Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

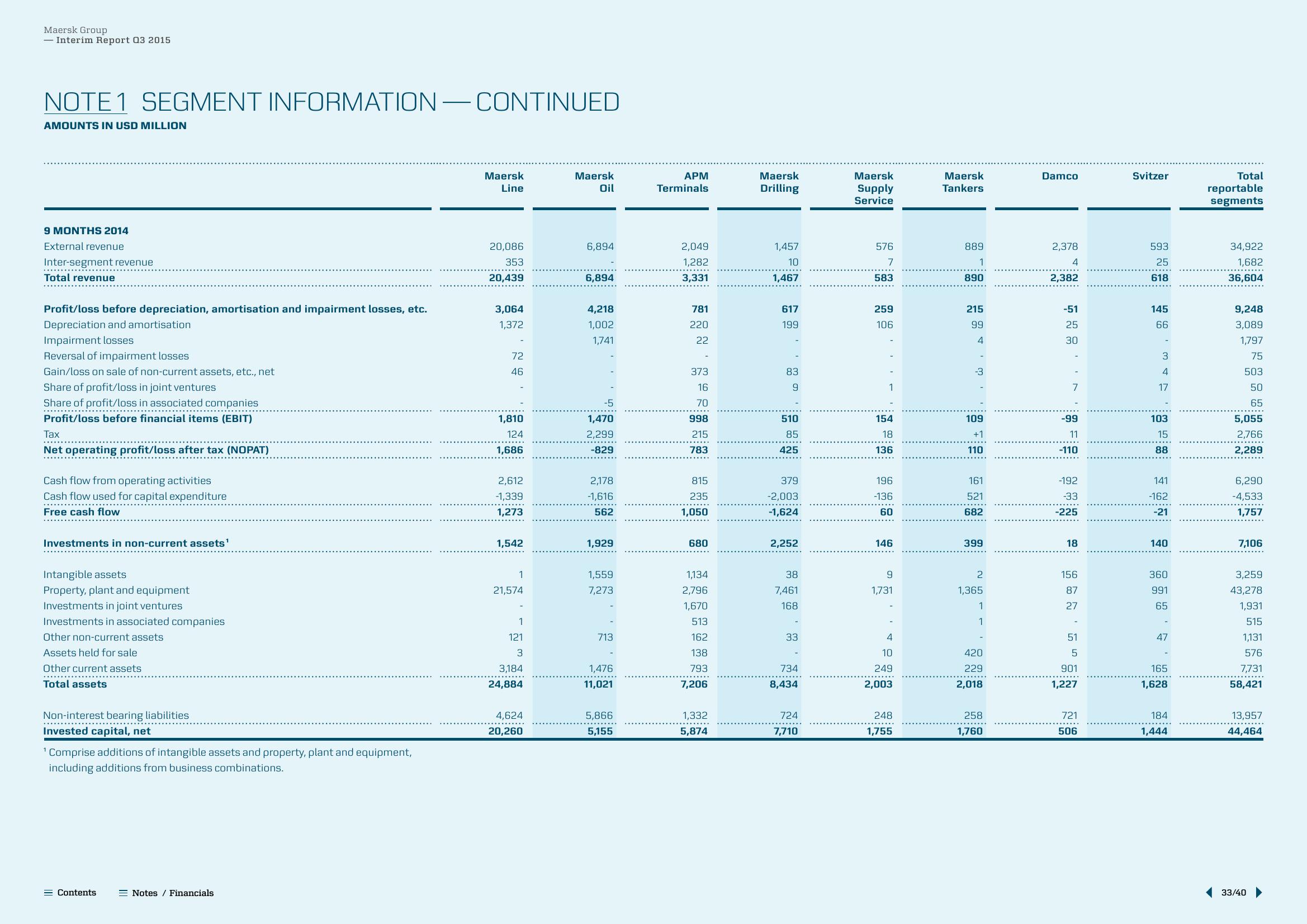

NOTE 1 SEGMENT INFORMATION — CONTINUED

AMOUNTS IN USD MILLION

9 MONTHS 2014

External revenue

Inter-segment revenue

Total revenue

Profit/loss before depreciation, amortisation and impairment losses, etc.

Depreciation and amortisation

Impairment losses

Reversal of impairment losses

Gain/loss on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

..……….……..…………………….

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Free cash flow

Investments in non-current assets¹

Intangible assets

Property, plant and equipment

Investments in joint ventures

Investments in associated companies

Other non-current assets

Assets held for sale

Other current assets

Total assets

Non-interest bearing liabilities

Invested capital, net

¹ Comprise additions of intangible assets and property, plant and equipment,

including additions from business combinations.

= Contents

Notes / Financials

Maersk

Line

20,086

353

20,439

3,064

1,372

72

46

1,810

124

1,686

2,612

-1,339

1,273

1,542

1

21,574

1

121

3

3,184

24,884

4,624

20,260

Maersk

Oil

6,894

6,894

4,218

1,002

1,741

-5

1,470

2,299

-829

2,178

-1,616

562

1,929

1,559

7,273

713

1,476

11,021

5,866

5,155

APM

Terminals

2,049

1,282

3,331

781

220

22

373

16

70

998

215

783

815

235

1,050

680

1,134

2,796

1,670

513

162

138

793

7,206

1,332

5,874

Maersk

Drilling

1,457

10

1,467

617

199

83

9

510

85

425

379

-2,003

-1,624

2,252

38

7,461

168

33

734

8,434

724

7,710

Maersk

Supply

Service

576

7

583

259

106

1

154

18

136

196

-136

60

146

9

1,731

4

10

249

2,003

248

1,755

Maersk

Tankers

889

1

890

215

99

4

-3

109

+1

110

161

521

682

399

2

1,365

1

1

420

229

2,018

258

1,760

Damco

2,378

4

2,382

-51

25

30

7

-99

11

-110

-192

-33

-225

18

156

87

27

51

5

901

1,227

721

506

Svitzer

593

25

618

145

66

3

4

17

103

15

88

141

-162

-21

140

360

991

65

47

165

1,628

184

1,444

Total

reportable

segments

34,922

1,682

36,604

9,248

3,089

1,797

75

503

50

65

5,055

2,766

2,289

6,290

-4,533

1,757

7,106

3,259

43,278

1,931

515

1,131

576

7,731

58,421

13,957

44,464

33/40View entire presentation