Ready Capital Investor Presentation Deck

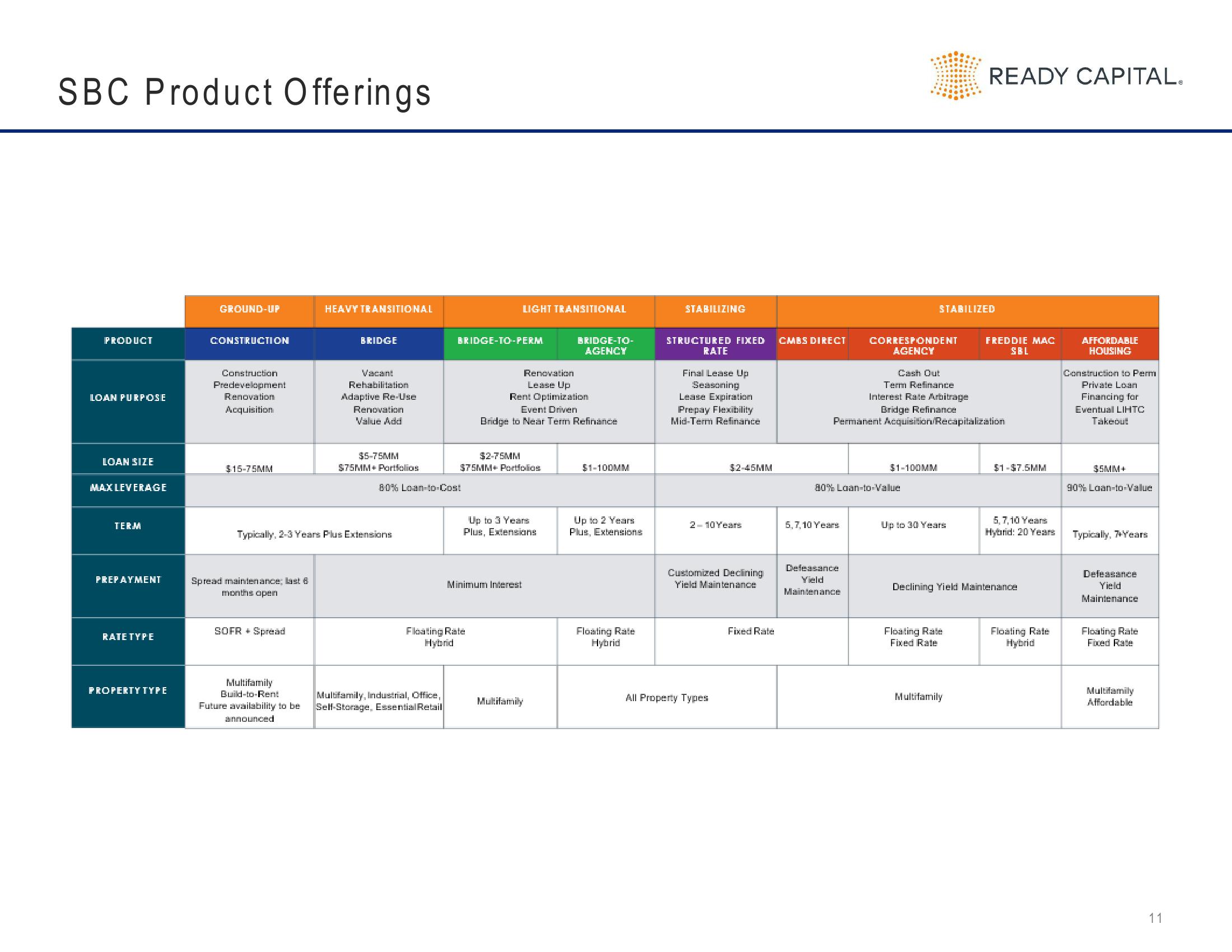

SBC Product Offerings

PRODUCT

LOAN PURPOSE

LOAN SIZE

MAX LEVERAGE

TERM

PREPAYMENT

RATE TYPE

PROPERTY TYPE

GROUND-UP

CONSTRUCTION

Construction

Predevelopment

Renovation

Acquisition

$15-75MM

Spread maintenance; last 6

months open

SOFR + Spread

HEAVY TRANSITIONAL

Multifamily

Build-to-Rent

Future availability to be

announced

BRIDGE

Vacant

Rehabilitation

Adaptive Re-Use

Renovation

Value Add

Typically, 2-3 Years Plus Extensions

$5-75MM

$75MM + Portfolios

80% Loan-to-Cost

BRIDGE-TO-PERM

Multifamily, Industrial, Office,

Self-Storage, Essential Retail

LIGHT TRANSITIONAL

$2-75MM

$75MM+ Portfolios

Floating Rate

Hybrid

Renovation

Lease Up

Rent Optimization

Event Driven

Bridge to Near Term Refinance

Up to 3 Years

Plus, Extensions

Minimum Interest

BRIDGE-TO-

AGENCY

Multifamily

$1-100MM

Up to 2 Years

Plus, Extensions

Floating Rate

Hybrid

STABILIZING

STRUCTURED FIXED CMBS DIRECT

RATE

Final Lease Up

Seasoning

Lease Expiration

Prepay Flexibility

Mid-Term Refinance

$2-45MM

2-10 Years

Customized Declining

Yield Maintenance

All Property Types

Fixed Rate

5,7,10 Years

CORRESPONDENT

AGENCY

Defeasance

Yield

Maintenance

Cash Out

Term Refinance

80% Loan-to-Value

STABILIZED

Interest Rate Arbitrage

Bridge Refinance

Permanent Acquisition/Recapitalization

$1-100MM

Up to 30 Years

READY CAPITAL.

Floating Rate

Fixed Rate

FREDDIE MAC

SBL

Multifamily

$1-$7.6MM

Declining Yield Maintenance

5,7,10 Years

Hybrid: 20 Years

Floating Rate

Hybrid

AFFORDABLE

HOUSING

Construction to Perm

Private Loan

Financing for

Eventual LIHTC

Takeout

$5MM+

90% Loan-to-Value

Typically, 7+Years

Defeasance

Yield

Maintenance

Floating Rate

Fixed Rate

Multifamily

Affordable

11View entire presentation