MP Materials Investor Conference Presentation Deck

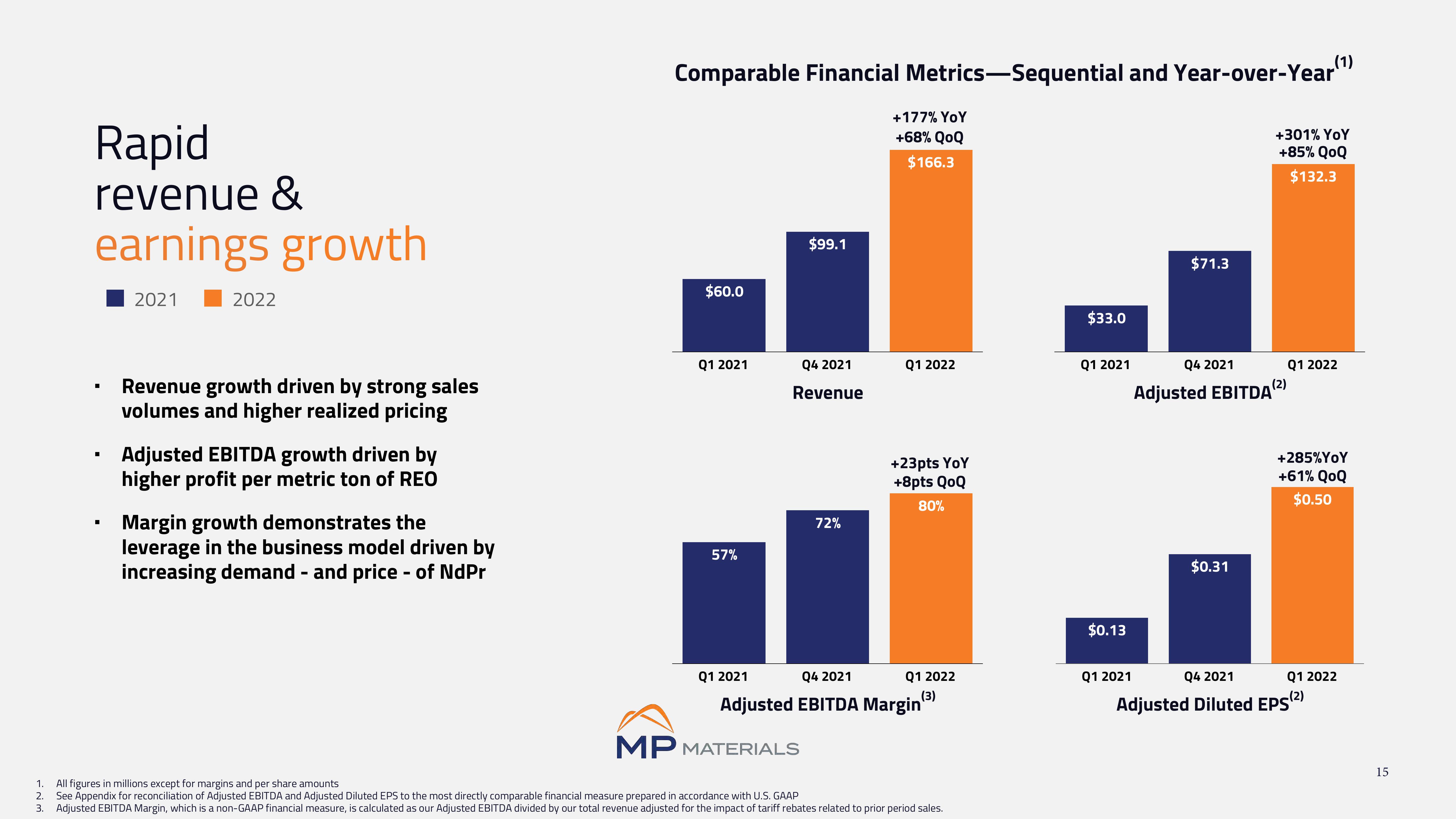

Rapid

revenue &

earnings growth

1.

2.

■

■

2021

2022

Revenue growth driven by strong sales

volumes and higher realized pricing

Adjusted EBITDA growth driven by

higher profit per metric ton of REO

Margin growth demonstrates the

leverage in the business model driven by

increasing demand - and price - of NdPr

Comparable Financial Metrics-Sequential and Year-over-Year

$60.0

Q1 2021

57%

$99.1

Q4 2021

Revenue

MP MATERIALS

72%

+177% YoY

+68% QOQ

$166.3

Q1 2022

+23pts YoY

+8pts QoQ

80%

Q1 2021

Q4 2021

Q1 2022

Adjusted EBITDA Margin(³)

All figures in millions except for margins and per share amounts

See Appendix for reconciliation of Adjusted EBITDA and Adjusted Diluted EPS to the most directly comparable financial measure prepared in accordance with U.S. GAAP

3. Adjusted EBITDA Margin, which is a non-GAAP financial measure, is calculated as our Adjusted EBITDA divided by our total revenue adjusted for the impact of tariff rebates related to prior period sales.

$33.0

Q1 2021

$0.13

Q1 2021

$71.3

Q4 2021

Adjusted EBITDA (²)

$0.31

(1)

+301% YoY

+85% QOQ

$132.3

Q1 2022

+285% YoY

+61% QOQ

$0.50

Q4 2021

Adjusted Diluted EPS(2)

Q1 2022

15View entire presentation