Hilltop Holdings Results Presentation Deck

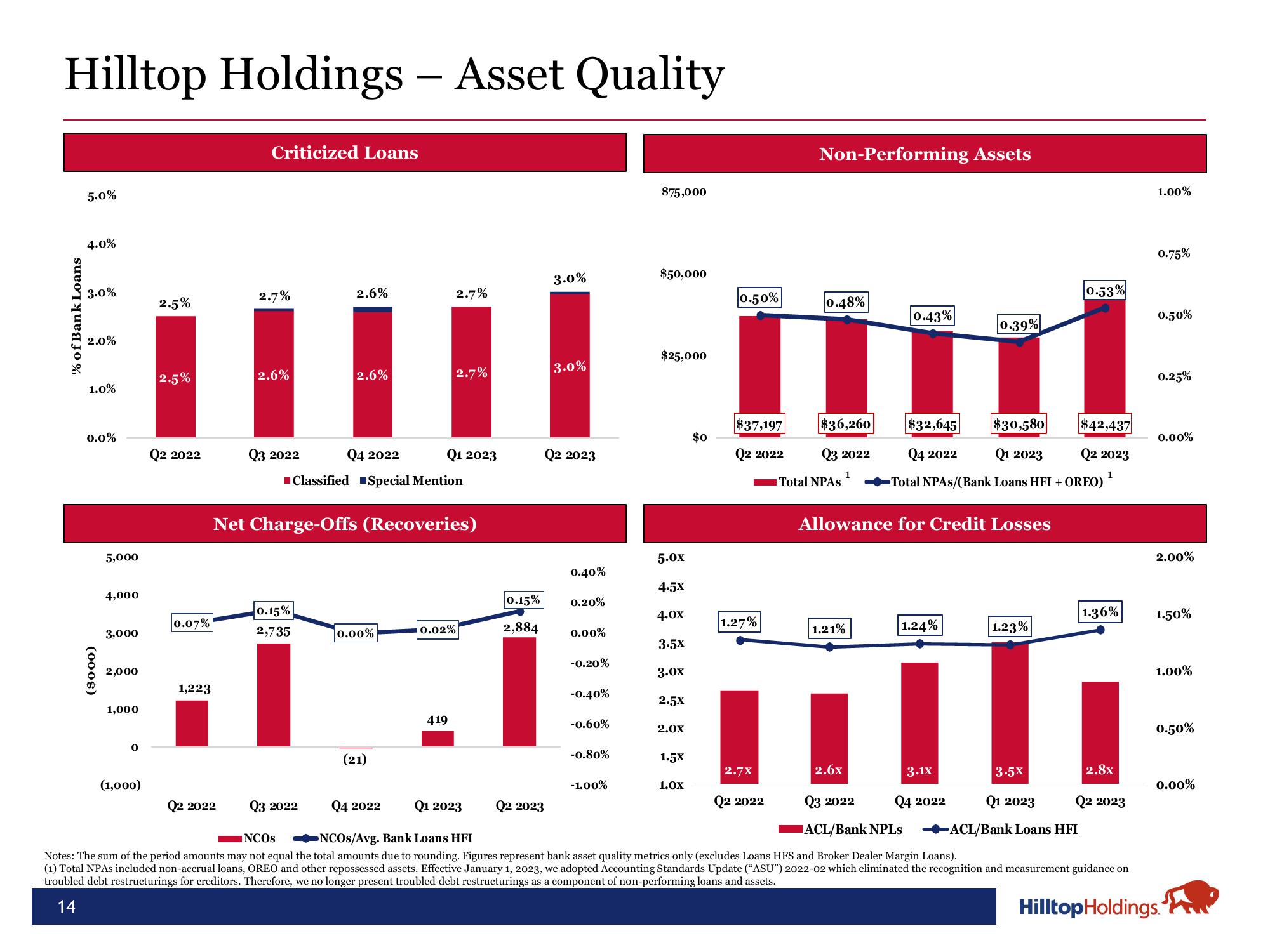

Hilltop Holdings - Asset Quality

% of Bank Loans

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

($000)

5,000

4,000

3,000

2,000

1,000

0

(1,000)

2.5%

2.5%

Q2 2022

0.07%

1,223

Criticized Loans

2.7%

Q2 2022

2.6%

Q3 2022

2.6%

0.15%

2,735

2.6%

Q4 2022

Classified Special Mention

Net Charge-Offs (Recoveries)

0.00%

(21)

2.7%

Q1 2023

2.7%

0.02%

419

0.15%

2,884

3.0%

3.0%

Q2 2023

Q2 2023

0.40%

0.20%

0.00%

-0.20%

-0.40%

-0.60%

-0.80%

-1.00%

$75,000

$50,000

$25,000

5.0x

4.5X

4.0x

3.5X

3.0x

2.5X

2.0X

1.5X

1.0X

$0

0.50%

$37,197

Q2 2022

1.27%

2.7X

Q2 2022

Non-Performing Assets

0.48%

$36,260

Q3 2022

Total NPAS

1

1.21%

2.6x

0.43%

Allowance for Credit Losses

0.39%

$32,645 $30,580

Q4 2022 Q1 2023

Total NPAs/(Bank Loans HFI + OREO)

1.24%

3.1x

1.23%

3.5x

0.53%

$42,437

Q2 2023

1

Q1 2023

ACL/Bank Loans HFI

1.36%

2.8x

Q2 2023

1.00%

0.75%

0.50%

0.25%

0.00%

2.00%

1.50%

Q3 2022 Q4 2022

ACL/Bank NPLs

Q3 2022 Q4 2022 Q1 2023

INCOS -NCOS/Avg. Bank Loans HFI

Notes: The sum of the period amounts may not equal the total amounts due to rounding. Figures represent bank asset quality metrics only (excludes Loans HFS and Broker Dealer Margin Loans).

(1) Total NPAs included non-accrual loans, OREO and other repossessed assets. Effective January 1, 2023, we adopted Accounting Standards Update ("ASU") 2022-02 which eliminated the recognition and measurement guidance on

troubled debt restructurings for creditors. Therefore, we no longer present troubled debt restructurings as a component of non-performing loans and assets.

14

Hilltop Holdings.

1.00%

0.50%

0.00%View entire presentation