OppFi Results Presentation Deck

15

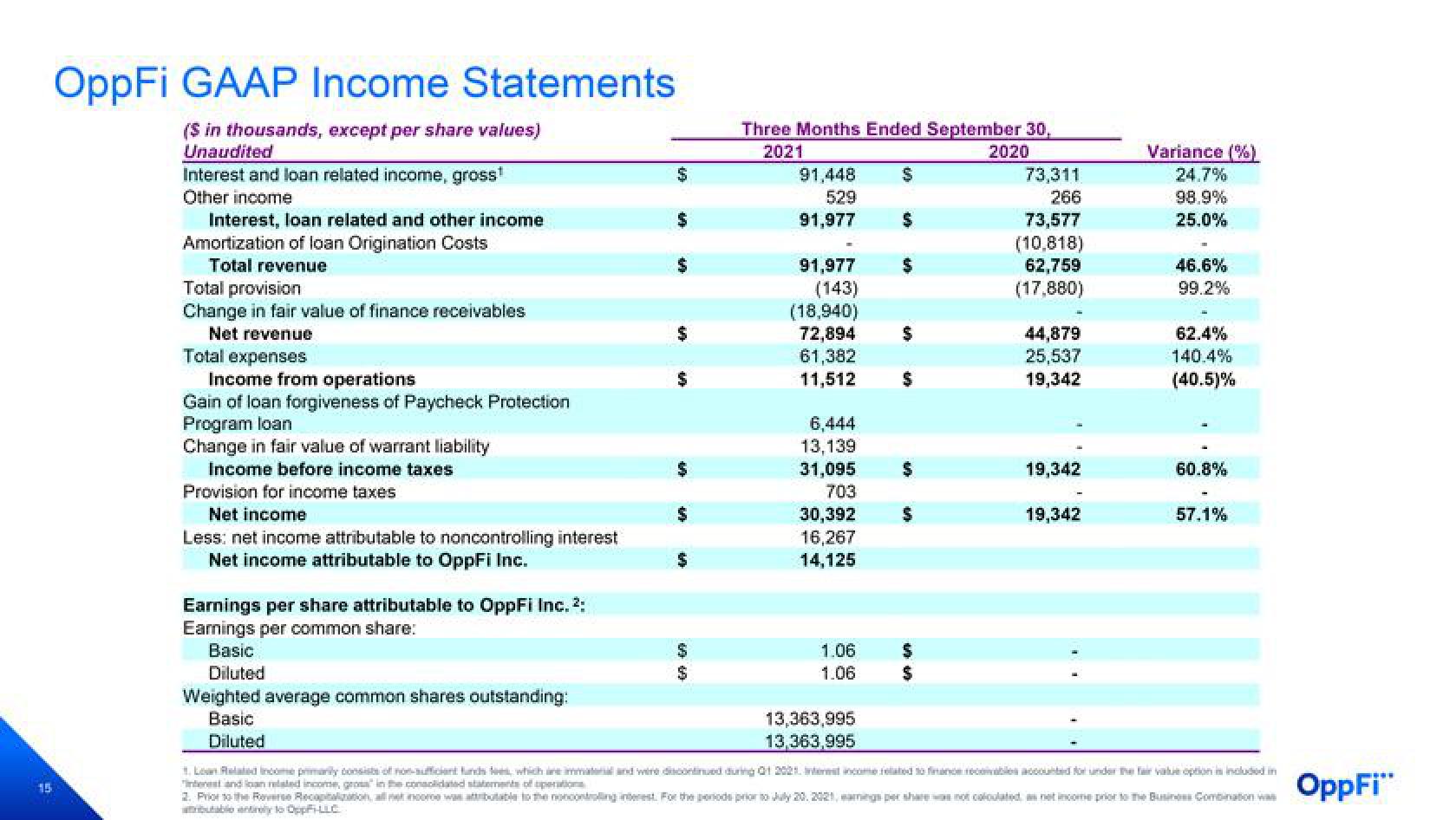

OppFi GAAP Income Statements

($ in thousands, except per share values)

Unaudited

Interest and loan related income, gross¹

Other income

Interest, loan related and other income

Amortization of loan Origination Costs

Total revenue

Total provision

Change in fair value of finance receivables

Net revenue

Total expenses

Income from operations

Gain of loan forgiveness of Paycheck Protection

Program loan

Change in fair value of warrant liability

Income before income taxes

Provision for income taxes

Net income

Less: net income attributable to noncontrolling interest

Net income attributable to OppFi Inc.

Earnings per share attributable to OppFi Inc. ²:

Earnings per common share:

Basic

Diluted

Weighted average common shares outstanding:

Basic

Diluted

$

$

$

69 69

Three Months Ended September 30,

2021

2020

91,448

529

91,977 $

91,977

(143)

(18,940)

72,894

61,382

11,512

6,444

13,139

31,095

703

30,392

16,267

14,125

1.06

1.06

$

13,363,995

13,363,995

$

$

$

$

$

$

73,311

266

73,577

(10,818)

62,759

(17,880)

44,879

25,537

19,342

19,342

19,342

Variance (%)

24,7%

98.9%

25.0%

46.6%

99.2%

62.4%

140.4%

(40.5)%

60.8%

57.1%

1. La Related Income primarily consists of non-sufficient funds, which are immaterial and wire discontinued during 01 2021. Internatincome related to finance recovables accounted for under the fair value option is included in

interest and loan related income, gros" in the consolidated statements of pati

2. Prior to the Reverse Recopitalization, all net incore was attributable to the noncontrolling interest. For the periode prior to July 20, 2021, eaegs per share not calculated as net income prior to The Business Combination was

atributable entirely to OppF-LLC

OppFi"View entire presentation