Lotus Cars SPAC Presentation Deck

KEY SUMMARY FINANCIAL FORECASTS

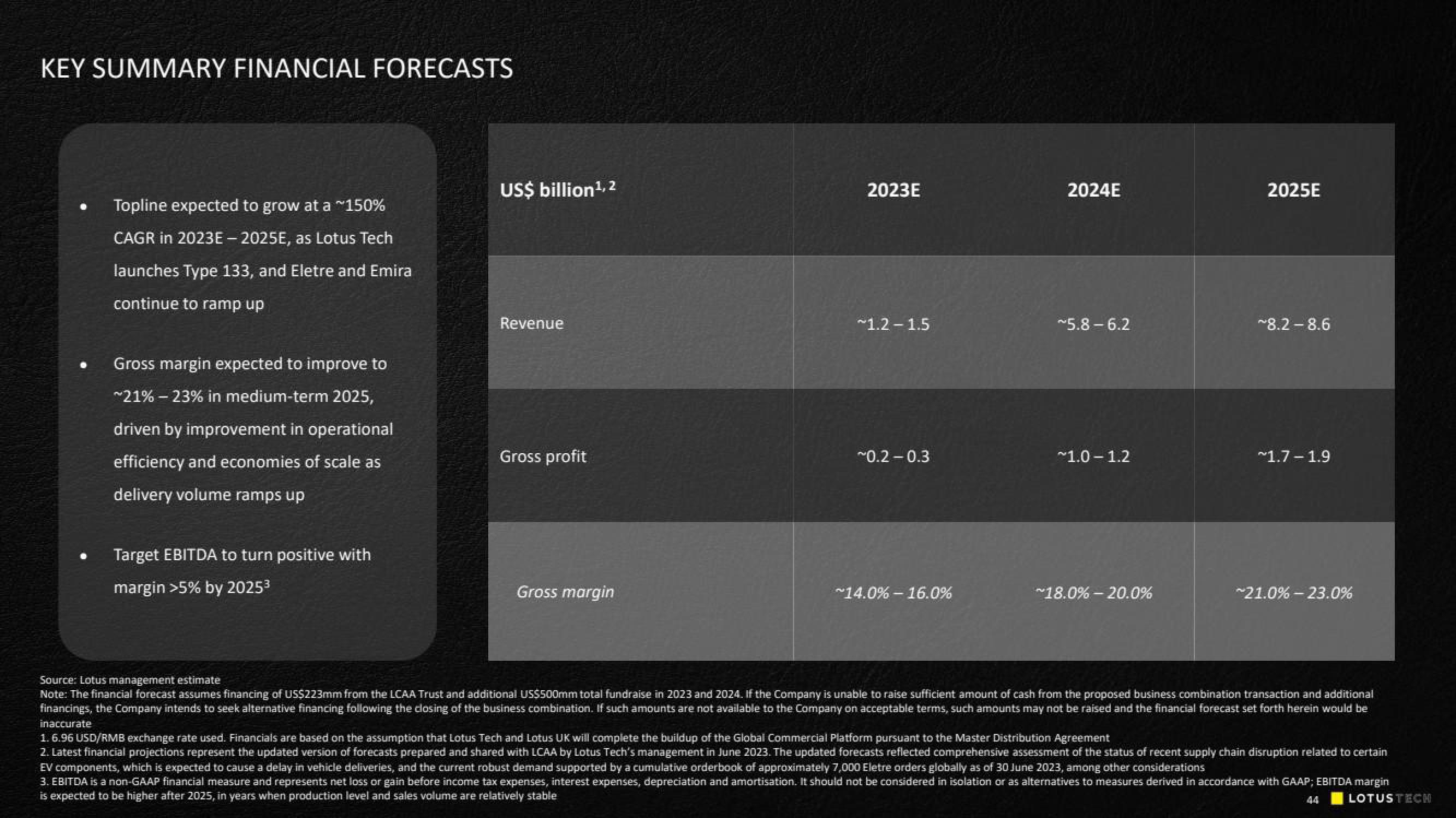

Topline expected to grow at a **150%

CAGR in 2023E - 2025E, as Lotus Tech

launches Type 133, and Eletre and Emira

continue to ramp up

Gross margin expected to improve to

~21% -23% in medium-term 2025,

driven by improvement in operational

efficiency and economies of scale as

delivery volume ramps up

Target EBITDA to turn positive with

margin >5% by 2025³

US$ billion ¹, 2

Revenue

Gross profit

Gross margin

2023E

~1.2-1.5

~0.2 -0.3

14.0%-16.0%

2024E

~5.8-6.2

~1.0-1.2

~18.0% -20.0%

2025E

~8.2-8.6

~1.7 -1.9

*21.0% -23.0%

Source: Lotus management estimate

Note: The financial forecast assumes financing of US$223mm from the LCAA Trust and additional US$500mm total fundraise in 2023 and 2024. If the Company is unable to raise sufficient amount of cash from the proposed business combination transaction and additional

financings, the Company intends to seek alternative financing following the closing of the business combination. If such amounts are not available to the Company on acceptable terms, such amounts may not be raised and the financial forecast set forth herein would be

inaccurate

1.6.96 USD/RMB exchange rate used. Financials are based on the assumption that Lotus Tech and Lotus UK will complete the buildup of the Global Commercial Platform pursuant to the Master Distribution Agreement

2. Latest financial projections represent the updated version of forecasts prepared and shared with LCAA by Lotus Tech's management in June 2023. The updated forecasts reflected comprehensive assessment of the status of recent supply chain disruption related to certain

EV components, which is expected to cause a delay in vehicle deliveries, and the current robust demand supported by a cumulative orderbook of approximately 7,000 Eletre orders globally as of 30 June 2023, among other considerations

3. EBITDA is a non-GAAP financial measure and represents net loss or gain before income tax expenses, interest expenses, depreciation and amortisation. It should not be considered in isolation or as alternatives to measures derived in accordance with GAAP; EBITDA margin

is expected to be higher after 2025, in years when production level and sales volume are relatively stable

LOTUSTECH

44View entire presentation