Kore SPAC Presentation Deck

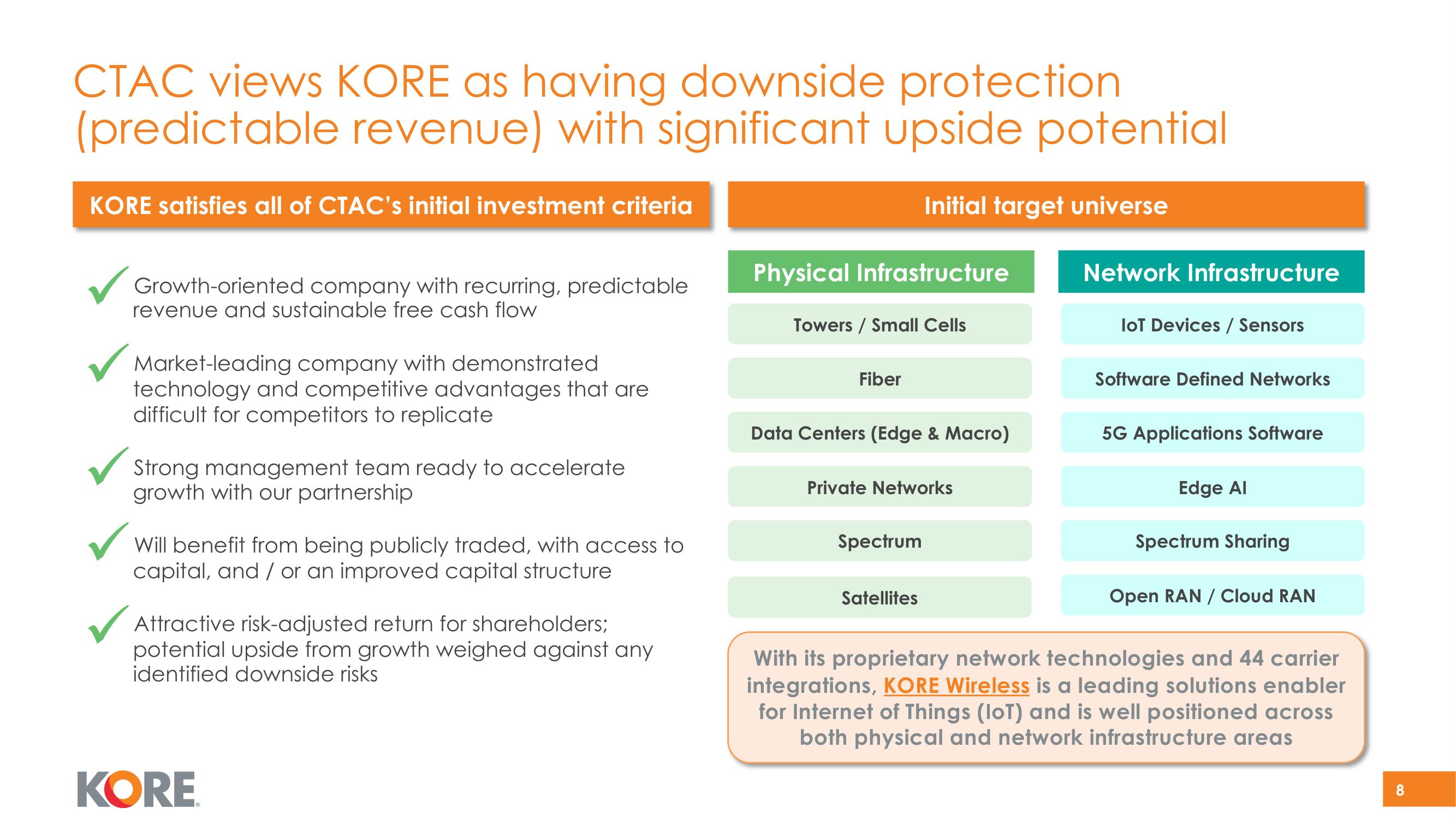

CTAC views KORE as having downside protection

(predictable revenue) with significant upside potential

KORE satisfies all of CTAC's initial investment criteria

Growth-oriented company with recurring, predictable

revenue and sustainable free cash flow

Market-leading company with demonstrated

technology and competitive advantages that are

difficult for competitors to replicate

Strong management team ready to accelerate

growth with our partnership

Will benefit from being publicly traded, with access to

capital, and / or an improved capital structure

Attractive risk-adjusted return for shareholders;

potential upside from growth weighed against any

identified downside risks

KORE

Physical Infrastructure

Towers / Small Cells

Fiber

Initial target universe

Data Centers (Edge & Macro)

Private Networks

Spectrum

Satellites

Network Infrastructure

lot Devices / Sensors

Software Defined Networks

5G Applications Software

Edge Al

Spectrum Sharing

Open RAN/Cloud RAN

With its proprietary network technologies and 44 carrier

integrations, KORE Wireless is a leading solutions enabler

for Internet of Things (IoT) and is well positioned across

both physical and network infrastructure areas

8View entire presentation