Antero Midstream Partners Mergers and Acquisitions Presentation Deck

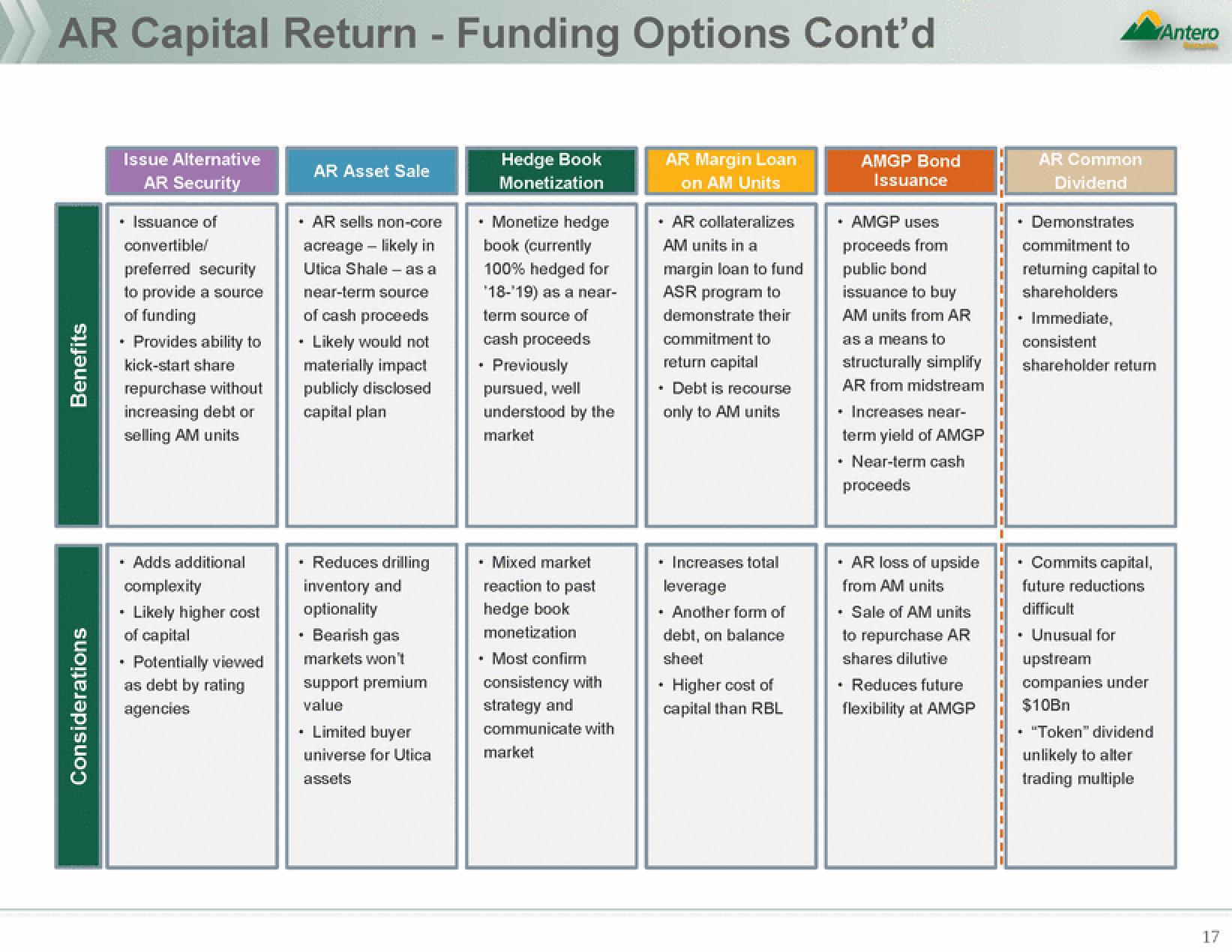

AR Capital Return - Funding Options Cont'd

Benefits

Considerations

Issue Alternative

AR Security

* Issuance of

convertible/

preferred security

to provide a source

of funding

Provides ability to

kick-start share

repurchase without

increasing debt or

selling AM units

+

• Adds additional

complexity

Likely higher cost

of capital

.

Potentially viewed

as debt by rating

agencies

+

AR Asset Sale

. AR sells non-core

acreage - likely in

Utica Shale - as a

near-term source

of cash proceeds

. Likely would not

materially impact

publicly disclosed

capital plan

• Reduces drilling

inventory and

optionality

• Bearish gas

markets won't

support premium

value

• Limited buyer

universe for Utica

assets

Hedge Book

Monetization

+ Monetize hedge

book (currently

100% hedged for

*18-'19) as a near-

term source of

cash proceeds

+

Previously

pursued, well

understood by the

market

• Mixed market

reaction to past

hedge book

monetization

. Most confirm

consistency with

strategy and

communicate with

market

AR Margin Loan

on AM Units

• AR collateralizes

AM units in a

margin loan to fund

ASR program to

demonstrate their

commitment to

return capital

• Debt is recourse

only to AM units

• Increases total

leverage

. Another form of

debt, on balance

sheet

* Higher cost of

capital than RBL

AMGP Bond

Issuance

+ AMGP uses

proceeds from

public bond

issuance to buy

AM units from AR

as a means to

structurally simplify

AR from midstream

+ Increases near-

term yield of AMGP

Near-term cash

proceeds

+ AR loss of upside

from AM units

• Sale of AM units

to repurchase AR

shares dilutive

Reduces future

flexibility at AMGP

•

AR Common

Dividend

Demonstrates

commitment to

returning capital to

shareholders

.

Immediate,

consistent

shareholder return

• Commits capital,

future reductions

difficult

. Unusual for

upstream

companies under

$10Bn

• "Token" dividend

unlikely to alter

trading multiple

Antero

17View entire presentation