Baird Investment Banking Pitch Book

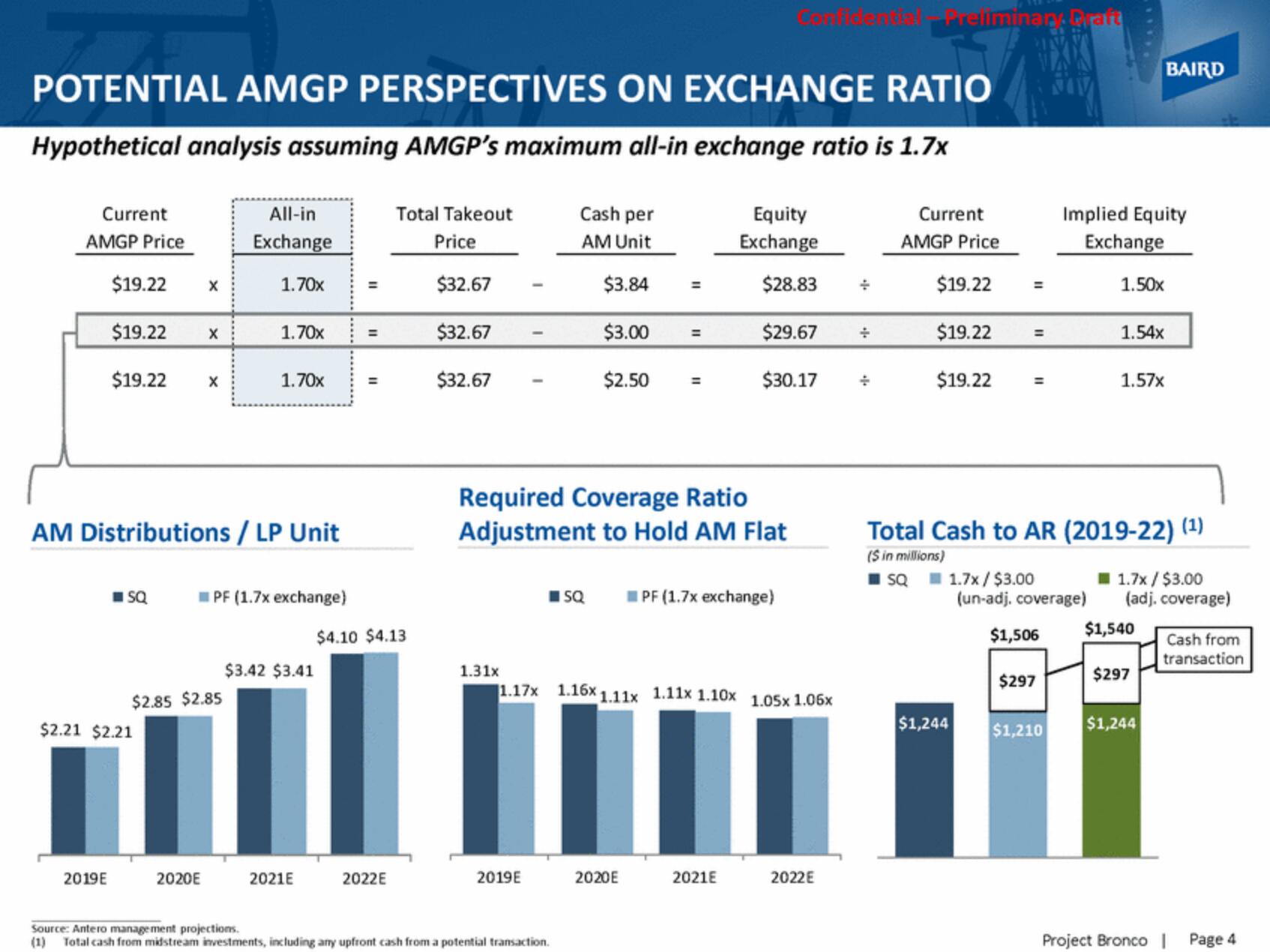

POTENTIAL AMGP PERSPECTIVES ON EXCHANGE RATIO

Hypothetical analysis assuming AMGP's maximum all-in exchange ratio is 1.7x

Current

AMGP Price

$19.22 X

$19.22 X

$19.22

2019E

ISQ

$2.21 $2.21

X

AM Distributions / LP Unit

$2.85 $2.85

2020E

All-in

Exchange

1.70x

1.70x

1.70x

PF (1.7x exchange)

$3.42 $3.41

2021E

=

=

Total Takeout

Price

$32.67

$32.67

$4.10 $4.13

2022E

$32.67

1.31x

Cash per

AM Unit

Required Coverage Ratio

Adjustment to Hold AM Flat

2019E

$3.84 =

$3.00 =

$2.50

Source: Antero management projections.

Total cash from midstream investments, including any upfront cash from a potential transaction.

ISQ PF (1.7x exchange)

1.17x 1.16x 1.11x 1.11x 1.10x 1.05x 1.06x

Confidenes Preliminary, Graft

Equity

Exchange

$28.83

$29.67 ÷

$30.17 +

2020E

2021E

2022E

Current

AMGP Price

$19.22

$19.22

$19.22

=

=

$1,244

=

1.7x / $3.00

(un-adj. coverage)

$1,506

$297

Implied Equity

Exchange

$1,210

1.50x

Total Cash to AR (2019-22) (¹)

(S in millions)

SQ

1.54x

1.57x

BAIRD

1.7x / $3.00

(adj. coverage)

$1,540

$297

$1,244

Cash from

transaction

Project Bronco I

Page 4View entire presentation