Inovalon Results Presentation Deck

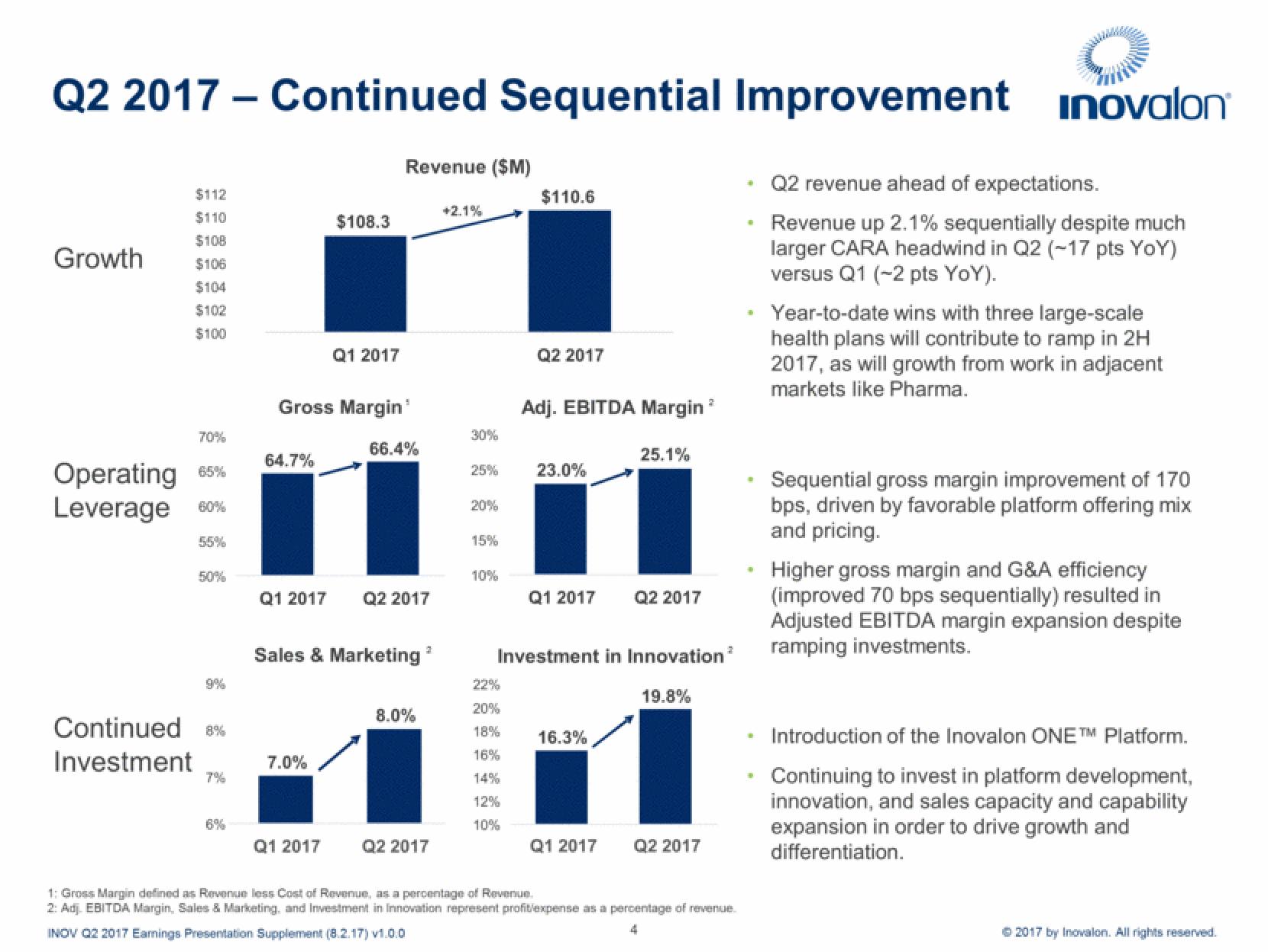

Q2 2017 - Continued Sequential Improvement inovalon

Growth

$112

$110

$108

$106

$104

$102

$100

70%

Operating 65%

Leverage 60%

55%

50%

Continued 8%

Investment

6%

64.7%

$108.3

Gross Margin'

Q1 2017

7.0%

Revenue ($M)

Q1 2017

Q1 2017 Q2 2017

66.4%

Sales & Marketing 2

8.0%

Q2 2017

+2.1%

25%

20%

15%

10%

$110.6

22%

20%

18%

16%

14%

12%

10%

Q2 2017

3

Adj. EBITDA Margin ³

23.0%

Q1 2017

25.1%

Investment in Innovation²

16.3%

Q2 2017

19.8%

Q1 2017 Q2 2017

1: Gross Margin defined as Revenue less Cost of Revenue, as a percentage of Revenue.

2: Adj. EBITDA Margin, Sales & Marketing, and Investment in Innovation represent profit/expense as a percentage of revenue.

INOV Q2 2017 Earnings Presentation Supplement (8.2.17) v1.0.0

4

1

#

Q2 revenue ahead of expectations.

Revenue up 2.1% sequentially despite much

larger CARA headwind in Q2 (-17 pts YoY)

versus Q1 (-2 pts YoY).

Year-to-date wins with three large-scale

health plans will contribute to ramp in 2H

2017, as will growth from work in adjacent

markets like Pharma.

Sequential gross margin improvement of 170

bps, driven by favorable platform offering mix

and pricing.

Higher gross margin and G&A efficiency

(improved 70 bps sequentially) resulted in

Adjusted EBITDA margin expansion despite

ramping investments.

Introduction of the Inovalon ONE™ Platform.

Continuing to invest in platform development,

innovation, and sales capacity and capability

expansion in order to drive growth and

differentiation.

© 2017 by Inovalon. All rights reserved.View entire presentation