First Merchants Results Presentation Deck

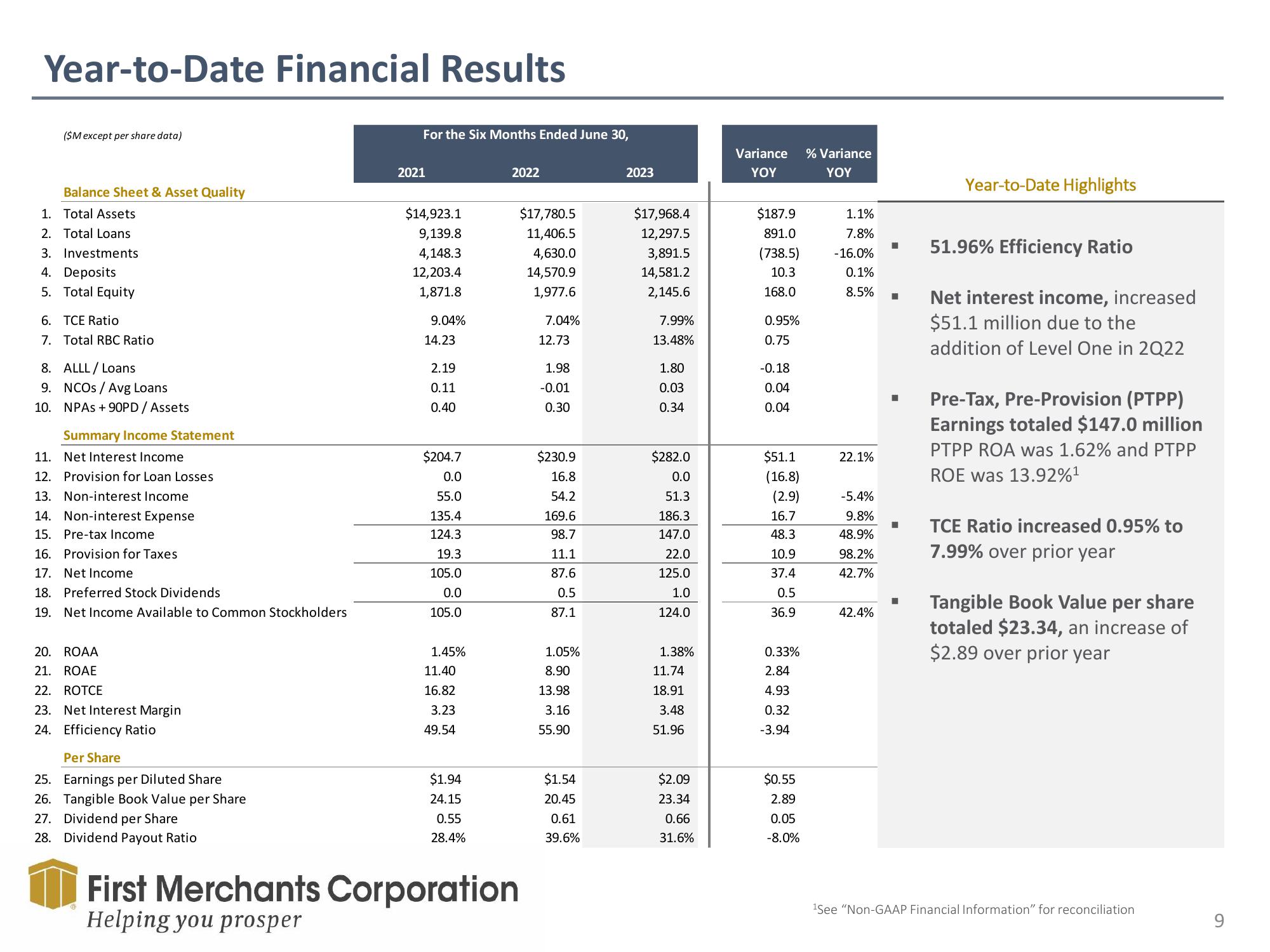

Year-to-Date Financial Results

($M except per share data)

Balance Sheet & Asset Quality

1.

Total Assets

2. Total Loans

3. Investments

4. Deposits

5. Total Equity

6. TCE Ratio

7. Total RBC Ratio

8. ALLL/Loans

9. NCOS/Avg Loans

10.

NPAS +90PD / Assets

Summary Income Statement

11. Net Interest Income

12. Provision for Loan Losses

13. Non-interest Income

14. Non-interest Expense

15. Pre-tax Income

16. Provision for Taxes

17. Net Income

18. Preferred Stock Dividends

19. Net Income Available to Common Stockholders

20. ROAA

21. ROAE

22. ROTCE

23. Net Interest Margin

24. Efficiency Ratio

Per Share

25. Earnings per Diluted Share

26. Tangible Book Value per Share

27. Dividend per Share

28. Dividend Payout Ratio

For the Six Months Ended June 30,

2021

$14,923.1

9,139.8

4,148.3

12,203.4

1,871.8

9.04%

14.23

2.19

0.11

0.40

$204.7

0.0

55.0

135.4

124.3

19.3

105.0

0.0

105.0

1.45%

11.40

16.82

3.23

49.54

$1.94

24.15

0.55

28.4%

2022

First Merchants Corporation

Helping you prosper

$17,780.5

11,406.5

4,630.0

14,570.9

1,977.6

7.04%

12.73

1.98

-0.01

0.30

$230.9

16.8

54.2

169.6

98.7

11.1

87.6

0.5

87.1

1.05%

8.90

13.98

3.16

55.90

$1.54

20.45

0.61

39.6%

2023

$17,968.4

12,297.5

3,891.5

14,581.2

2,145.6

7.99%

13.48%

1.80

0.03

0.34

$282.0

0.0

51.3

186.3

147.0

22.0

125.0

1.0

124.0

1.38%

11.74

18.91

3.48

51.96

$2.09

23.34

0.66

31.6%

Variance % Variance

YOY

YOY

$187.9

891.0

(738.5)

10.3

168.0

0.95%

0.75

-0.18

0.04

0.04

$51.1

(16.8)

(2.9)

16.7

48.3

10.9

37.4

0.5

36.9

0.33%

2.84

4.93

0.32

-3.94

$0.55

2.89

0.05

-8.0%

1.1%

7.8%

-16.0%

0.1%

8.5%

22.1%

-5.4%

9.8%

48.9%

98.2%

42.7%

42.4%

■

■

■

■

Year-to-Date Highlights

51.96% Efficiency Ratio

Net interest income, increased

$51.1 million due to the

addition of Level One in 2Q22

Pre-Tax, Pre-Provision (PTPP)

Earnings totaled $147.0 million

PTPP ROA was 1.62% and PTPP

ROE was 13.92%¹

TCE Ratio increased 0.95% to

7.99% over prior year

Tangible Book Value per share

totaled $23.34, an increase of

$2.89 over prior year

¹See "Non-GAAP Financial Information" for reconciliation

9View entire presentation