Barclays Capital 2010 Global Financial Services Conference

Strategic Plan - tracking our progress

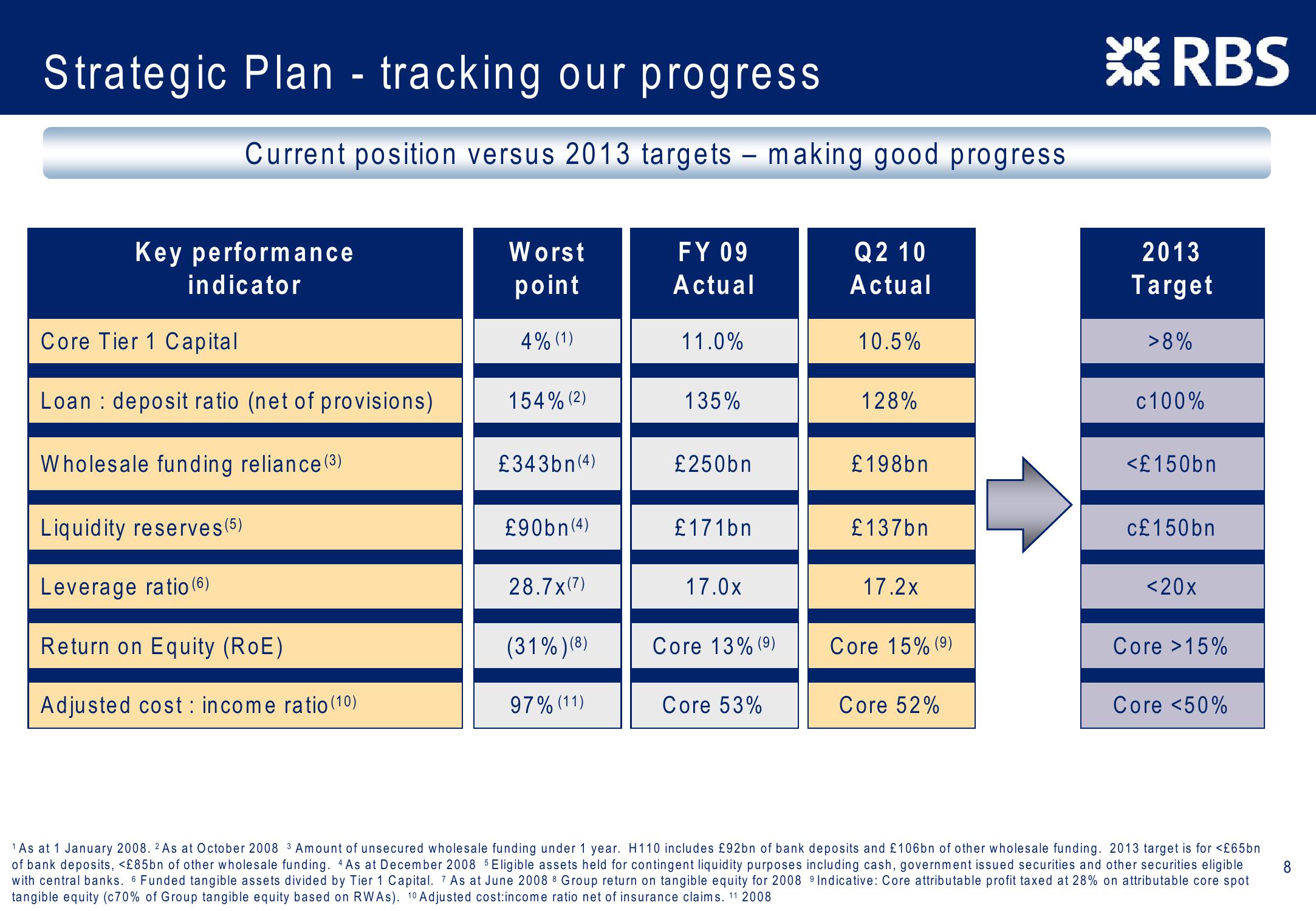

Current position versus 2013 targets - making good progress

Key performance

indicator

XRBS

2013

Target

Worst

point

FY 09

Actual

Q2 10

Actual

Core Tier 1 Capital

4% (1)

11.0%

10.5%

>8%

Loan deposit ratio (net of provisions)

154% (2)

135%

128%

c100%

Wholesale funding reliance (3)

£343bn (4)

£250bn

£198bn

<£150bn

Liquidity reserves (5)

£90bn (4)

£171bn

£137bn

c£150bn

Leverage ratio (6)

28.7x(7)

17.0x

17.2x

<20x

Return on Equity (RoE)

(31%)(8)

Core 13% (9)

Core 15% (9)

Core >15%

Adjusted cost income ratio (10)

97% (11)

Core 53%

Core 52%

Core <50%

1 As at 1 January 2008. 2 As at October 2008 3 Amount of unsecured wholesale funding under 1 year. H110 includes £92bn of bank deposits and £106bn of other wholesale funding. 2013 target is for <£65bn

of bank deposits, <£85bn of other wholesale funding. 4 As at December 2008 5 Eligible assets held for contingent liquidity purposes including cash, government issued securities and other securities eligible

with central banks. 6 Funded tangible assets divided by Tier 1 Capital. 7 As at June 2008 8 Group return on tangible equity for 2008 9 Indicative: Core attributable profit taxed at 28% on attributable core spot

tangible equity (c70% of Group tangible equity based on RWAs). 10 Adjusted cost:income ratio net of insurance claims. 11 2008

8View entire presentation