PJT Partners Investment Banking Pitch Book

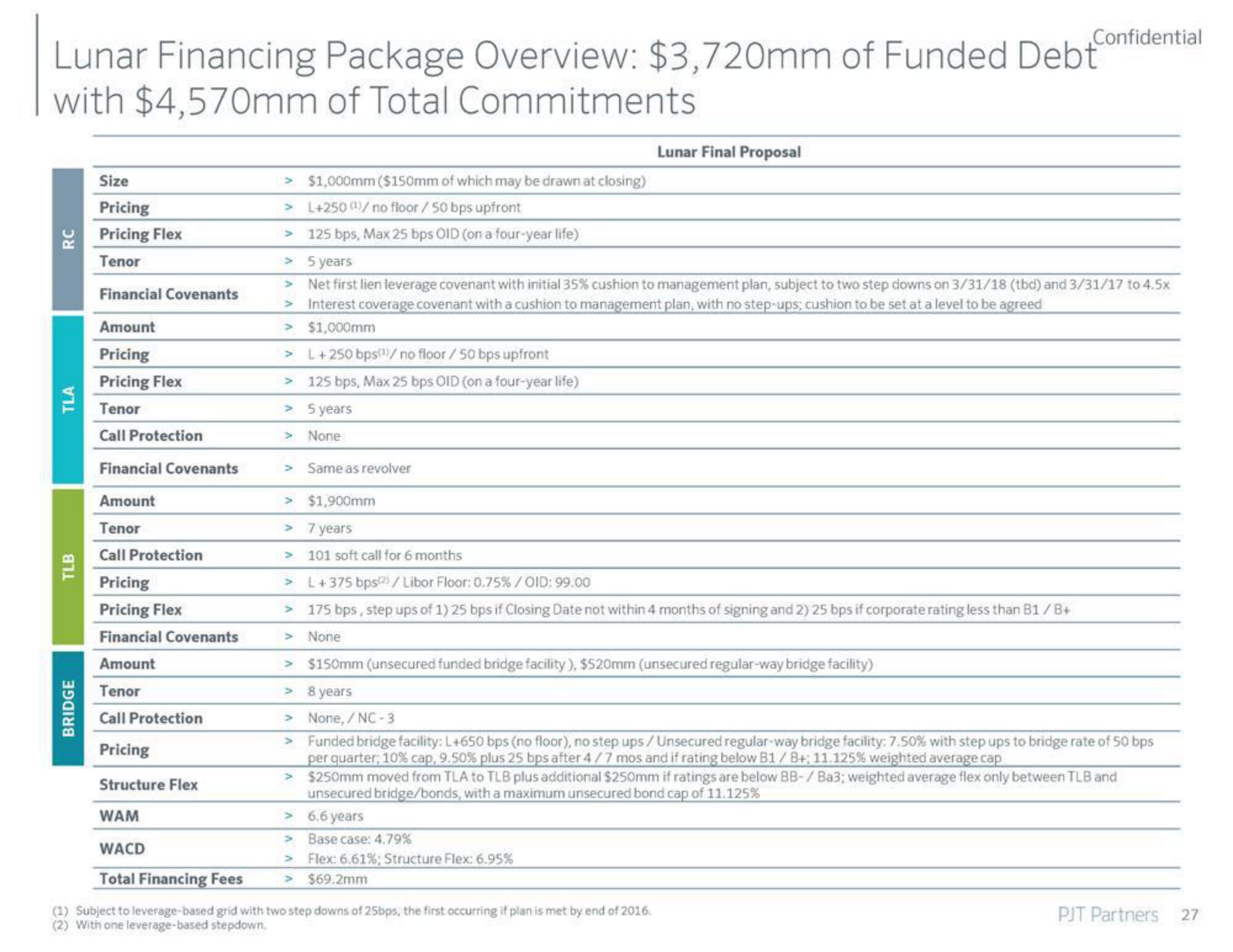

Lunar Financing Package Overview: $3,720mm of Funded Debt

with $4,570mm of Total Commitments

RC

TLA

TLB

Size

Pricing

Pricing Flex

Tenor

Financial Covenants

Amount

Pricing

Pricing Flex

Tenor

Call Protection

BRIDGE

Financial Covenants

Amount

Tenor

Call Protection

L+250 bps¹/no floor / 50 bps upfront

> 125 bps, Max 25 bps OID (on a four-year life)

5 years

>

$1,000mm ($150mm of which may be drawn at closing)

>

L+250 (¹)/ no floor / 50 bps upfront

> 125 bps, Max 25 bps OID (on a four-year life)

> 5 years

Net first lien leverage covenant with initial 35% cushion to management plan, subject to two step downs on 3/31/18 (tbd) and 3/31/17 to 4.5x

Interest coverage covenant with a cushion to management plan, with no step-ups; cushion to be set at a level to be agreed

> $1,000mm

>>

> None

> Same as revolver

>

Pricing

Pricing Flex

Financial Covenants

Amount

Tenor

Call Protection

Pricing

Structure Flex

WAM

WACD

Total Financing Fees

(1) Subject to leverage-based grid with two step downs of 25bps, the first occurring if plan is met by end of 2016.

(2) With one leverage-based stepdown.

Confidential

Lunar Final Proposal

> $1,900mm

>

7 years

101 soft call for 6 months

> L+375 bps) / Libor Floor: 0.75% / OID: 99.00

> 175 bps, step ups of 1) 25 bps if Closing Date not within 4 months of signing and 2) 25 bps if corporate rating less than B1/B+

> None

> $150mm (unsecured funded bridge facility), $520mm (unsecured regular-way bridge facility)

8 years

> None, / NC -3

Funded bridge facility: L+650 bps (no floor), no step ups/Unsecured regular-way bridge facility: 7.50% with step ups to bridge rate of 50 bps

per quarter, 10% cap. 9.50% plus 25 bps after 4/7 mos and if rating below B1/B+; 11.125% weighted average cap

> $250mm moved from TLA to TLB plus additional $250mm if ratings are below BB-/ Ba3; weighted average flex only between TLB and

unsecured bridge/bonds, with a maximum unsecured bond cap 11.125%

6.6 years

>

Base case: 4.79%

> Flex: 6.61%; Structure Flex: 6.95%

> $69.2mm

>

PJT Partners

27View entire presentation