Kinnevik Results Presentation Deck

Intro

Net Asset Value

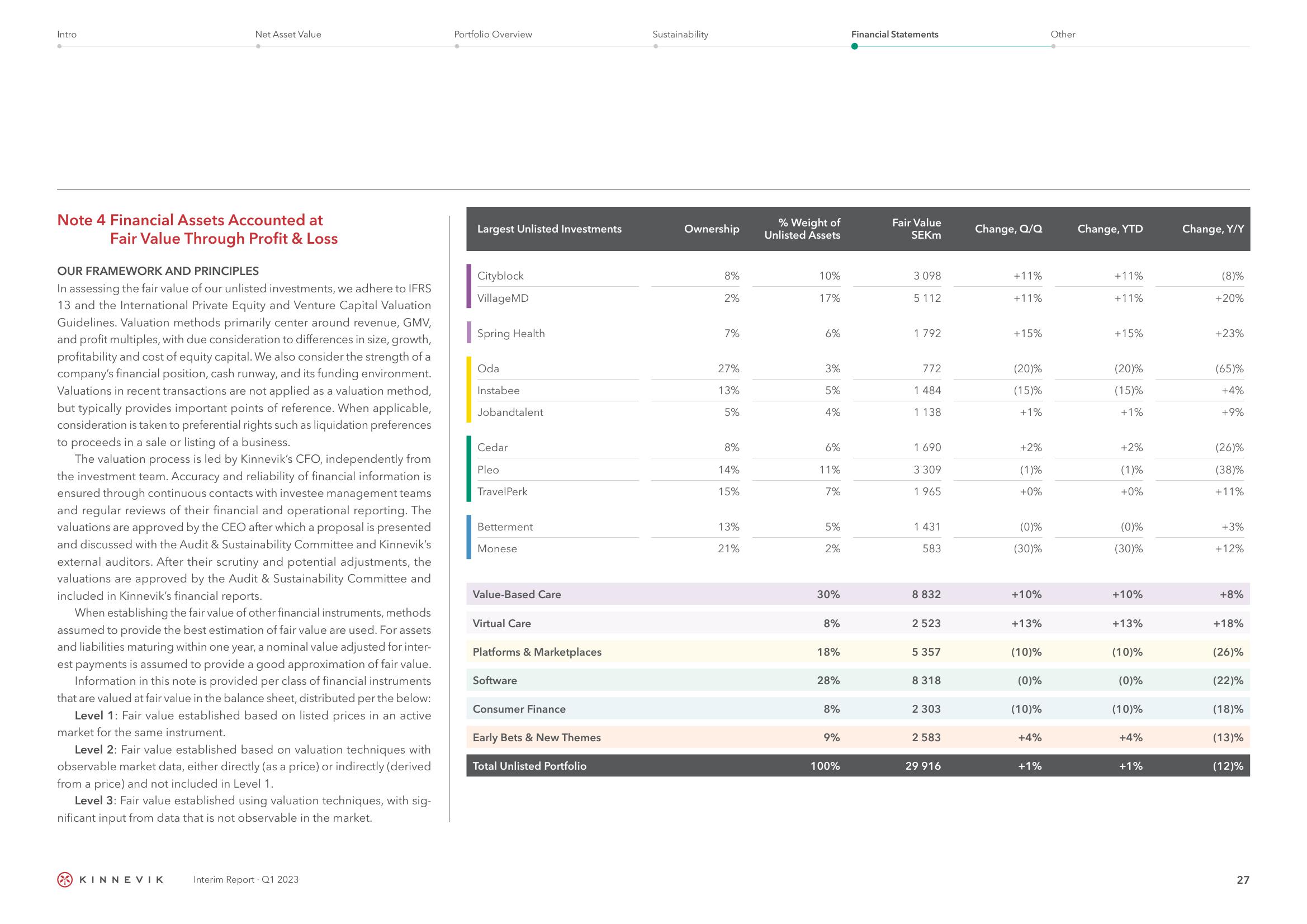

Note 4 Financial Assets Accounted at

Fair Value Through Profit & Loss

OUR FRAMEWORK AND PRINCIPLES

In assessing the fair value of our unlisted investments, we adhere to IFRS

13 and the International Private Equity and Venture Capital Valuation

Guidelines. Valuation methods primarily center around revenue, GMV,

and profit multiples, with due consideration to differences in size, growth,

profitability and cost of equity capital. We also consider the strength of a

company's financial position, cash runway, and its funding environment.

Valuations in recent transactions are not applied as a valuation method,

but typically provides important points of reference. When applicable,

consideration is taken to preferential rights such as liquidation preferences

to proceeds in a sale or listing of a business.

The valuation process is led by Kinnevik's CFO, independently from

the investment team. Accuracy and reliability of financial information is

ensured through continuous contacts with investee management teams

and regular reviews of their financial and operational reporting. The

valuations are approved by the CEO after which a proposal is presented

and discussed with the Audit & Sustainability Committee and Kinnevik's

external auditors. After their scrutiny and potential adjustments, the

valuations are approved by the Audit & Sustainability Committee and

included in Kinnevik's financial reports.

When establishing the fair value of other financial instruments, methods

assumed to provide the best estimation of fair value are used. For assets

and liabilities maturing within one year, a nominal value adjusted for inter-

est payments is assumed to provide a good approximation of fair value.

Information in this note is provided per class of financial instruments

that are valued at fair value in the balance sheet, distributed per the below:

Level 1: Fair value established based on listed prices in an active

market for the same instrument.

Level 2: Fair value established based on valuation techniques with

observable market data, either directly (as a price) or indirectly (derived

from a price) and not included in Level 1.

Level 3: Fair value established using valuation techniques, with sig-

nificant input from data that is not observable in the market.

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

Largest Unlisted Investments

Cityblock

Village MD

Spring Health

Oda

Instabee

Jobandtalent

Cedar

Pleo

TravelPerk

Betterment

Monese

Value-Based Care

Virtual Care

Platforms & Marketplaces

Software

Consumer Finance

Early Bets & New Themes

Total Unlisted Portfolio

Sustainability

Ownership

8%

2%

7%

27%

13%

5%

8%

14%

15%

13%

21%

% Weight of

Unlisted Assets

10%

17%

6%

3%

5%

4%

6%

11%

7%

5%

2%

30%

8%

18%

28%

8%

9%

100%

Financial Statements

Fair Value

SEKM

3 098

5112

1 792

772

1 484

1 138

1 690

3 309

1 965

1 431

583

8 832

2 523

5 357

8 318

2 303

2 583

29 916

Change, Q/Q

+11%

+11%

+15%

(20)%

(15)%

+1%

+2%

(1)%

+0%

(0)%

(30)%

+10%

+13%

(10)%

(0)%

(10)%

+4%

+1%

Other

Change, YTD

+11%

+11%

+15%

(20)%

(15)%

+1%

+2%

(1)%

+0%

(0)%

(30)%

+10%

+13%

(10)%

(0)%

(10)%

+4%

+1%

Change, Y/Y

(8)%

+20%

+23%

(65)%

+4%

+9%

(26)%

(38)%

+11%

+3%

+12%

+8%

+18%

(26)%

(22)%

(18)%

(13)%

(12)%

27View entire presentation