J.P.Morgan Mergers and Acquisitions Presentation Deck

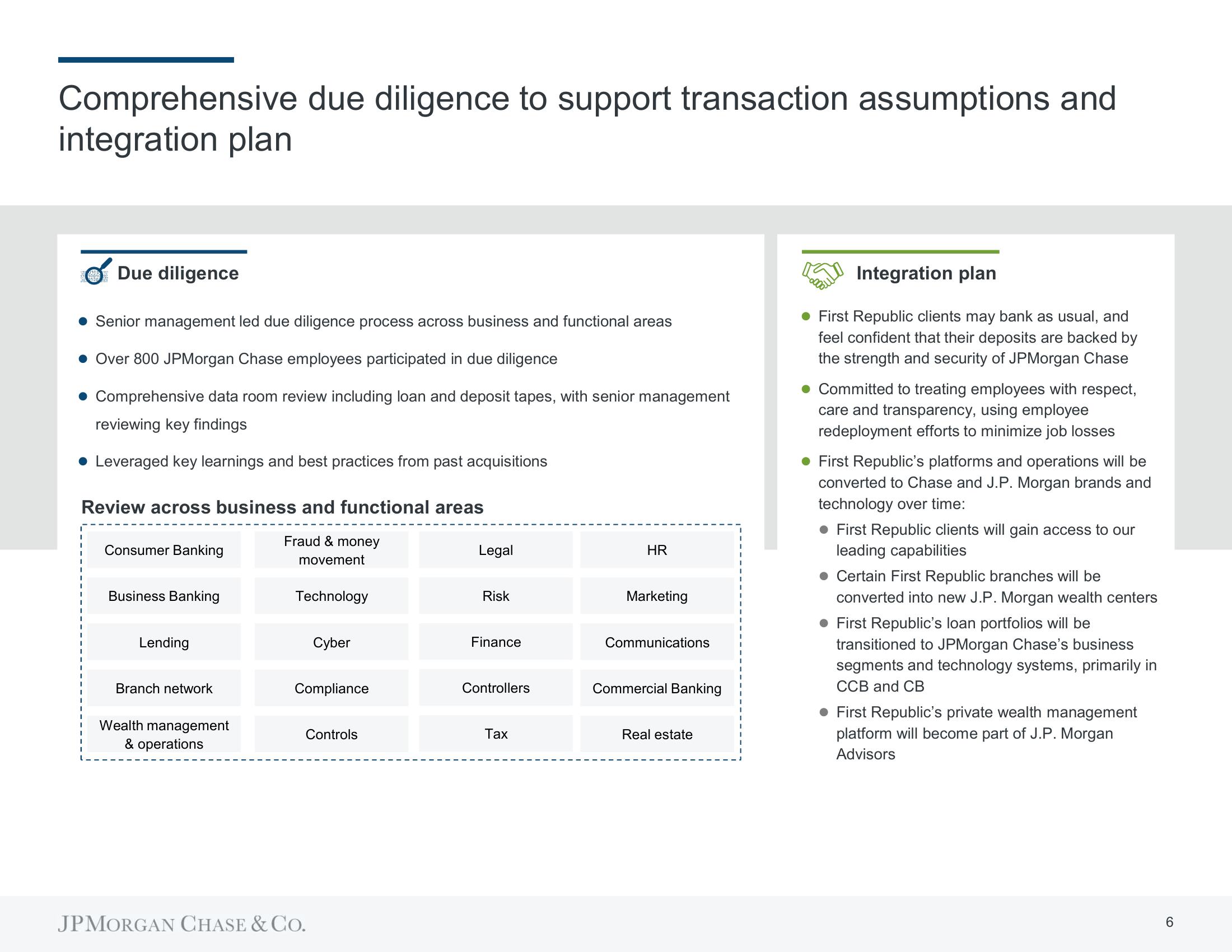

Comprehensive due diligence to support transaction assumptions and

integration plan

Due diligence

Senior management led due diligence process across business and functional areas

Over 800 JPMorgan Chase employees participated in due diligence

Comprehensive data room review including loan and deposit tapes, with senior management

reviewing key findings

Leveraged key learnings and best practices from past acquisitions

Review across business and functional areas

Consumer Banking

Business Banking

Lending

Branch network

Wealth management

& operations

Fraud & money

movement

Technology

Cyber

Compliance

Controls

JPMORGAN CHASE & CO.

Legal

Risk

Finance

Controllers

Tax

HR

Marketing

Communications

Commercial Banking

Real estate

Integration plan

First Republic clients may bank as usual, and

feel confident that their deposits are backed by

the strength and security of JPMorgan Chase

Committed to treating employees with respect,

care and transparency, using employee

redeployment efforts to minimize job losses

• First Republic's platforms and operations will be

converted to Chase and J.P. Morgan brands and

technology over time:

• First Republic clients will gain access to our

leading capabilities

• Certain First Republic branches will be

converted into new J.P. Morgan wealth centers

• First Republic's loan portfolios will be

transitioned to JPMorgan Chase's business

segments and technology systems, primarily in

CCB and CB

• First Republic's private wealth management

platform will become part of J.P. Morgan

Advisors

6View entire presentation