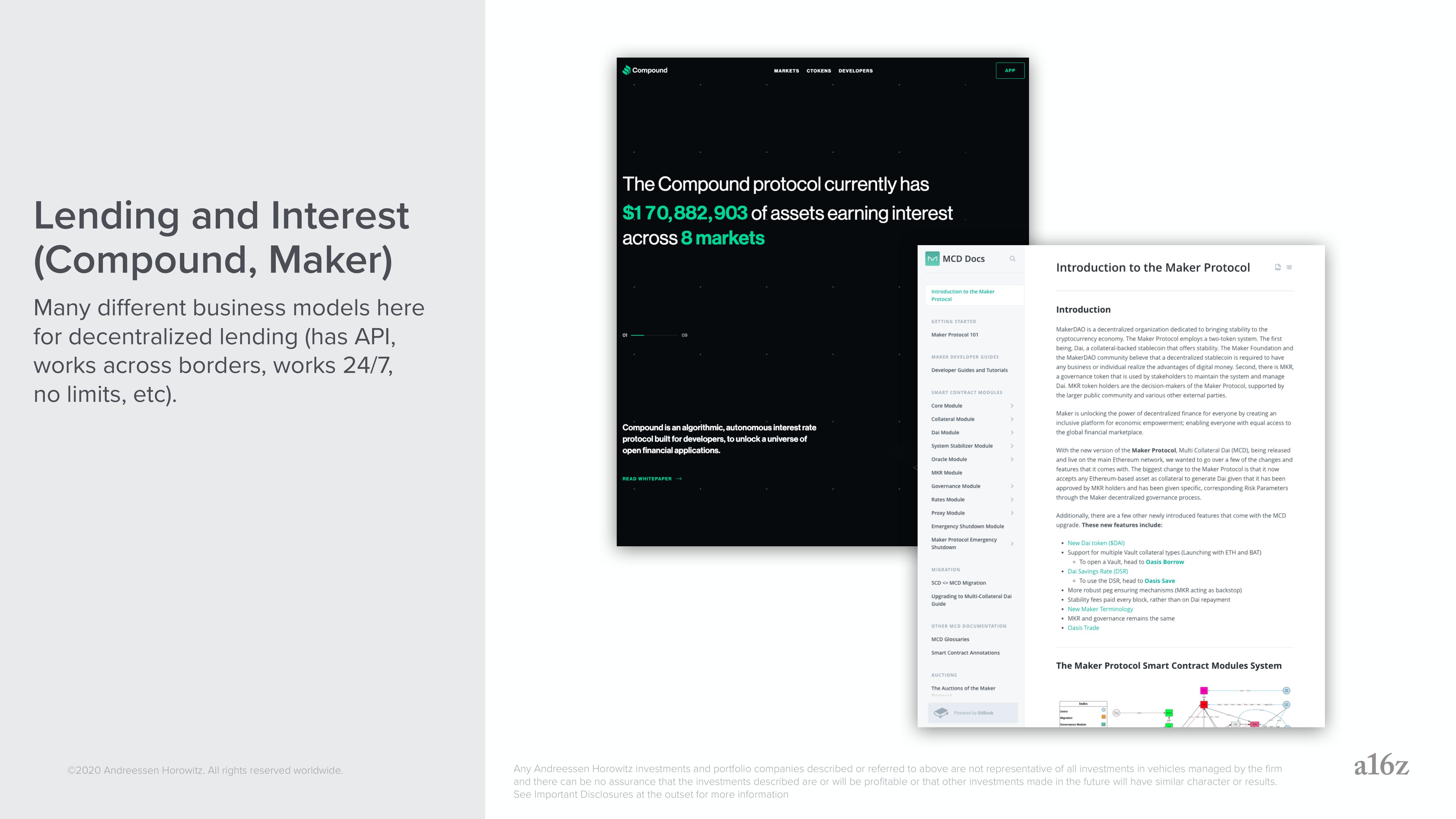

Lending and Interest

(Compound, Maker)

Many different business models here

for decentralized lending (has API,

works across borders, works 24/7,

no limits, etc).

Ⓒ2020 Andreessen Horowitz. All rights reserved worldwide.

Compound

MARKETS CTOKENS

The Compound protocol currently has

$170,882,903 of assets earning interest

across 8 markets

Compound is an algorithmic, autonomous interest rate

protocol built for developers, to unlock a universe of

open financial applications.

READ WHITEPAPER →

DEVELOPERS

MCD Docs

Introduction to the Maker

Protocol

GETTING STARTED

Maker Protocol 101

MAKER DEVELOPER GUIDES

Developer Guides and Tutorials

SMART CONTRACT MODULES

Core Module

Collateral Module

Dai Module

System Stabilizer Module

Oracle Module

MKR Module

Governance Module

Rates Module

Proxy Module

Emergency Shutdown Module

Maker Protocol Emergency

Shutdown

MIGRATION

APP

SCD MCD Migration

Upgrading to Multi-Collateral Dai

Guide

OTHER MCD DOCUMENTATION

MCD Glossaries

Smart Contract Annotations

AUCTIONS

The Auctions of the Maker

Powered by Book

Q

Introduction to the Maker Protocol

Introduction

MakerDAO is a decentralized organization dedicated to bringing stability to the

cryptocurrency economy. The Maker Protocol employs a two-token system. The first

being, Dai, a collateral-backed stablecoin that offers stability. The Maker Foundation and

the MakerDAO community believe that a decentralized stablecoin is required to have

any business or individual realize the advantages of digital money. Second, there is MKR,

a governance token that is used by stakeholders to maintain the system and manage

Dai. MKR token holders are the decision-makers of the Maker Protocol, supported by

the larger public community and various other external parties.

Maker is unlocking the power of decentralized finance for everyone by creating an

inclusive platform for economic empowerment; enabling everyone with equal access to

the global financial marketplace.

With the new version of the Maker Protocol, Multi Collateral Dai (MCD), being released

and live on the main Ethereum network, we wanted to go over a few of the changes and

features that it comes with. The biggest change to the Maker Protocol is that it now

accepts any Ethereum-based asset as collateral to generate Dai given that it has been

approved by MKR holders and has been given specific, corresponding Risk Parameters

through the Maker decentralized governance process.

Additionally, there are a few other newly introduced features that come with the MCD

upgrade. These new features include:

• New Dai token ($DAI)

• Support for multiple Vault collateral types (Launching with ETH and BAT)

To open a Vault, head to Oasis Borrow

Savings Rate (DSR)

Dai

• To use the DSR, head to Oasis Save

• More robust peg ensuring mechanisms (MKR acting as backstop)

• Stability fees paid every block, rather than on Dai repayment

• New Maker Terminology

• MKR and governance remains the same

• Oasis Trade

The Maker Protocol Smart Contract Modules System

Any Andreessen Horowitz investments and portfolio companies described or referred to above are not representative of all investments in vehicles managed by the firm

and there can be no assurance that the investments described are or will be profitable or that other investments made in the future will have similar character or results.

See Important Disclosures at the outset for more information

a16zView entire presentation