Solid Cash Flows: Fed Tightening

U.S. Real Estate Assets Provide Attractive Returns

In a world of growing uncertainty and intensifying global risk, we at Dynex believe that generating cash income from

United States real estate related assets and the United States housing finance system is the most attractive

investment in global capital markets today.

●

In our opinion, the optimal portfolio for the environment is a diversified pool of highly liquid mortgage investments

with minimal credit risk.

Given our view of the environment, we believe long-term investors should seek and favor experienced management

teams and Dynex brings significant experience and expertise in managing securitized real estate assets through

multiple economic cycles.

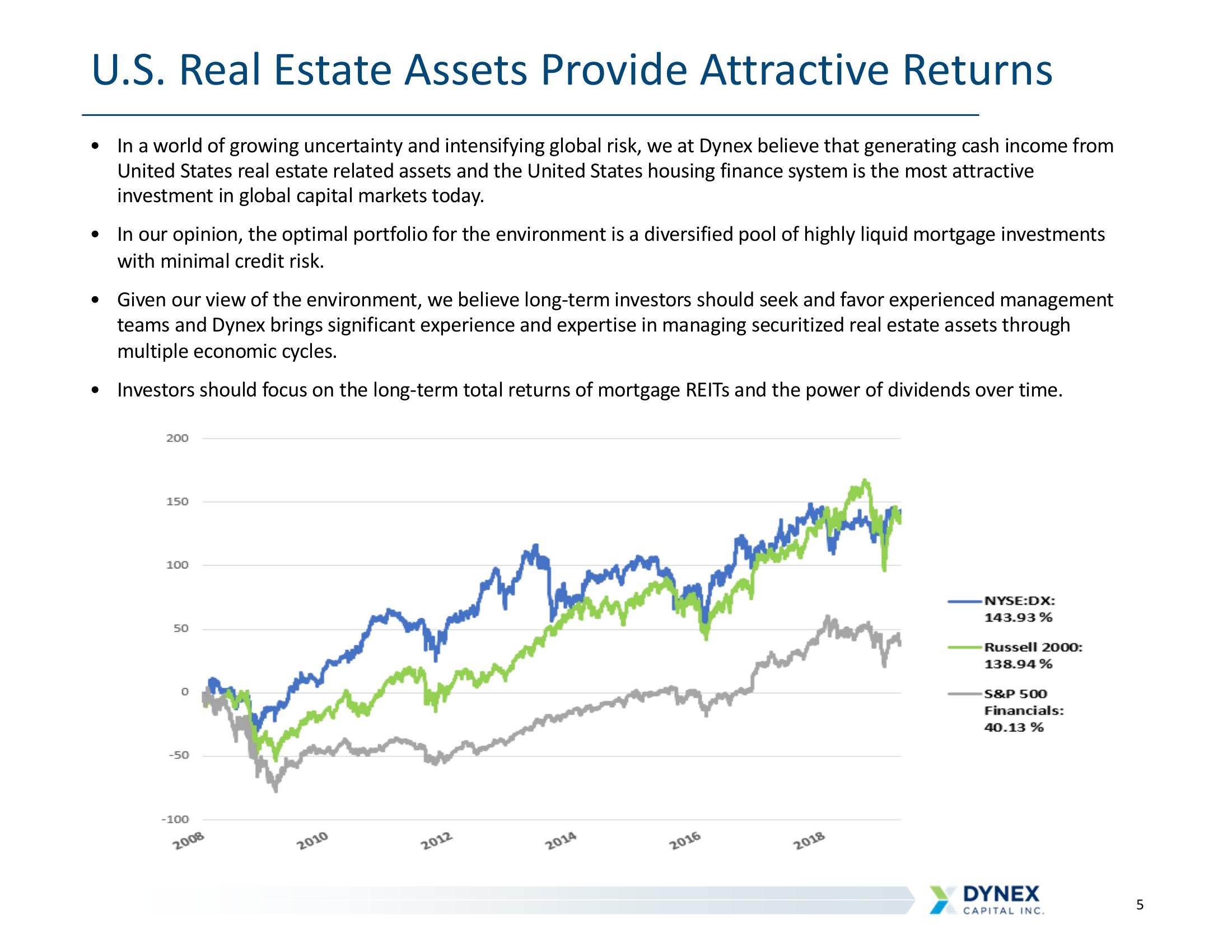

Investors should focus on the long-term total returns of mortgage REITs and the power of dividends over time.

200

150

100

50

0

-50

-100

2008

2010

2012

2014

2016

Marty

2018

NYSE:DX:

143.93 %

Russell 2000:

138.94%

S&P 500

Financials:

40.13 %

DYNEX

CAPITAL INC.

LO

5View entire presentation