Tesla Results Presentation Deck

24

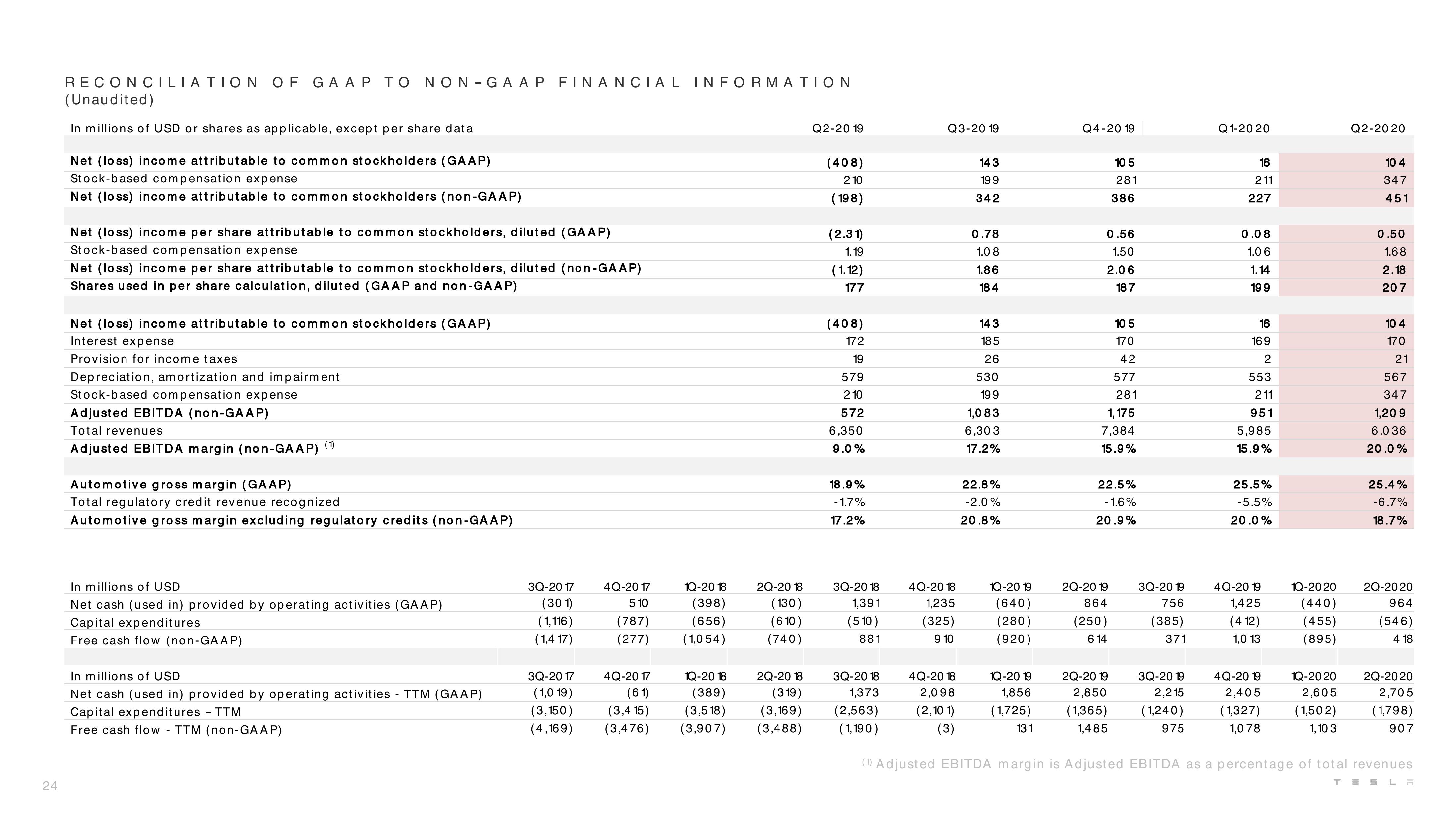

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(Unaudited)

In millions of USD or shares as applicable, except per share data

Net (loss) income attributable to common stockholders (GAAP)

Stock-based compensation expense

Net (loss) income attributable to common stockholders (non-GAAP)

Net (loss) income per share attributable to common stockholders, diluted (GAAP)

Stock-based compensation expense

Net (loss) income per share attributable to common stockholders, diluted (non-GAAP)

Shares used in per share calculation, diluted (GAAP and non-GAAP)

Net (loss) income attributable to common stockholders (GAAP)

Interest expense

Provision for income taxes

Depreciation, amortization and impairment

Stock-based compensation expense

Adjusted EBITDA (non-GAAP)

Total revenues

Adjusted EBITDA margin (non-GAAP) (¹)

Automotive gross margin (GAAP)

Total regulatory credit revenue recognized

Automotive gross margin excluding regulatory credits (non-GAAP)

In millions of USD

Net cash (used in) provided by operating activities (GAAP)

Capital expenditures

Free cash flow (non-GAAP)

In millions of USD

Net cash (used in) provided by operating activities - TTM (GAAP)

Capital expenditures - TTM

Free cash flow - TTM (non-GAAP)

3Q-20 17

(301)

(1,116)

(1,4 17)

4Q-20 17

5 10

(787)

(277)

3Q-20 17

(1,0 19)

(3,150)

(4,169) (3,476)

4Q-20 17

(61)

(3,4 15)

1Q-20 18

(398)

(656)

(1,054)

1Q-20 18

(389)

(3,518)

(3,907)

2Q-20 18

(130)

(610)

(740)

2Q-20 18

(319)

(3,169)

(3,488)

Q2-20 19

(408)

210

(198)

(2.31)

1.19

(1.12)

177

(408)

172

19

579

210

572

6,350

9.0%

18.9%

-1.7%

17.2%

3Q-20 18

1,391

(510)

881

3Q-20 18

1,373

(2,563)

(1,190)

Q3-20 19

4Q-2018

1,235

(325)

9 10

4Q-20 18

2,098

(2,10 1)

(3)

143

199

342

0.78

1.08

1.86

184

143

185

26

530

199

1,083

6,303

17.2%

22.8%

-2.0%

20.8%

1Q-20 19

(640)

(280)

(920)

1Q-20 19

1,856

(1,725)

131

Q4-20 19

10 5

281

0.56

1.50

2.06

187

386

2Q-20 19

864

(250)

6 14

1,175

7,384

15.9%

2Q-20 19

2,850

(1,365)

1,485

10 5

170

42

577

281

22.5%

-1.6%

20.9%

3Q-20 19

756

(385)

371

3Q-20 19

2,215

(1,240)

975

Q1-2020

16

211

227

0.08

1.0 6

1.14

199

16

169

2

553

211

951

5,985

15.9%

25.5%

-5.5%

20.0%

4Q-20 19

1,425

(412)

1,0 13

4Q-20 19

2,405

(1,327)

1,078

1Q-2020

(440)

(455)

(895)

1Q-2020

2,605

(1,502)

1,10 3

Q2-2020

10 4

347

451

0.50

1.68

2.18

207

10 4

170

21

567

347

1,20 9

6,036

20.0%

25.4%

-6.7%

18.7%

2Q-2020

964

(546)

4 18

2Q-2020

2,705

(1,798)

907

(1) Adjusted EBITDA margin is Adjusted EBITDA as a percentage of total revenues

TESLAView entire presentation