Apollo Global Management Investor Day Presentation Deck

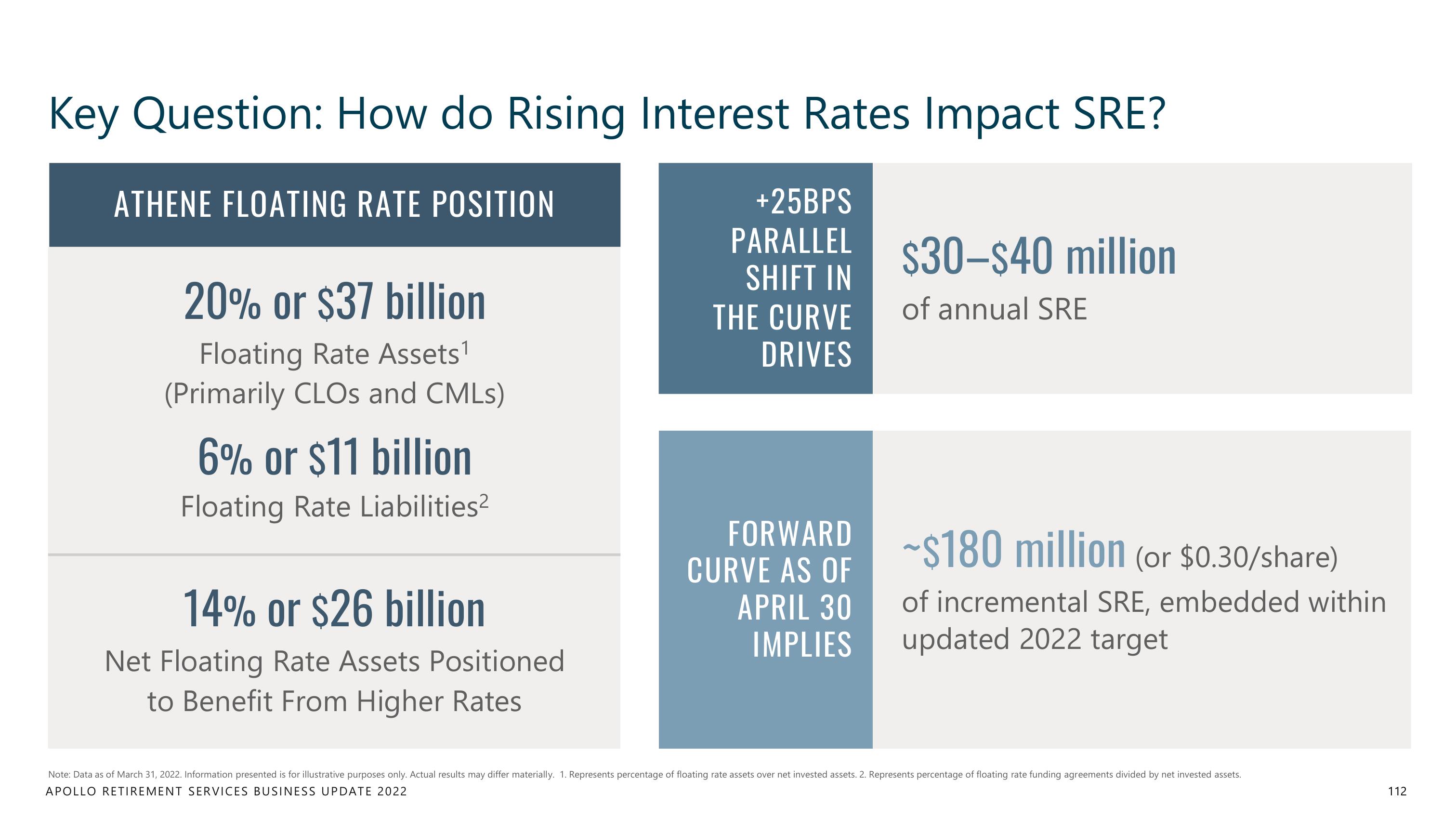

Key Question: How do Rising Interest Rates Impact SRE?

ATHENE FLOATING RATE POSITION

20% or $37 billion

Floating Rate Assets¹

(Primarily CLOs and CMLs)

6% or $11 billion

Floating Rate Liabilities²

14% or $26 billion

Net Floating Rate Assets Positioned

to Benefit From Higher Rates

+25BPS

PARALLEL

SHIFT IN

THE CURVE

DRIVES

FORWARD

CURVE AS OF

APRIL 30

IMPLIES

$30-$40 million

of annual SRE

~$180 million (or $0.30/share)

of incremental SRE, embedded within

updated 2022 target

Note: Data as of March 31, 2022. Information presented is for illustrative purposes only. Actual results may differ materially. 1. Represents percentage of floating rate assets over net invested assets. 2. Represents percentage of floating rate funding agreements divided by net invested assets.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

112View entire presentation