Centrus IPO Presentation Deck

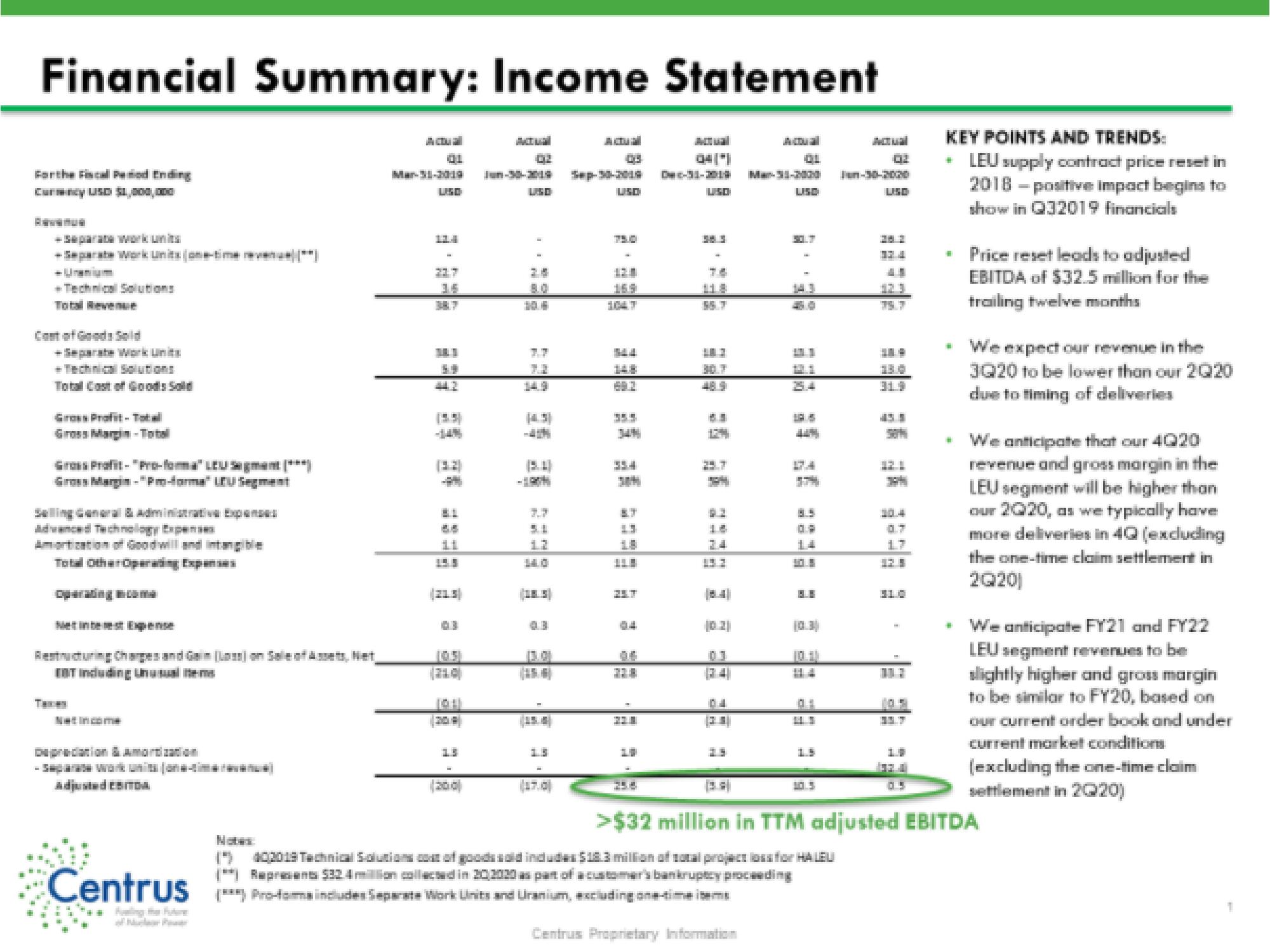

Financial Summary: Income Statement

Forte Fiscal Period Ending

Curncy USD $1,000,000

Bwwwmum

+Technical Solutions

Gross Profet-Total

Gross Margin-Total

Gross Profit-"Pro-loma" LEU Segment |***|

Total OtherOperating Expense

Adjusted EBITDA

Centrus

Puelling the Future)

Noter

01

LSD

P

(32)

(213)

4

01

102

(45)

10.3

155

⠀⠀

218

COM

Dec-31-201

-

124

17

18

01

SOLT

Centrus Proprietary Information

20

17.4

⠀.

#02019 Technical Solutions cost of goods sold indudes $18.3 million of total project loss for HALEU

(**) Represens $32. 4 million collected in 20, 2020 as part of a customer's bankruptcy proceeding

(***) Pro-toma includes Separate Work Units and Uranium, excluding one-time itemi

Jun-30-2020

FEL

121

0.7

10.5

13.7

KEY POINTS AND TRENDS:

LEU supply contract price reset in

2018-positive impact begins to

show in Q32019 financials

1

.

.

Price reset leads to adjusted

EBITDA of $32.5 million for the

trailing twelve months

We expect our revenue in the

3Q20 to be lower than our 2Q 20

due to timing of deliveries

We anticipate that our 4Q20

revenue and gross margin in the

LEU segment will be higher than

our 2020, as we typically have

more deliveries in 4Q (excluding

the one-time claim settlement in

2Q20)

>$32 million in TTM adjusted EBITDA

We anticipate FY21 and FY22

LEU segment revenues to be

slightly higher and gross margin

to be similar to FY20, based on

our current order book and under

current market conditions

(excluding the one-time claim

settlement in 2Q20)View entire presentation