Anghami SPAC Presentation Deck

Transaction Summary

VISTAS MEDIA

ACQUISITION COMPANY

(L.) anghami

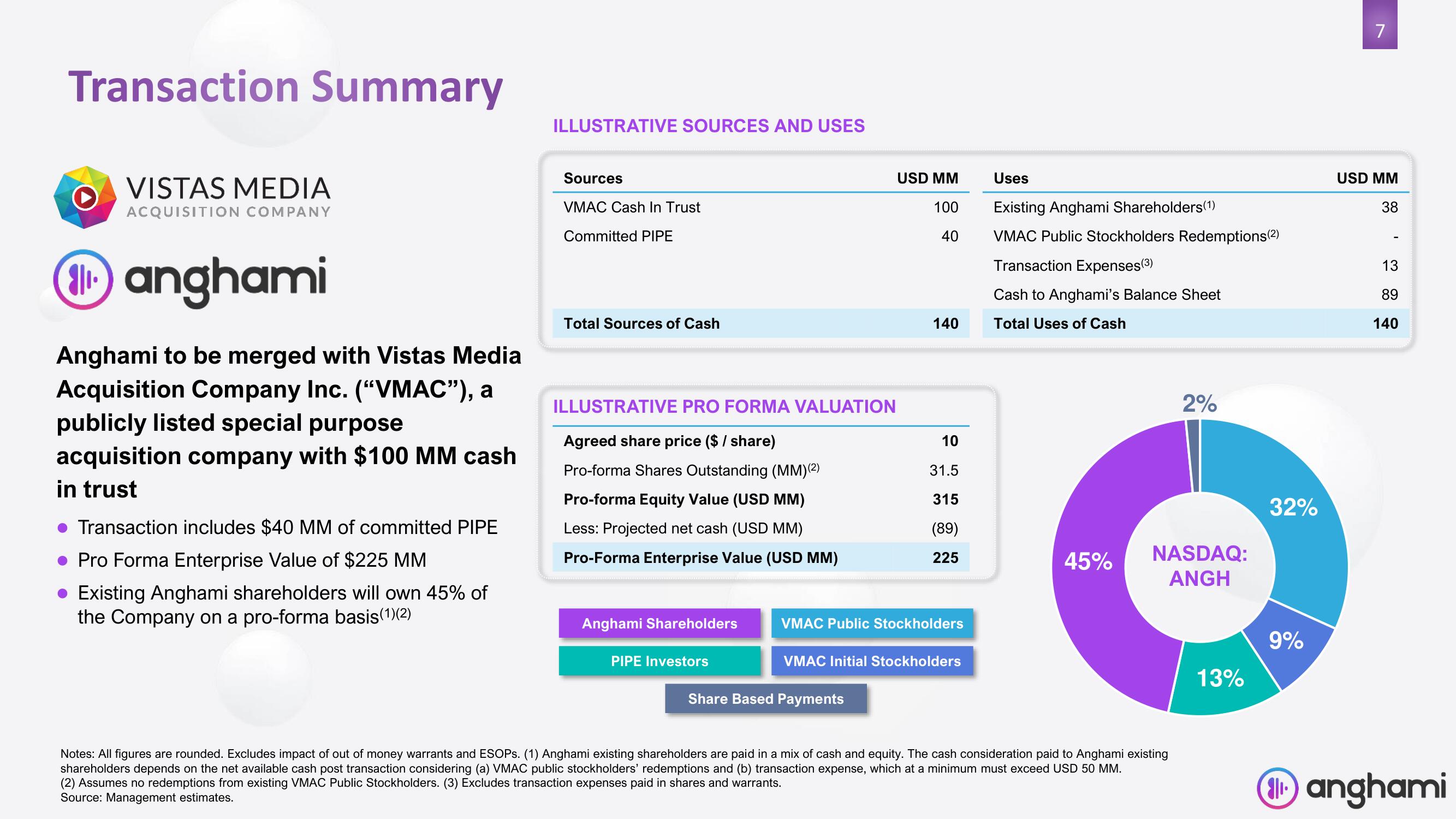

Anghami to be merged with Vistas Media

Acquisition Company Inc. ("VMAC”), a

publicly listed special purpose

acquisition company with $100 MM cash

in trust

Transaction includes $40 MM of committed PIPE

● Pro Forma Enterprise Value of $225 MM

Existing Anghami shareholders will own 45% of

the Company on a pro-forma basis(1)(2)

ILLUSTRATIVE SOURCES AND USES

Sources

VMAC Cash In Trust

Committed PIPE

Total Sources of Cash

ILLUSTRATIVE PRO FORMA VALUATION

Agreed share price ($ / share)

Pro-forma Shares Outstanding (MM) (2)

Pro-forma Equity Value (USD MM)

Less: Projected net cash (USD MM)

Pro-Forma Enterprise Value (USD MM)

Anghami Shareholders

PIPE Investors

USD MM

100

40

Share Based Payments

10

31.5

315

(89)

225

VMAC Public Stockholders

140 To

VMAC Initial Stockholders

Uses

Existing Anghami Shareholders(1)

VMAC Public Stockholders Redemptions(2)

Transaction Expenses(3)

Cash to Anghami's Balance Sheet

Total Uses of Cash

45%

2%

NASDAQ:

ANGH

Notes: All figures are rounded. Excludes impact of out of money warrants and ESOPs. (1) Anghami existing shareholders are paid in a mix of cash and equity. The cash consideration paid to Anghami existing

shareholders depends on the net available cash post transaction considering (a) VMAC public stockholders' redemptions and (b) transaction expense, which at a minimum must exceed USD 50 MM.

(2) Assumes no redemptions from existing VMAC Public Stockholders. (3) Excludes transaction expenses paid in shares and warrants.

Source: Management estimates.

13%

32%

9%

7

USD MM

38

13

89

140

(11. anghamiView entire presentation