MoneyLion SPAC Presentation Deck

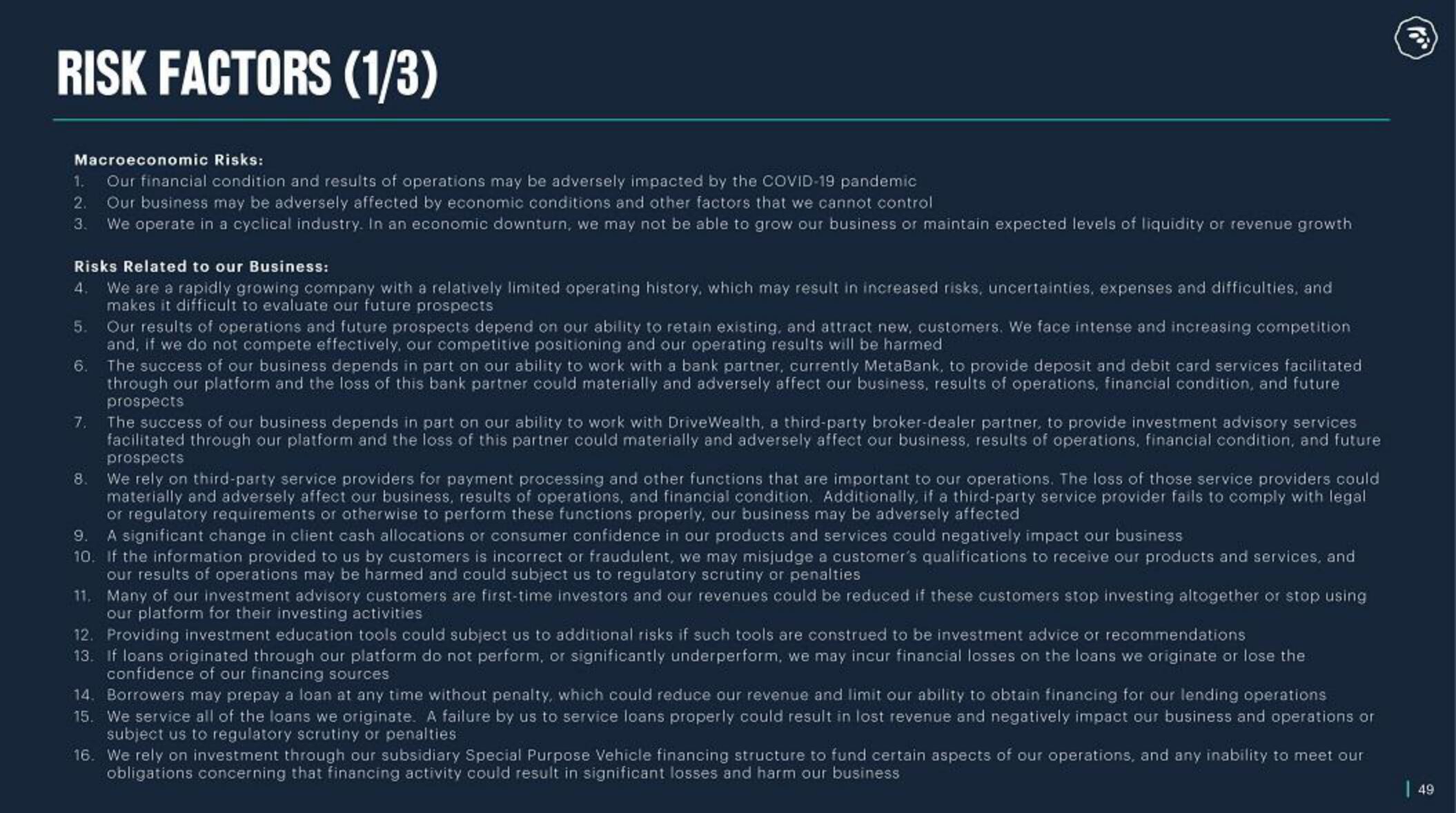

RISK FACTORS (1/3)

Macroeconomic Risks:

2.

1. Our financial condition and results of operations may be adversely impacted by the COVID-19 pandemic

Our business may be adversely affected by economic conditions and other factors that we cannot control

3. We operate in a cyclical industry. In an economic downturn, we may not be able to grow our business or maintain expected levels of liquidity or revenue growth

Risks Related to our Business:

4. We are a rapidly growing company with a relatively limited operating history, which may result in increased risks, uncertainties, expenses and difficulties, and

makes it difficult to evaluate our future prospects

5.

6.

7.

8.

Our results of operations and future prospects depend on our ability to retain existing, and attract new, customers. We face intense and increasing competition

and, if we do not compete effectively, our competitive positioning and our operating results will be harmed

The success of our business depends in part on our ability to work with a bank partner, currently MetaBank, to provide deposit and debit card services facilitated

through our platform and the loss of this bank partner could materially and adversely affect our business, results of operations, financial condition, and future

prospects

The success of our business depends in part on our ability to work with DriveWealth, a third-party broker-dealer partner, to provide investment advisory services

facilitated through our platform and the loss of this partner could materially and adversely affect our business, results of operations, financial condition, and future

prospects

We rely on third-party service providers for payment processing and other functions that are important to our operations. The loss of those service providers could

materially and adversely affect our business, results of operations, and financial condition. Additionally, if a third-party service provider fails to comply with legal

or regulatory requirements or otherwise to perform these functions properly, our business may be adversely affected

9.

A significant change in client cash allocations or consumer confidence in our products and services could negatively impact our business

10. If the information provided to us by customers is incorrect or fraudulent, we may misjudge a customer's qualifications to receive our products and services, and

our results of operations may be harmed and could subject us to regulatory scrutiny or penalties

11. Many of our investment advisory customers are first-time investors and our revenues could be reduced if these customers stop investing altogether or stop using

our platform for their investing activities

12. Providing investment education tools could subject us to additional risks if such tools are construed to be investment advice or recommendations

13. If loans originated through our platform do not perform, or significantly underperform, we may incur financial losses on the loans we originate or lose the

confidence of our financing sources

14. Borrowers may prepay a loan at any time without penalty, which could reduce our revenue and limit our ability to obtain financing for our lending operations

15. We service all of the loans we originate. A failure by us to service loans properly could result in lost revenue and negatively impact our business and operations or

subject us to regulatory scrutiny or penalties

16. We rely on investment through our subsidiary Special Purpose Vehicle financing structure to fund certain aspects of our operations, and any inability to meet our

obligations concerning that financing activity could result in significant losses and harm our business

| 49View entire presentation