Hydrofarm IPO Presentation Deck

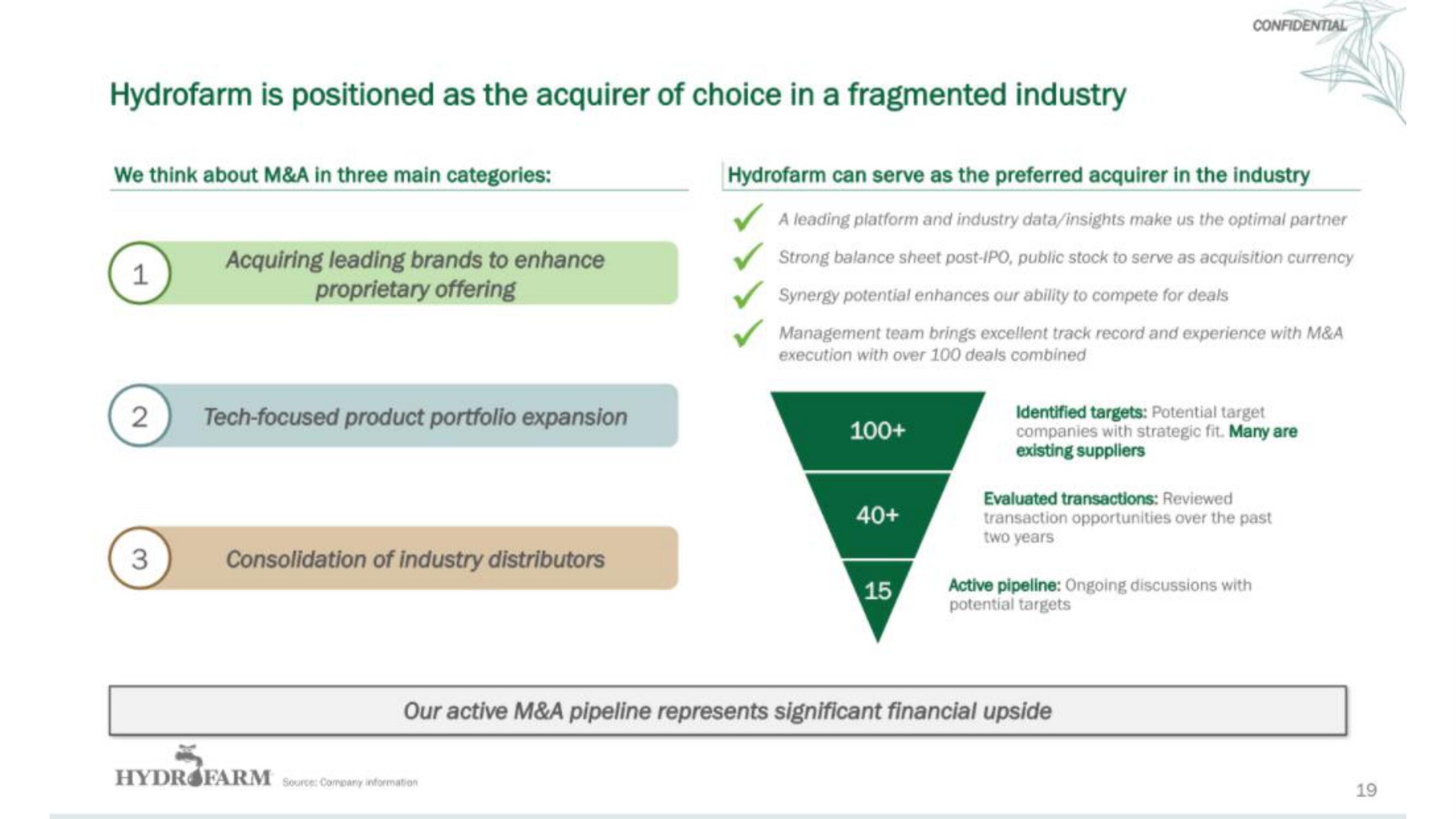

Hydrofarm is positioned as the acquirer of choice in a fragmented industry

We think about M&A in three main categories:

1

2

3

Acquiring leading brands to enhance

proprietary offering

Tech-focused product portfolio expansion

Consolidation of industry distributors

HYDROFARM Source: Company information

Hydrofarm can serve as the preferred acquirer in the industry

A leading platform and industry data/insights make us the optimal partner

Strong balance sheet post-IPO, public stock to serve as acquisition currency

Synergy potential enhances our ability to compete for deals

Management team brings excellent track record and experience with M&A

execution with over 100 deals combined

100+

40+

15

CONFIDENTIAL

Identified targets: Potential target

companies with strategic fit. Many are

existing suppliers

Evaluated transactions: Reviewed

transaction opportunities over the past

two years

Active pipeline: Ongoing discussions with

potential targets

Our active M&A pipeline represents significant financial upside

19View entire presentation