Bausch Health Companies Investor Conference Presentation Deck

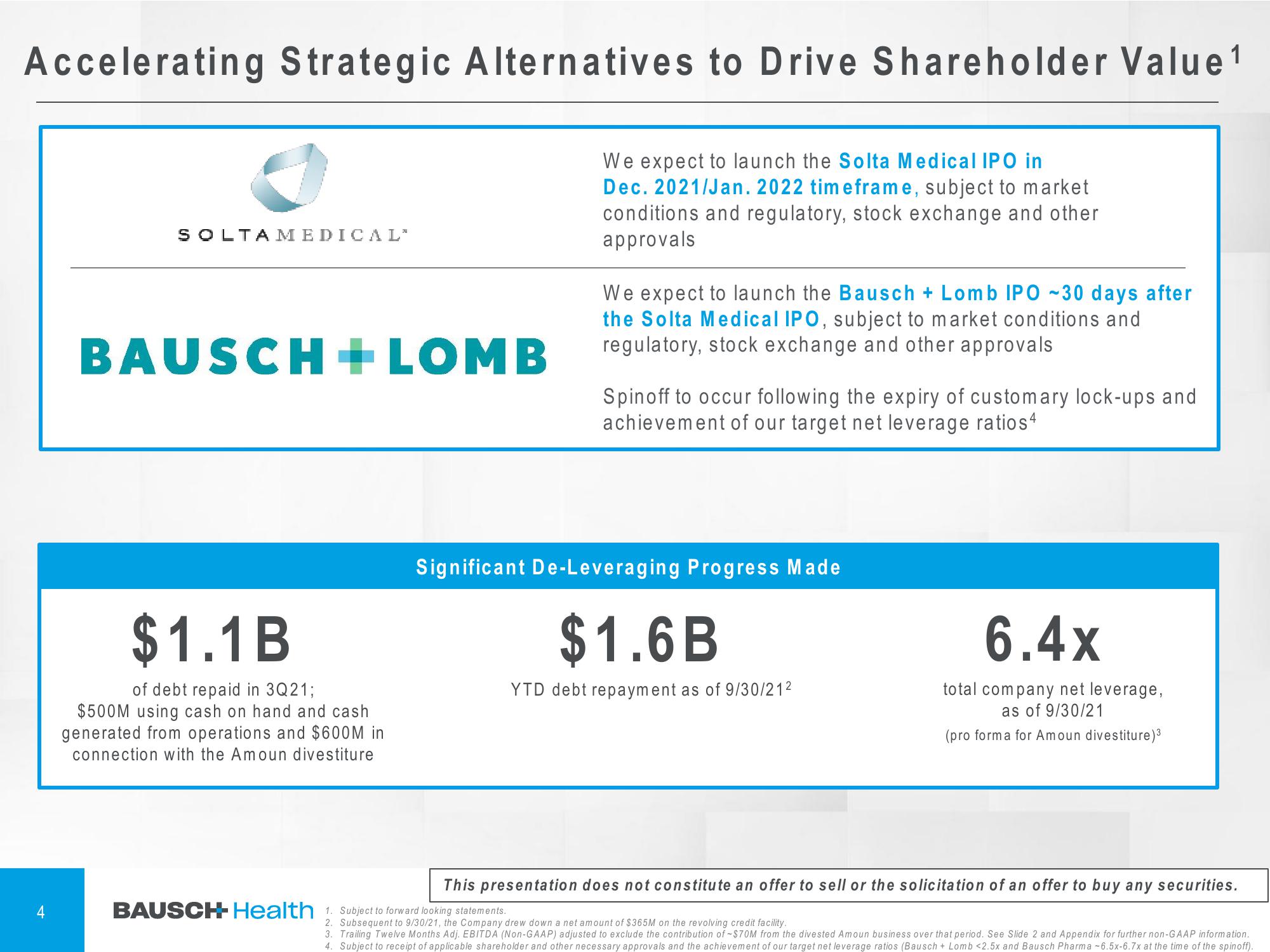

Accelerating Strategic Alternatives to Drive Shareholder Value ¹

We expect to launch the Solta Medical IPO in

Dec. 2021/Jan. 2022 timeframe, subject to market

conditions and regulatory, stock exchange and other

approvals

SOLTAMEDICAL'

BAUSCH + LOMB

$1.1B

of debt repaid in 3Q21;

$500M using cash on hand and cash

generated from operations and $600M in

connection with the Amoun divestiture

BAUSCH- Health

We expect to launch the Bausch + Lomb IPO-30 days after

the Solta Medical IPO, subject to market conditions and

regulatory, stock exchange and other approvals

Spinoff to occur following the expiry of customary lock-ups and

achievement of our target net leverage ratios4

Significant De-Leveraging Progress Made

$1.6B

YTD debt repayment as of 9/30/21²

6.4x

total company net leverage,

as of 9/30/21

(pro forma for Amoun divestiture)³

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities.

1. Subject to forward looking statements.

2. Subsequent to 9/30/21, the Company drew down a net amount of $365M on the revolving credit facility.

3. Trailing Twelve Months Adj. EBITDA (Non-GAAP) adjusted to exclude the contribution of -$70M from the divested Amoun business over that period. See Slide 2 and Appendix for further non-GAAP information.

4. Subject to receipt of applicable shareholder and other necessary approvals and the achievement of our target net leverage ratios (Bausch+Lomb <2.5x and Bausch Pharma -6.5x-6.7x at the time of the spinoff).View entire presentation