One Medical Investor Conference Presentation Deck

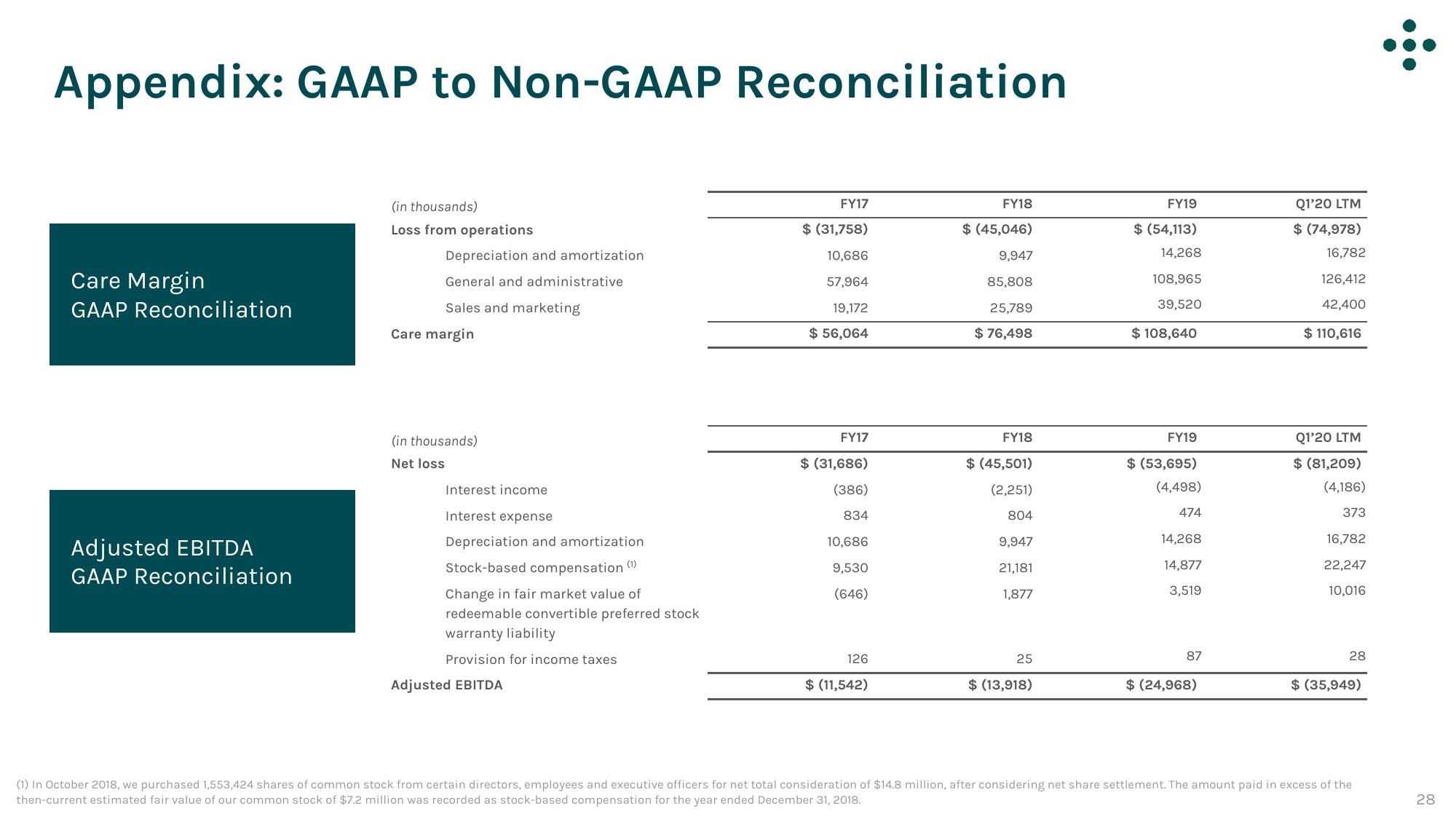

Appendix: GAAP to Non-GAAP Reconciliation

Care Margin

GAAP Reconciliation

Adjusted EBITDA

GAAP Reconciliation

(in thousands)

Loss from operations

Depreciation and amortization

General and administrative

Sales and marketing

Care margin

(in thousands)

Net loss

Interest income

Interest expense

Depreciation and amortization

Stock-based compensation (¹)

Change in fair market value of

redeemable convertible preferred stock

warranty liability

Provision for income taxes

Adjusted EBITDA

FY17

$ (31,758)

10,686

57,964

19,172

$ 56,064

FY17

$ (31,686)

(386)

834

10,686

9,530

(646)

126

$ (11,542)

FY18

$ (45,046)

9,947

85,808

25,789

$ 76,498

FY18

$ (45,501)

(2,251)

804

9,947

21,181

1,877

25

$ (13,918)

FY19

$ (54,113)

14,268

108,965

39,520

$ 108,640

FY19

$ (53,695)

(4,498)

474

14,268

14,877

3,519

87

$ (24,968)

Q1'20 LTM

$ (74,978)

16,782

126,412

42,400

$ 110,616

Q1'20 LTM

$ (81,209)

(4,186)

373

16,782

22,247

10,016

28

$ (35,949)

(1) In October 2018, we purchased 1,553,424 shares of common stock from certain directors, employees and executive officers for net total consideration of $14.8 million, after considering net share settlement. The amount paid in excess of the

then-current estimated fair value of our common stock of $7.2 million was recorded as stock-based compensation for the year ended December 31, 2018.

.:.

28View entire presentation