Connecticut Fund Risk Overview

Fortress Lending Fund III

Fund

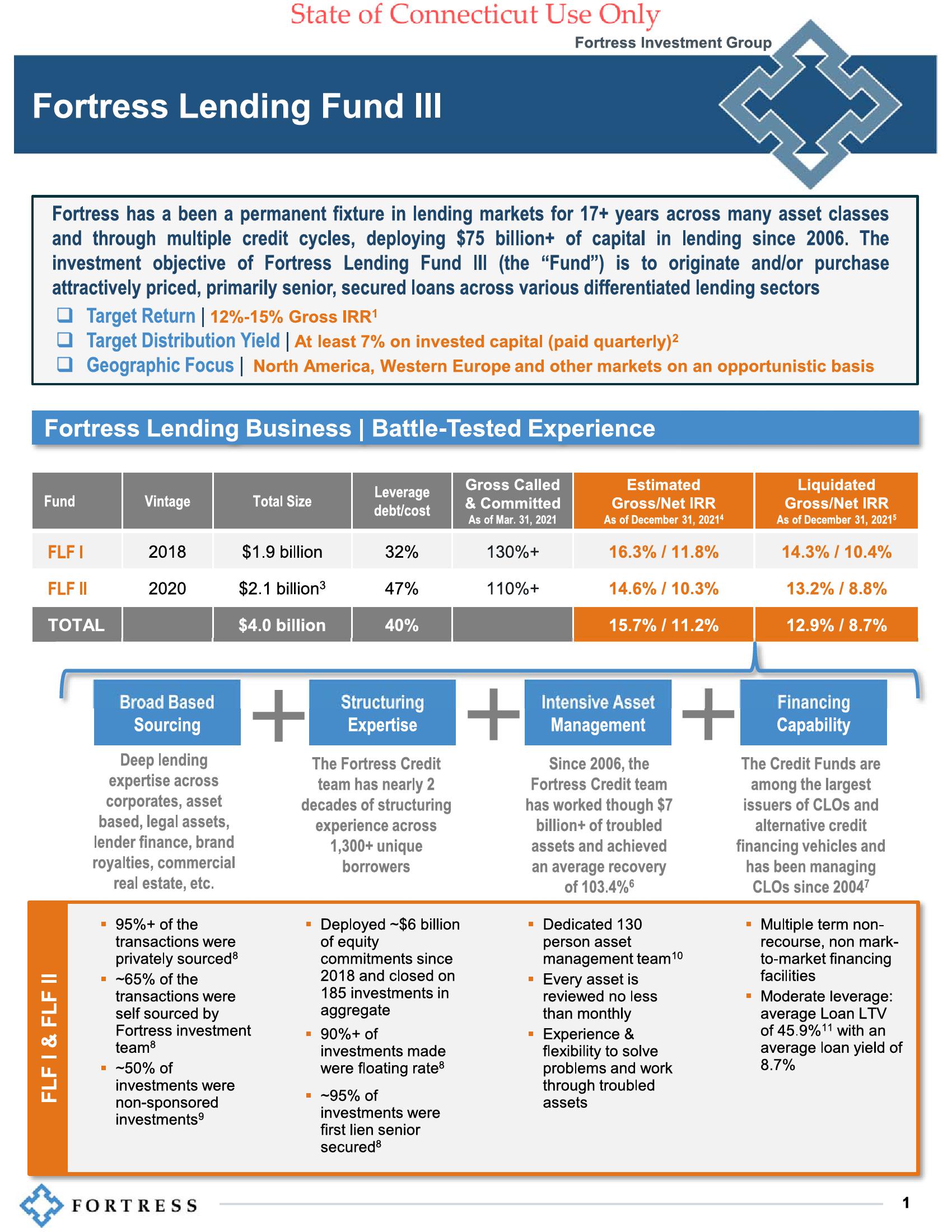

Fortress has a been a permanent fixture in lending markets for 17+ years across many asset classes

and through multiple credit cycles, deploying $75 billion+ of capital in lending since 2006. The

investment objective of Fortress Lending Fund III (the "Fund") is to originate and/or purchase

attractively priced, primarily senior, secured loans across various differentiated lending sectors

Fortress Lending Business | Battle-Tested Experience

FLFI

FLF II

TOTAL

FLF I & FLF II

Target Return | 12%-15% Gross IRR¹

Target Distribution Yield | At least 7% on invested capital (paid quarterly)²

Geographic Focus | North America, Western Europe and other markets on an opportunistic basis

Vintage

2018

2020

Broad Based

Sourcing

Deep lending

expertise across

corporates, asset

based, legal assets,

lender finance, brand

State of Connecticut Use Only

royalties, commercial

real estate, etc.

investments were

non-sponsored

investments⁹

▪ 95%+ of the

transactions were

privately sourced8

■ -65% of the

transactions were

self sourced by

Fortress investment

team8

■ ~50% of

FORTRESS

Total Size

$1.9 billion

$2.1 billion ³

$4.0 billion

+

Leverage

debt/cost

H

Structuring

Expertise

The Fortress Credit

team has nearly 2

decades of structuring

experience across

1,300+ unique

borrowers

32%

47%

40%

Deployed $6 billion

of equity

commitments since

2018 and closed on

185 investments in

aggregate

▪ 90%+ of

investments made

were floating rate8

▪ ~95% of

Fortress Investment Group

investments were

first lien senior

secured8

Gross Called

& Committed

As of Mar. 31, 2021

130%+

110%+

+

Estimated

Gross/Net IRR

As of December 31, 20214

16.3% / 11.8%

14.6% / 10.3%

15.7% / 11.2%

Intensive Asset

Management

Since 2006, the

Fortress Credit team

has worked though $7

billion+ of troubled

assets and achieved

an average recovery

of 103.4%6

+

3

■ Dedicated 130

person asset

management team 10

Every asset is

reviewed no less

than monthly

Experience &

flexibility to solve

problems and work

through troubled

assets

H

Liquidated

Gross/Net IRR

As of December 31, 20215

14.3% / 10.4%

13.2% / 8.8%

12.9% / 8.7%

Financing

Capability

The Credit Funds are

among the largest

issuers of CLOs and

alternative credit

financing vehicles and

has been managing

CLOS since 20047

Multiple term non-

recourse, non mark-

to-market financing

facilities

▪ Moderate leverage:

average Loan LTV

of 45.9%11 with an

average loan yield of

8.7%

1View entire presentation