HPS Specialty Loan Fund VI

HPS

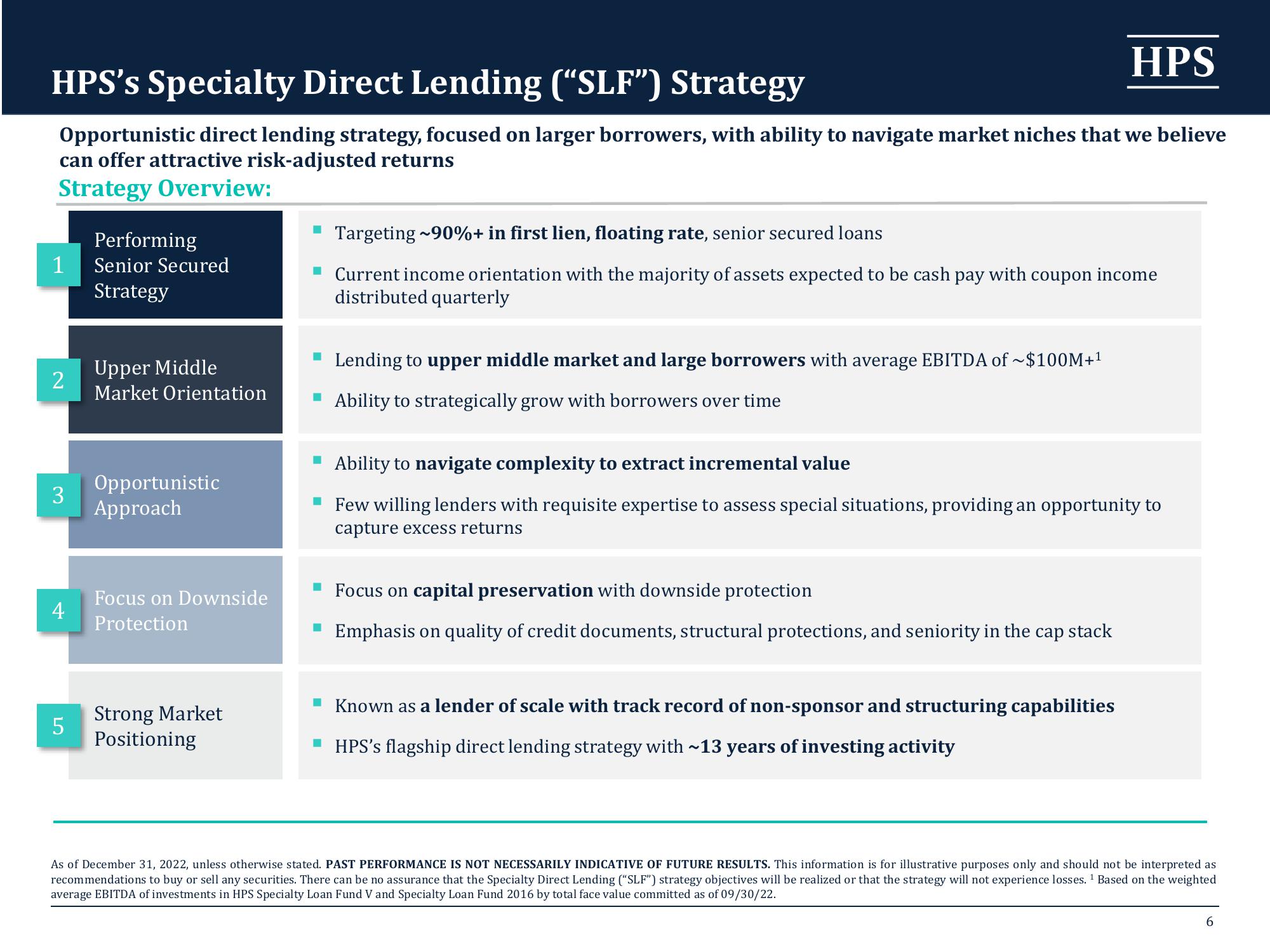

HPS's Specialty Direct Lending ("SLF") Strategy

Opportunistic direct lending strategy, focused on larger borrowers, with ability to navigate market niches that we believe

can offer attractive risk-adjusted returns

Strategy Overview:

Performing

1 Senior Secured

Strategy

2

3

4

5

Upper Middle

Market Orientation

Opportunistic

Approach

Focus on Downside

Protection

Strong Market

Positioning

Targeting ~90%+ in first lien, floating rate, senior secured loans

▪ Current income orientation with the majority of assets expected to be cash pay with coupon income

distributed quarterly

Lending to upper middle market and large borrowers with average EBITDA of ~$100M+¹

Ability to strategically grow with borrowers over time

Ability to navigate complexity to extract incremental value

▪ Few willing lenders with requisite expertise to assess special situations, providing an opportunity to

capture excess returns

Focus on capital preservation with downside protection

Emphasis on quality of credit documents, structural protections, and seniority in the cap stack

Known as a lender of scale with track record of non-sponsor and structuring capabilities

HPS's flagship direct lending strategy with ~13 years of investing activity

As of December 31, 2022, unless otherwise stated. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. This information is for illustrative purposes only and should not be interpreted as

recommendations to buy or sell any securities. There can be no assurance that the Specialty Direct Lending ("SLF") strategy objectives will be realized or that the strategy will not experience losses. ¹ Based on the weighted

average EBITDA of investments in HPS Specialty Loan Fund V and Specialty Loan Fund 2016 by total face value committed as of 09/30/22.

6View entire presentation