SmileDirectClub Investor Presentation Deck

●

●

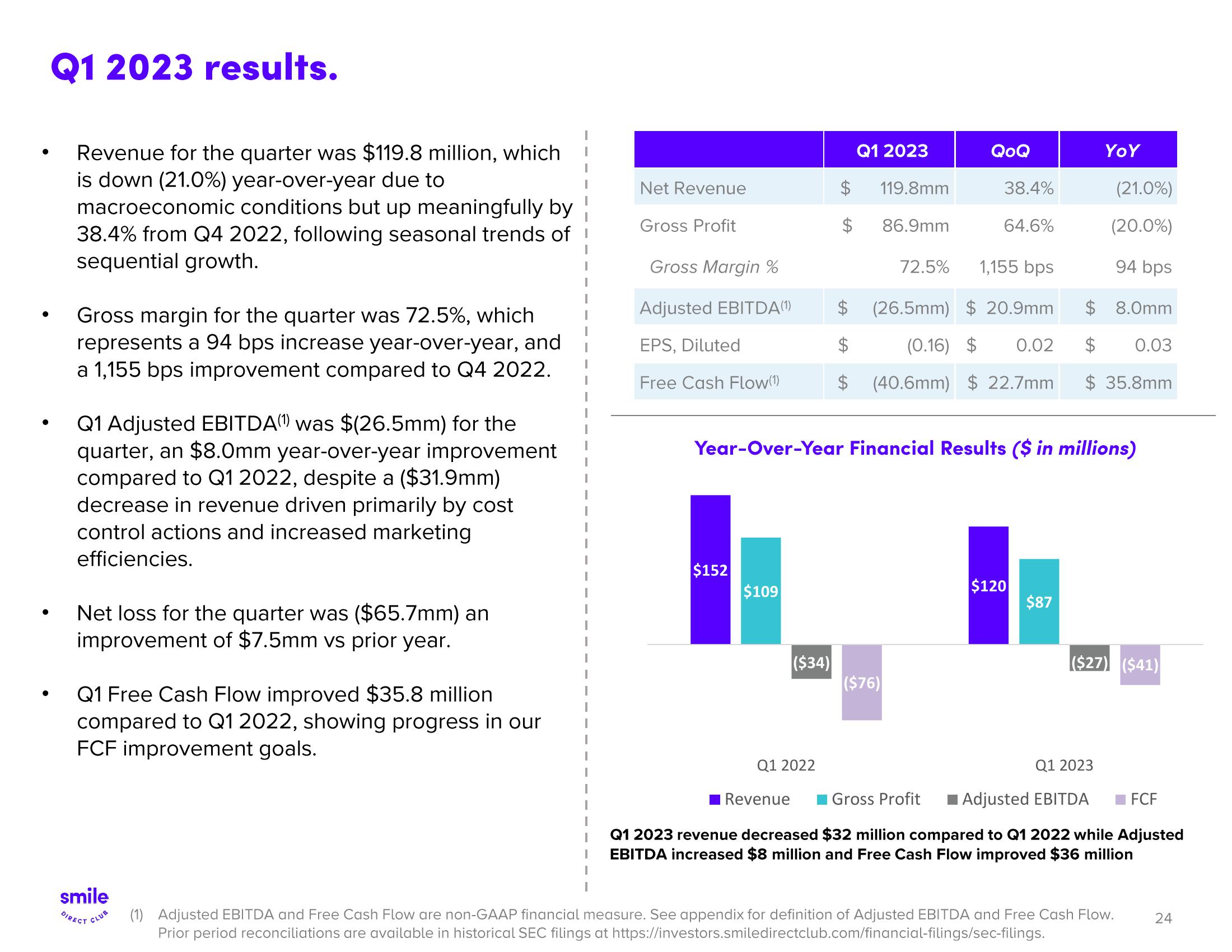

Q1 2023 results.

Revenue for the quarter was $119.8 million, which

is down (21.0%) year-over-year due to

macroeconomic conditions but up meaningfully by

38.4% from Q4 2022, following seasonal trends of

sequential growth.

Gross margin for the quarter was 72.5%, which

represents a 94 bps increase year-over-year, and

a 1,155 bps improvement compared to Q4 2022.

Q1 Adjusted EBITDA) was $(26.5mm) for the

quarter, an $8.0mm year-over-year improvement

compared to Q1 2022, despite a ($31.9mm)

decrease in revenue driven primarily by cost

control actions and increased marketing

efficiencies.

Net loss for the quarter was ($65.7mm) an

improvement of $7.5mm vs prior year.

Q1 Free Cash Flow improved $35.8 million

compared to Q1 2022, showing progress in our

FCF improvement goals.

smile

DIRECT CLUB

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA (1)

EPS, Diluted

Free Cash Flow(1)

$152

$109

($34)

Q1 2022

$

Revenue

$

$

Q1 2023

119.8mm

86.9mm

QoQ

(21.0%)

(20.0%)

94 bps

$

8.0mm

(0.16) $ 0.02 $ 0.03

$ 35.8mm

72.5%

Year-Over-Year Financial Results ($ in millions)

($76)

38.4%

1,155 bps

(26.5mm) $20.9mm

64.6%

(40.6mm) $ 22.7mm

$120

YOY

$87

($27) ($41)

Q1 2023

Gross Profit ■Adjusted EBITDA

FCF

Q1 2023 revenue decreased $32 million compared to Q1 2022 while Adjusted

EBITDA increased $8 million and Free Cash Flow improved $36 million

(1) Adjusted EBITDA and Free Cash Flow are non-GAAP financial measure. See appendix for definition of Adjusted EBITDA and Free Cash Flow. 24

Prior period reconciliations are available in historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.View entire presentation