Pathward Financial Results Presentation Deck

HEALTHY BALANCE SHEET WITH ROBUST PAYMENT

DEPOSIT GROWTH

FIRST QUARTER ENDED DECEMBER 31, 2020

LO

5

BALANCE SHEET

($ in thousands)

Loans and leases

Allowance

Total assets

Noninterest-bearing checking

Total deposits

Total liabilities

Total stockholders' equity

Total liabilities and stockholders equity

for credit losses

Loans / Deposits

Net Interest Margin

Return on Average Assets

Return on Average Equity

●

●

●

$

$

1021

3,448,675

(72,389)

7,264,515

5,581,597

6,207,791

6,451,305

813,210

7,264,515

56 %

4.65 %

1.73 %

13.91 %

$

$

PERIOD ENDING

4Q20

3,322,765

(56,188)

6,092,074

4,356,630

4,979,200

5,244,766

847,308

6,092,074

67%

3.77 %

0.69 %

6.21 %

$

$

1Q20

3,590,474

(30,176)

6,180,926

2,927,967

4,517,605

5,343,858

837,068

6,180,926

79 %

4.94 %

1.38 %

10.04 %

$

$

AVERAGE

1021

3,341,023

(72,252)

6,481,823

4,880,314

5,426,443

5,675,676

806,147

6,481,823

62 %

4.65 %

1.73 %

13.91 %

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

$

$

1Q20

3,601,302

(28,853)

6,122,504

2,717,346

4,481,158

5,283,173

839,331

6,122,504

80 %

4.94 %

1.38 %

10.04 %

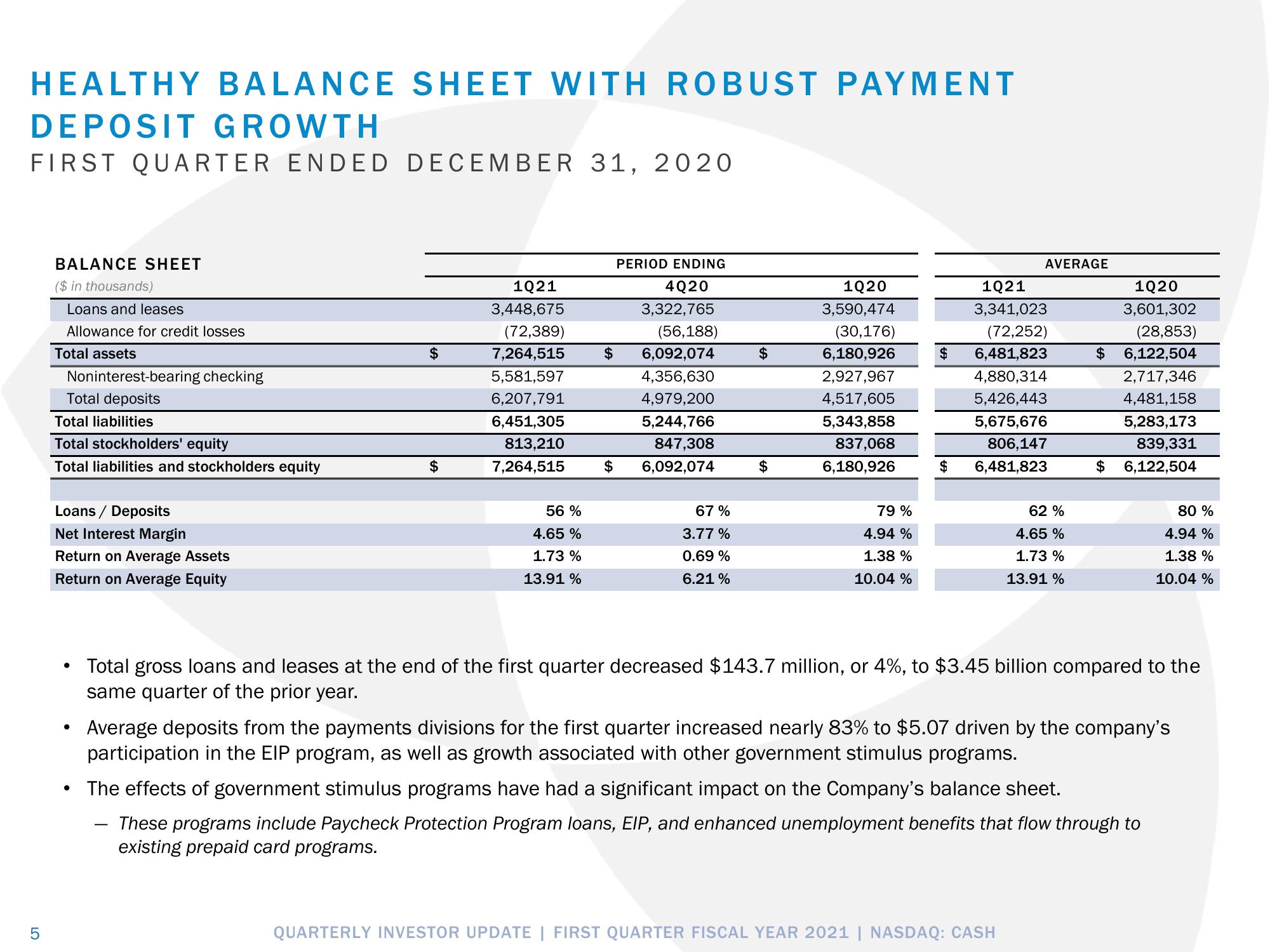

Total gross loans and leases at the end of the first quarter decreased $143.7 million, or 4%, to $3.45 billion compared to the

same quarter of the prior year.

Average deposits from the payments divisions for the first quarter increased nearly 83% to $5.07 driven by the company's

participation in the EIP program, as well as growth associated with other government stimulus programs.

The effects of government stimulus programs have had a significant impact on the Company's balance sheet.

These programs include Paycheck Protection Program loans, EIP, and enhanced unemployment benefits that flow through to

existing prepaid card programs.View entire presentation