Silicon Valley Bank Results Presentation Deck

Glossary

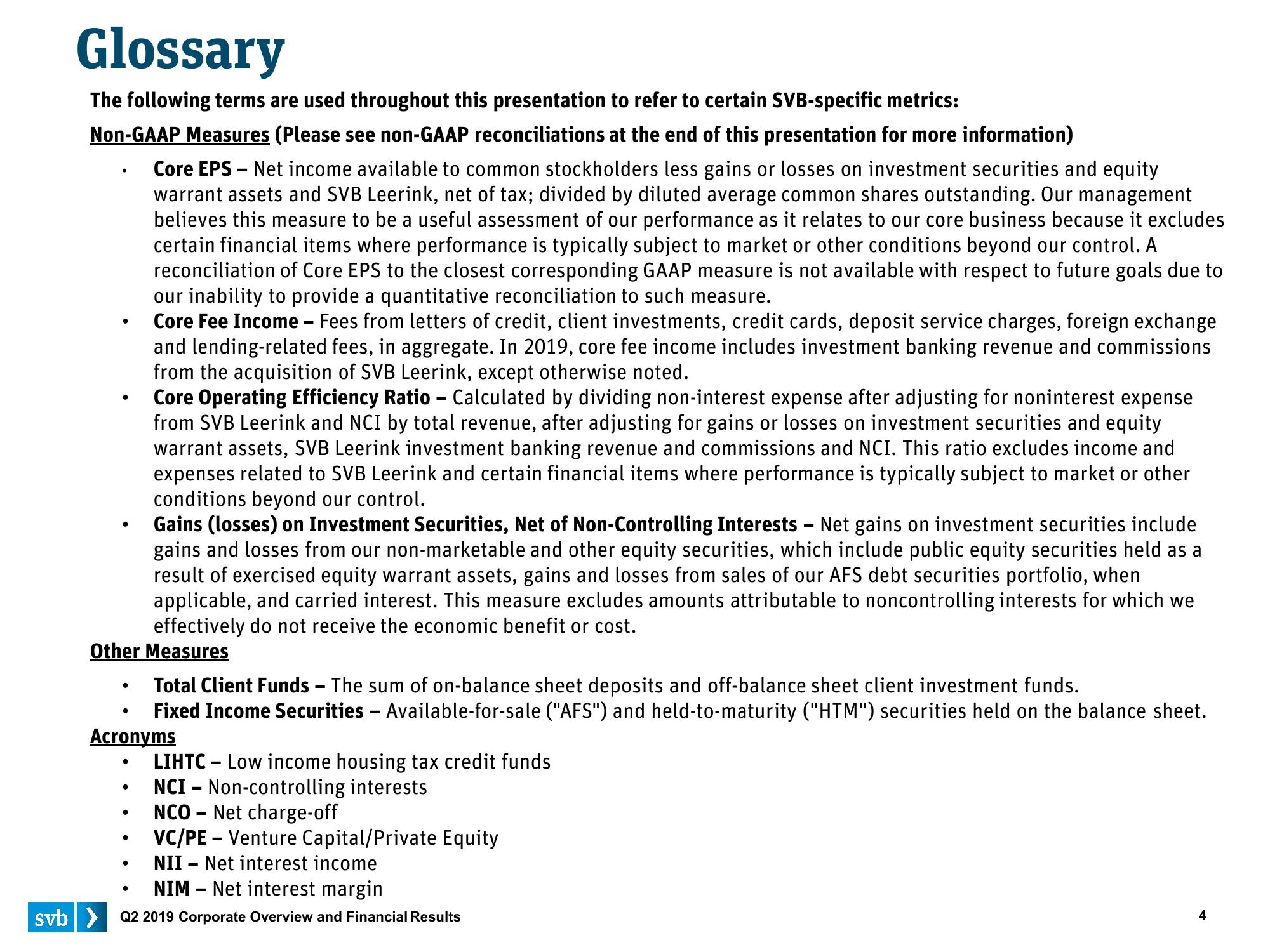

The following terms are used throughout this presentation to refer to certain SVB-specific metrics:

Non-GAAP Measures (Please see non-GAAP reconciliations at the end of this presentation for more information)

Core EPS-Net income available to common stockholders less gains or losses on investment securities and equity

warrant assets and SVB Leerink, net of tax; divided by diluted average common shares outstanding. Our management

believes this measure to be a useful assessment of our performance as it relates to our core business because it excludes

certain financial items where performance is typically subject to market or other conditions beyond our control. A

reconciliation of Core EPS to the closest corresponding GAAP measure is not available with respect to future goals due to

our inability to provide a quantitative reconciliation to such measure.

Core Fee Income - Fees from letters of credit, client investments, credit cards, deposit service charges, foreign exchange

and lending-related fees, in aggregate. In 2019, core fee income includes investment banking revenue and commissions

from the acquisition of SVB Leerink, except otherwise noted.

Core Operating Efficiency Ratio - Calculated by dividing non-interest expense after adjusting for noninterest expense

from SVB Leerink and NCI by total revenue, after adjusting for gains or losses on investment securities and equity

warrant assets, SVB Leerink investment banking revenue and commissions and NCI. This ratio excludes income and

expenses related to SVB Leerink and certain financial items where performance is typically subject to market or other

conditions beyond our control.

●

●

Gains (losses) on Investment Securities, Net of Non-Controlling Interests - Net gains on investment securities include

gains and losses from our non-marketable and other equity securities, which include public equity securities held as a

result of exercised equity warrant assets, gains and losses from sales of our AFS debt securities portfolio, when

applicable, and carried interest. This measure excludes amounts attributable to noncontrolling interests for which we

effectively do not receive the economic benefit or cost.

Other Measures

●

Total Client Funds - The sum of on-balance sheet deposits and off-balance sheet client investment funds.

Fixed Income Securities - Available-for-sale ("AFS") and held-to-maturity ("HTM") securities held on the balance sheet.

Acronyms

LIHTC - Low income housing tax credit funds

NCI - Non-controlling interests

NCO Net charge-off

●

●

●

●

VC/PE - Venture Capital/Private Equity

NII - Net interest income

NIM-Net interest margin

svb> Q2 2019 Corporate Overview and Financial Results

●

●

●

4View entire presentation