Tudor, Pickering, Holt & Co Investment Banking

Discount Rate

Discount Rate

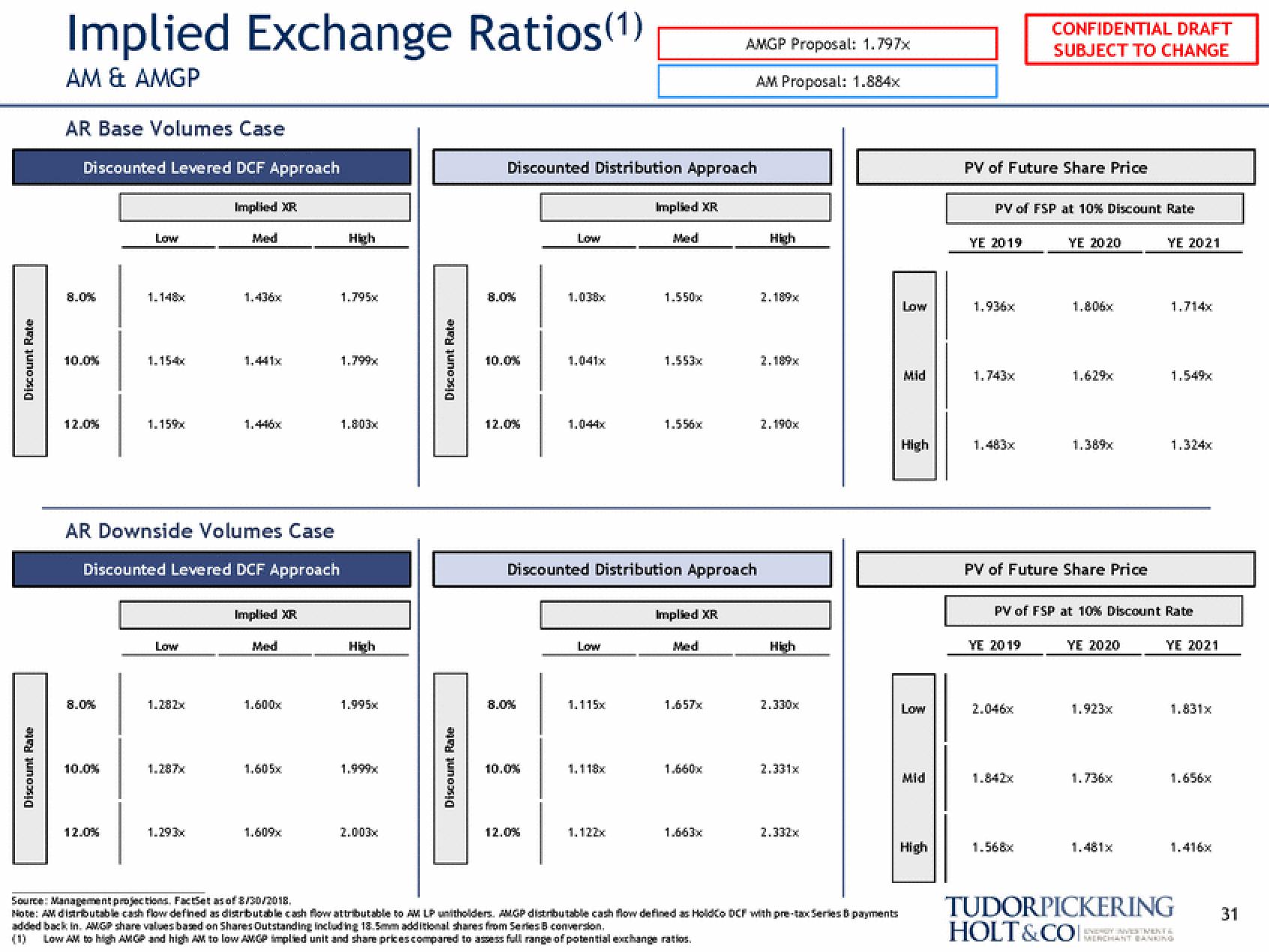

Implied Exchange Ratios(1)

AM & AMGP

AR Base Volumes Case

Discounted Levered DCF Approach

8.0%

10.0%

12.0%

8.0%

10.0%

Low

12.0%

1.148x

1.154x

1.159x

AR Downside Volumes Case

Discounted Levered DCF Approach

Low

1.282x

1.287x

Implied XR

1.293x

1.436x

1.446x

Implied XR

Med

1.600x

1.605x

1.609x

High

1.795x

1.803x

High

1.995x

1.999x

2.003x

Discount Rate

Discount Rate

Discounted Distribution Approach

8.0%

10.0%

12.0%

8.0%

10.0%

Low

12.0%

1.038x

1.041x

Low

1.115x

Discounted Distribution Approach

1.118x

Implied XR

1.122x

Med

1.550x

1.553x

1.556x

Implied XR

Med

1.657x

AMGP Proposal: 1.797x

AM Proposal: 1.884x

1.660x

1.663x

High

2.189x

2.189x

2.190x

2.330x

2.331x

2.332x

Source: Management projections. FactSet as of 8/30/2018.

Note: AM distributable cash flow defined as distributable cash flow attributable to AM LP unitholders. AMGP distributable cash flow defined as HoldCo DCF with pre-tax Series B payments

added back in AMGP share values based on Shares Outstanding including 13.5mm additional shares from Series B conversion.

Low AM to high AMGP and high AM to low AMGP implied unit and share prices compared to assess full range of potential exchange ratios.

Low

Mid

High

Low

Mid

High

PV of Future Share Price

PV of FSP at 10% Discount Rate

YE 2019

1.936x

1.743x

1.483x

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

YE 2019

2.046x

1.842x

YE 2020

PV of Future Share Price

1.568x

1.806x

1.629x

1.389x

PV of FSP at 10% Discount Rate

YE 2020

1.923x

1.736x

YE 2021

1.481x

1.714x

1.549x

1.324x

YE 2021

1.831x

1.656x

1.416x

TUDORPICKERING

HOLT&COI:

ENERGY INVESTMENTS

MERCHANT BANKING

31View entire presentation