KKR Real Estate Finance Trust Investor Presentation Deck

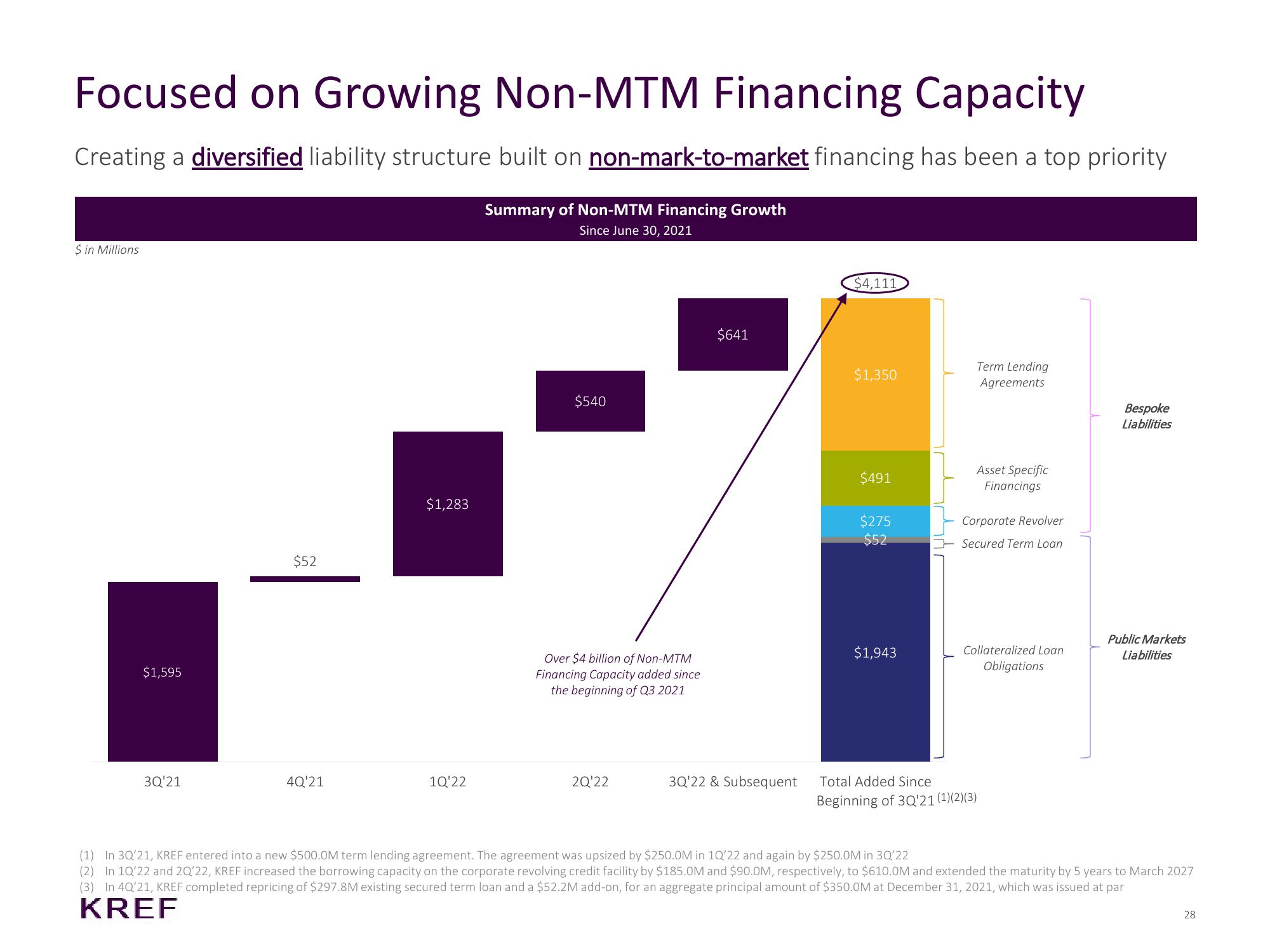

Focused on Growing Non-MTM Financing Capacity

Creating a diversified liability structure built on non-mark-to-market financing has been a top priority

$ in Millions

$1,595

3Q'21

$52

4Q'21

$1,283

1Q'22

Summary of Non-MTM Financing Growth

Since June 30, 2021

$540

Over $4 billion of Non-MTM

Financing Capacity added since

the beginning of Q3 2021

2Q'22

$641

3Q'22 & Subsequent

$4,111

$1,350

$491

$275

$52

$1,943

Term Lending

Agreements

Asset Specific

Financings

Corporate Revolver

Secured Term Loan

Collateralized Loan

Obligations

Total Added Since

Beginning of 3Q'21 (1)(2)(3)

Bespoke

Liabilities

Public Markets

Liabilities

(1) In 3Q'21, KREF entered into a new $500.0M term lending agreement. The agreement was upsized by $250.0M in 10'22 and again by $250.0M in 3Q'22

(2) In 10'22 and 20'22, KREF increased the borrowing capacity on the corporate revolving credit facility by $185.0M and $90.0M, respectively, to $610.0M and extended the maturity by 5 years to March 2027

(3) In 4Q'21, KREF completed repricing of $297.8M existing secured term loan and a $52.2M add-on, for an aggregate principal amount of $350.0M at December 31, 2021, which was issued at par

KREF

28View entire presentation