Azure Power Investor Presentation

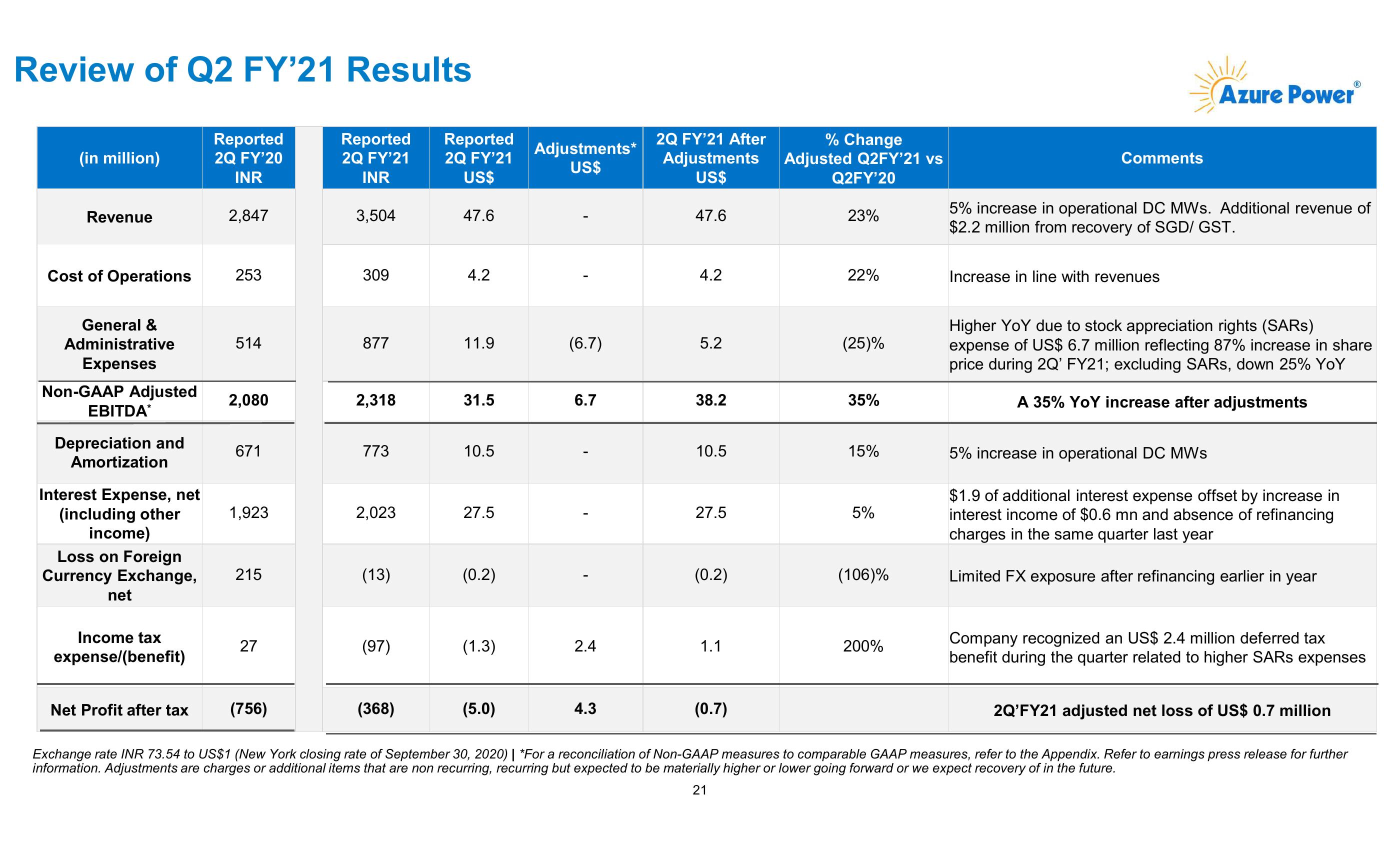

Review of Q2 FY'21 Results

(in million)

Reported

2Q FY'20

INR

Reported

2Q FY'21

INR

Reported

2Q FY'21

US$

2Q FY'21 After

% Change

Adjustments*

US$

Adjustments

Adjusted Q2FY'21 vs

US$

Q2FY'20

Revenue

2,847

3,504

47.6

47.6

23%

Cost of Operations

253

309

4.2

Comments

Azure Power

5% increase in operational DC MWs. Additional revenue of

$2.2 million from recovery of SGD/ GST.

4.2

22%

Increase in line with revenues

General &

Administrative

514

877

11.9

(6.7)

5.2

(25)%

Expenses

Non-GAAP Adjusted

2,080

2,318

31.5

6.7

38.2

35%

EBITDA*

Depreciation and

671

773

10.5

10.5

15%

Amortization

Interest Expense, net

(including other

1,923

2,023

27.5

27.5

5%

income)

Higher YoY due to stock appreciation rights (SARS)

expense of US$ 6.7 million reflecting 87% increase in share

price during 2Q' FY21; excluding SARS, down 25% YoY

A 35% YoY increase after adjustments

5% increase in operational DC MWs

$1.9 of additional interest expense offset by increase in

interest income of $0.6 mn and absence of refinancing

charges in the same quarter last year

Loss on Foreign

Currency Exchange,

215

(13)

(0.2)

(0.2)

(106)%

Limited FX exposure after refinancing earlier in year

net

Income tax

expense/(benefit)

27

(97)

(1.3)

2.4

1.1

200%

Net Profit after tax

(756)

(368)

(5.0)

4.3

(0.7)

Company recognized an US$ 2.4 million deferred tax

benefit during the quarter related to higher SARS expenses

2Q'FY21 adjusted net loss of US$ 0.7 million

Exchange rate INR 73.54 to US$1 (New York closing rate of September 30, 2020) | *For a reconciliation of Non-GAAP measures to comparable GAAP measures, refer to the Appendix. Refer to earnings press release for further

information. Adjustments are charges or additional items that are non recurring, recurring but expected to be materially higher or lower going forward or we expect recovery of in the future.

21View entire presentation