Netstreit Investor Presentation Deck

Conservative Balance Sheet with Improved Liquidity

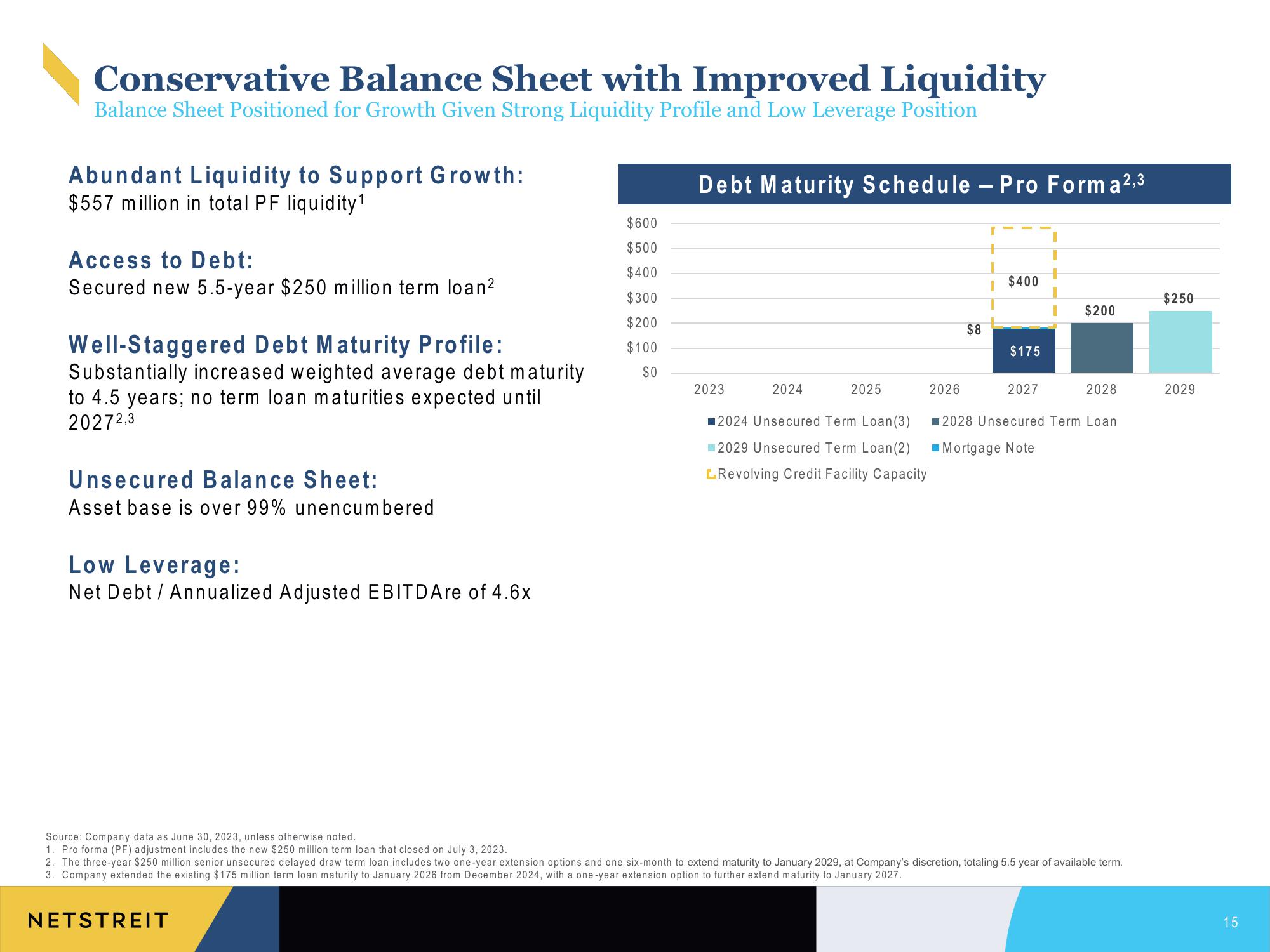

Balance Sheet Positioned for Growth Given Strong Liquidity Profile and Low Leverage Position

Abundant Liquidity to Support Growth:

$557 million in total PF liquidity ¹

Access to Debt:

Secured new 5.5-year $250 million term loan²

Well-Staggered Debt Maturity Profile:

Substantially increased weighted average debt maturity

to 4.5 years; no term loan maturities expected until

20272,3

Unsecured Balance Sheet:

Asset base is over 99% unencumbered

Low Leverage:

Net Debt / Annualized Adjusted EBITDAre of 4.6x

$600

$500

$400

$300

$200

$100

$0

Debt Maturity Schedule - Pro Forma ²,3

2023

2024

2025

2024 Unsecured Term Loan (3)

2029 Unsecured Term Loan (2)

LRevolving Credit Facility Capacity

2026

$8

I

I

$400

$175

2027

$200

2028

2028 Unsecured Term Loan

Mortgage Note

Source: Company data as June 30, 2023, unless otherwise noted.

1. Pro forma (PF) adjustment includes the new $250 million term loan that closed on July 3, 2023.

2. The three-year $250 million senior unsecured delayed draw term loan includes two one-year extension options and one six-month to extend maturity to January 2029, at Company's discretion, totaling 5.5 year of available term.

3. Company extended the existing $175 million term loan maturity to January 2026 from December 2024, with a one-year extension option to further extend maturity to January 2027.

NETSTREIT

$250

2029

15View entire presentation