Lyft Results Presentation Deck

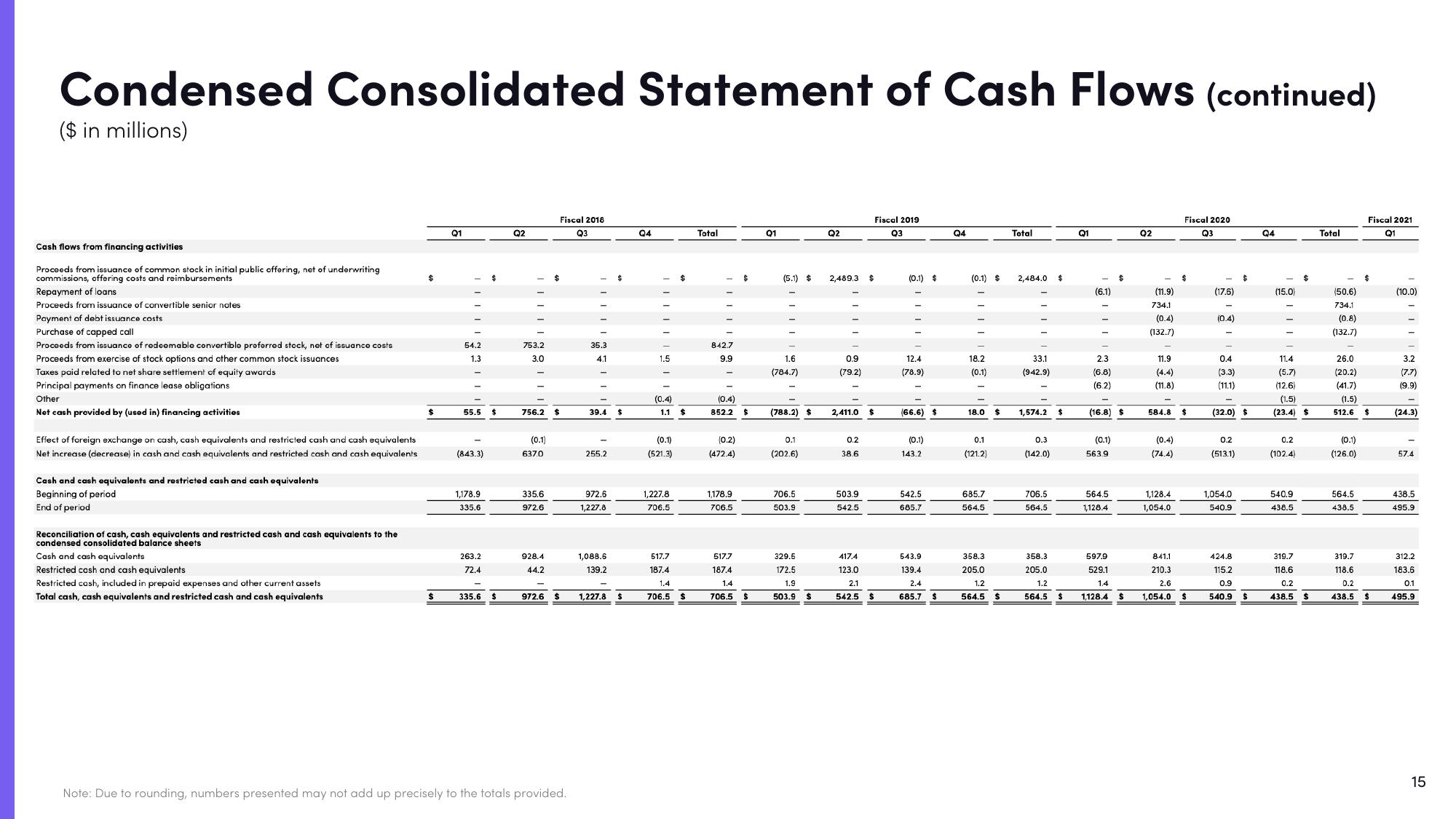

Condensed Consolidated Statement of Cash Flows (continued)

($ in millions)

Cash flows from financing activities

Proceeds from issuance of common stock in initial public offering, net of underwriting

commissions, offering costs and reimbursements

Repayment of loans

Proceeds from issuance of convertible senior notes

Payment of debt issuance costs.

Purchase of capped call

Proceeds from issuance of redeemable convertible preferred stock, net of issuance costs

Proceeds from exercise of stock options and other common stock issuances

Taxes paid related to net share settlement of equity awards

Principal payments on finance lease obligations

Other

Net cash provided by (used in) financing activities

Effect of foreign exchange on cash, cash equivalents and restricted cash and cash equivalents

Net increase (decrease) in cash and cash equivalents and restricted cash and cash equivalents

Cash and cash equivalents and restricted cash and cash equivalents

Beginning of period

End of period

Reconciliation of cash, cash equivalents and restricted cash and cash equivalents to the

condensed consolidated balance sheets

Cash and cash equivalents

Restricted cash and cash equivalents

Restricted cash, included in prepaid expenses and other current assets

Total cash, cash equivalents and restricted cash and cash equivalents

$

Q1

54.2

1.3

55.5 $

(843.3)

1,178.9

335.6

263.2

72.4

335.6

Q2

753.2

3.0

756.2 $

(0.1)

637.0

335.6

972.6

928.4

44.2

Fiscal 2018

Q3

972.6

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

35.3

4.1

39.4 $

255.2

972.6

1,227.8

1,088.6

139.2

1,227.8

Q4

IE

1.5

(0.4)

1.1

(0.1)

(521.3)

1,227.8

706.5

517.7

187.4

1.4

706.5

$

Total

842.7

9.9

(0.4)

852.2 $

(0.2)

(472.4)

1,178.9

706.5

517.7

187.4

1.4

706.5

Q1

(5.1) $

1.6

(784.7)

(788.2) $

0.1

(202.6)

706.5

503.9

329.5

172.5

1.9

503.9

Q2

2,489.3 $

0.9

(79.2)

2,411.0 $

0.2

38.6

Fiscal 2019

Q3

503.9

542.5

417.4

123.0

2.1

542.5

(0.1) $

12.4

(78.9)

(66.6) $

(0.1)

143.2

542.5

685.7

543.9

139.4

2.4

685.7 $

Q4

(0.1) $

8

18.2

(0.1)

18.0

0.1

(121.2)

685.7

564.5

358.3

205.0

1.2

564.5

$

Total

2,484.0

33.1

(942.9)

1,574.2

0.3

(142.0)

706.5

564.5

358.3

205.0

1.2

564.5

$

$

Q1

(6.1)

2.3

(6.8)

(6.2)

(16.8) $

(0.1)

563.9

564.5

1,128.4

$

597.9

529.1

1.4

1.128.4

Q2

(11.9)

734.1

(0.4)

(132.7)

11.9

(4.4)

(11.8)

(0.4)

(74.4)

584.8 $

1,128.4

1,054.0

Fiscal 2020

Q3

841.1

210.3

2.6

1,054.0

$

(17.6)

(0.4)

0.4

(3.3)

(11.1)

(32.0) $

0.2

(513.1)

1,054.0

540.9

$

424.8

115.2

0.9

540.9

Q4

(15.0)

11.4

(5.7)

(12.6)

(1.5)

(23.4) $

0.2

(102.4)

540.9

438.5

$

319.7

118.6

0.2

438.5

Total

(50.6)

734.1

(0.8)

(132.7)

26.0

(20.2)

(41.7)

(0.1)

(126.0)

(1.5)

512.6 $

564.5

438.5

Fiscal 2021

Q1

319.7

118.6

0.2

438.5

$

(10.0)

3.2

(7.7)

(9.9)

(24.3)

57.4

438.5

495.9

312.2

183.6

0.1

495.9

15View entire presentation