Jefferies Financial Group Investor Day Presentation Deck

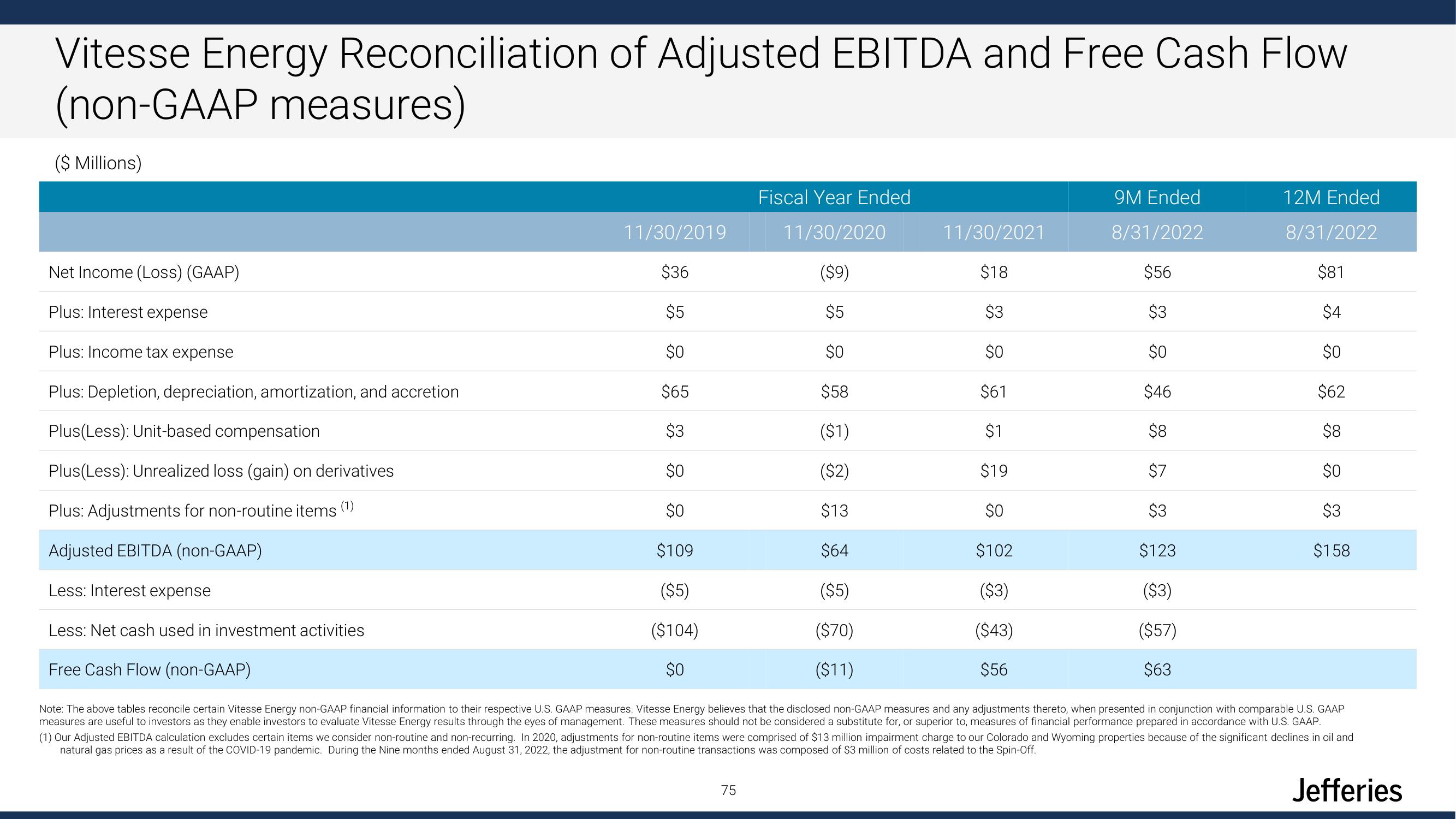

Vitesse Energy Reconciliation of Adjusted EBITDA and Free Cash Flow

(non-GAAP measures)

($ Millions)

Net Income (Loss) (GAAP)

Plus: Interest expense

Plus: Income tax expense

Plus: Depletion, depreciation, amortization, and accretion

11/30/2019

$36

$5

$0

$65

$3

$0

$0

$109

($5)

($104)

$0

Fiscal Year Ended

11/30/2020

($9)

$5

$0

$58

($1)

($2)

$13

$64

($5)

($70)

($11)

75

11/30/2021

$18

$3

$0

$61

$1

$19

$0

$102

($3)

($43)

$56

9M Ended

8/31/2022

$56

$3

$0

$46

$8

$7

$3

$123

($3)

($57)

$63

12M Ended

8/31/2022

$81

$4

$0

$62

$8

$0

$3

$158

Plus(Less): Unit-based compensation

Plus (Less): Unrealized loss (gain) on derivatives

(1)

Plus: Adjustments for non-routine items

Adjusted EBITDA (non-GAAP)

Less: Interest expense

Less: Net cash used in investment activities

Free Cash Flow (non-GAAP)

Note: The above tables reconcile certain Vitesse Energy non-GAAP financial information to their respective U.S. GAAP measures. Vitesse Energy believes that the disclosed non-GAAP measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP

measures are useful to investors as they enable investors to evaluate Vitesse Energy results through the eyes of management. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

(1) Our Adjusted EBITDA calculation excludes certain items we consider non-routine and non-recurring. In 2020, adjustments for non-routine items were comprised of $13 million impairment charge to our Colorado and Wyoming properties because of the significant declines in oil and

natural gas prices as a result of the COVID-19 pandemic. During the Nine months ended August 31, 2022, the adjustment for non-routine transactions was composed of $3 million of costs related to the Spin-Off.

JefferiesView entire presentation