Cannae SPAC Presentation Deck

2.

3.

4.

SYSTEM

5.

TREBIA

ACQUISITION

CORPORATION

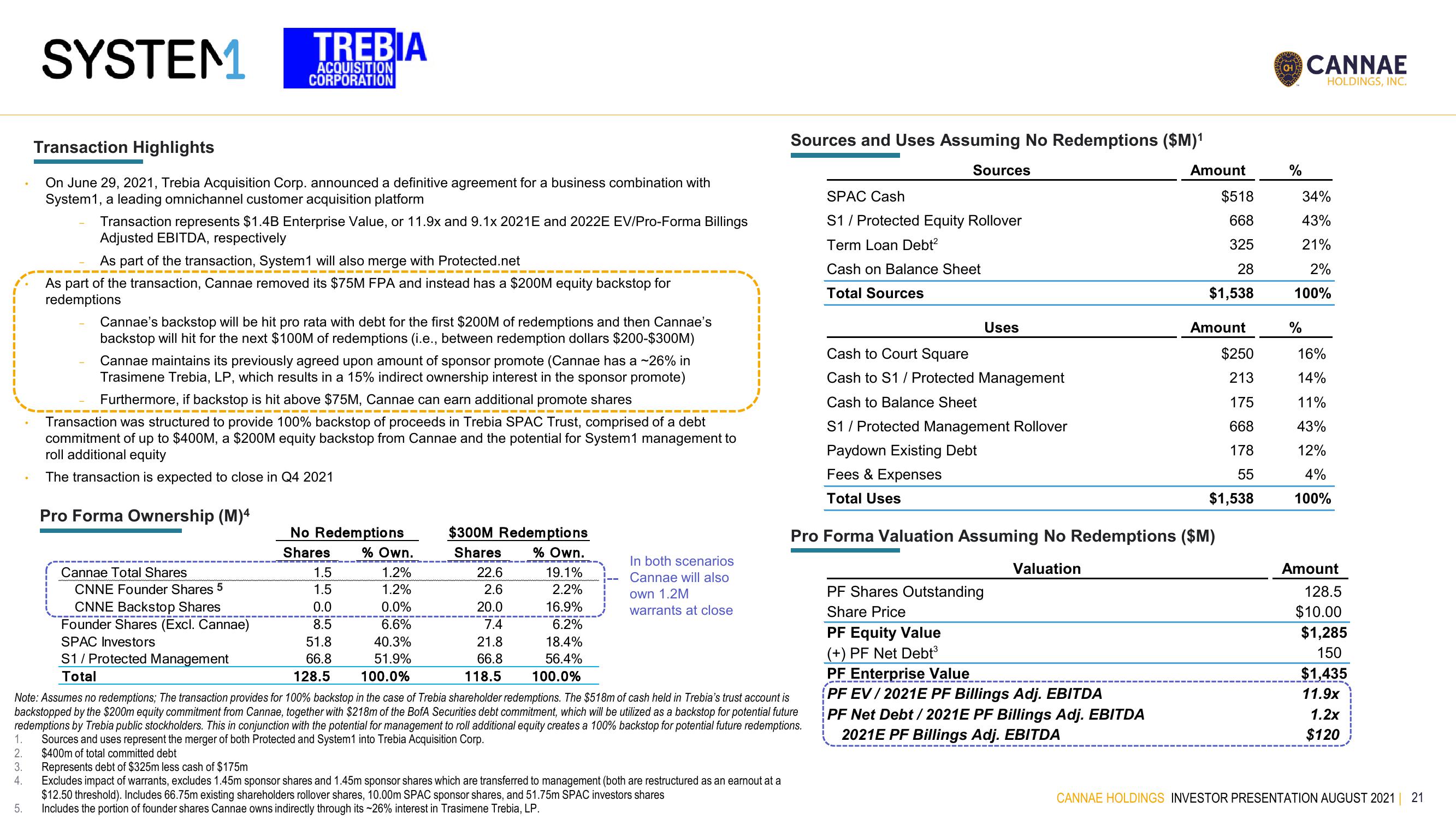

Transaction Highlights

On June 29, 2021, Trebia Acquisition Corp. announced a definitive agreement for a business combination with

System1, a leading omnichannel customer acquisition platform

Transaction represents $1.4B Enterprise Value, or 11.9x and 9.1x 2021E and 2022E EV/Pro-Forma Billings

Adjusted EBITDA, respectively

As part of the transaction, System1 will also merge with Protected.net

As part of the transaction, Cannae removed its $75M FPA and instead has a $200M equity backstop for

redemptions

Cannae's backstop will be hit pro rata with debt for the first $200M of redemptions and then Cannae's

backstop will hit for the next $100M of redemptions (i.e., between redemption dollars $200-$300M)

Cannae maintains its previously agreed upon amount of sponsor promote (Cannae has a -26% in

Trasimene Trebia, LP, which results in a 15% indirect ownership interest in the sponsor promote)

Furthermore, if backstop is hit above $75M, Cannae can earn additional promote shares

Transaction was structured to provide 100% backstop of proceeds in Trebia SPAC Trust, comprised of a debt

commitment of up to $400M, a $200M equity backstop from Cannae and the potential for System1 management to

roll additional equity

The transaction is expected to close in Q4 2021

Pro Forma Ownership (M)4

No Redemptions

Shares % Own.

1.5

1.2%

1.5

1.2%

0.0

0.0%

8.5

6.6%

51.8

40.3%

66.8

51.9%

128.5

100.0%

$300M Redemptions

Shares % Own.

22.6

19.1%

2.6

2.2%

16.9%

20.0

7.4

6.2%

21.8

18.4%

66.8

56.4%

118.5

100.0%

In both scenarios

Cannae will also

own 1.2M

warrants at close

Sources and Uses Assuming No Redemptions ($M)¹

Cannae Total Shares

CNNE Founder Shares 5

CNNE Backstop Shares

Founder Shares (Excl. Cannae)

SPAC Investors

S1/Protected Management

Total

Note: Assumes no redemptions; The transaction provides for 100% backstop in the case of Trebia shareholder redemptions. The $518m of cash held in Trebia's trust account is

backstopped by the $200m equity commitment from Cannae, together with $218m of the BofA Securities debt commitment, which will be utilized as a backstop for potential future

redemptions by Trebia public stockholders. This in conjunction with the potential for management to roll additional equity creates a 100% backstop for potential future redemptions.

1. Sources and uses represent the merger of both Protected and System1 into Trebia Acquisition Corp.

$400m of total committed debt

Represents debt of $325m less cash of $175m

Excludes impact of warrants, excludes 1.45m sponsor shares and 1.45m sponsor shares which are transferred to management (both are restructured as an earnout at a

$12.50 threshold). Includes 66.75m existing shareholders rollover shares, 10.00m SPAC sponsor shares, and 51.75m SPAC investors shares

Includes the portion of founder shares Cannae owns indirectly through its ~26% interest in Trasimene Trebia, LP.

Sources

SPAC Cash

S1 / Protected Equity Rollover

Term Loan Debt²

Cash on Balance Sheet

Total Sources

Uses

Cash to Court Square

Cash to S1 Protected Management

Cash to Balance Sheet

S1 / Protected Management Rollover

Paydown Existing Debt

Fees & Expenses

Total Uses

Amount

PF Shares Outstanding

Share Price

PF Equity Value

(+) PF Net Debt³

PF Enterprise Value

PF EV/2021E PF Billings Adj. EBITDA

PF Net Debt / 2021E PF Billings Adj. EBITDA

2021E PF Billings Adj. EBITDA

$518

668

325

28

$1,538

Amount

Pro Forma Valuation Assuming No Redemptions ($M)

Valuation

$250

213

175

668

178

55

$1,538

CH

%

CANNAE

HOLDINGS, INC.

34%

43%

21%

2%

100%

%

16%

14%

11%

43%

12%

4%

100%

Amount

128.5

$10.00

$1,285

150

$1,435

11.9x

1.2x

$120

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 21View entire presentation