Truist Financial Corp Results Presentation Deck

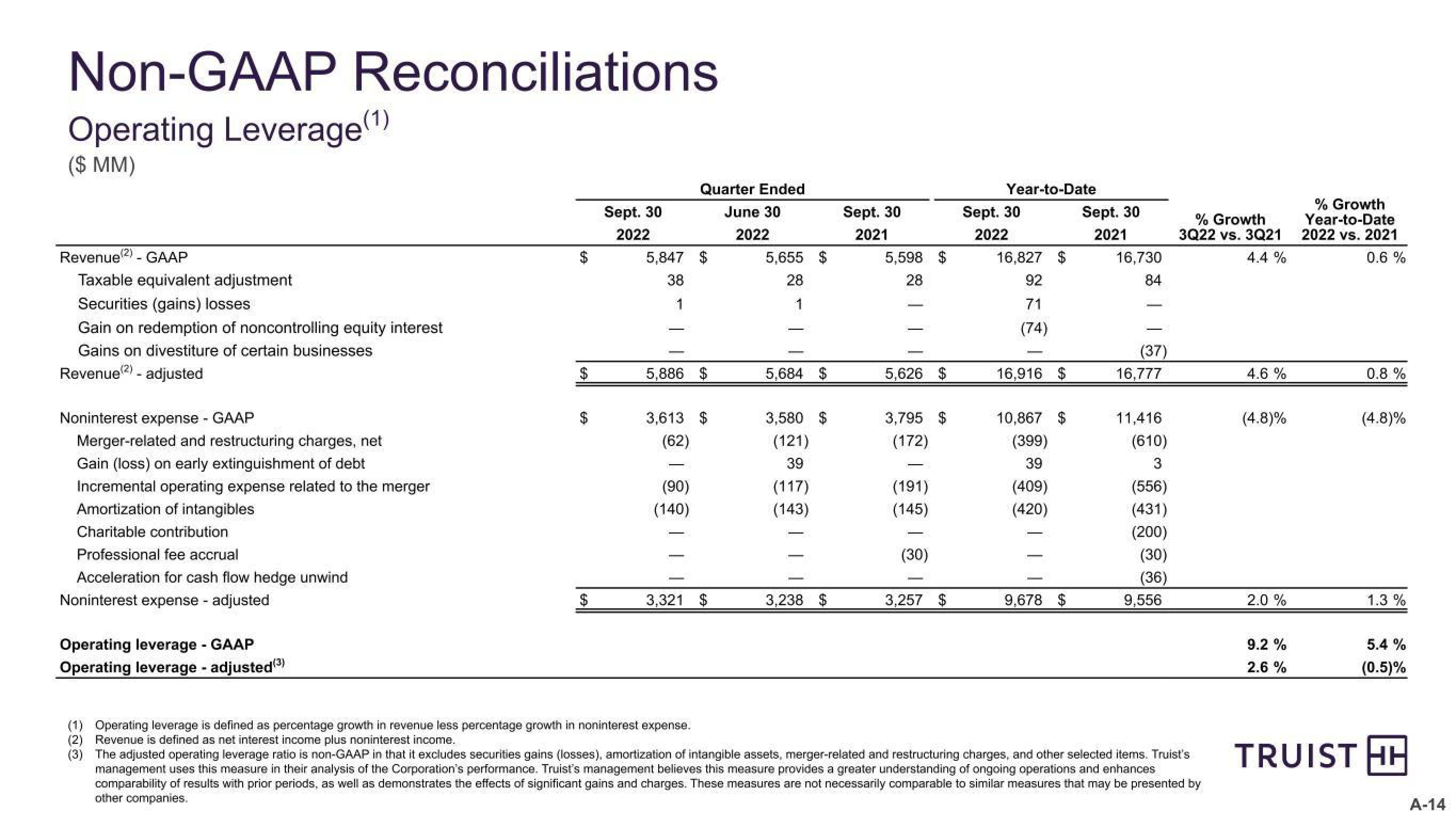

Non-GAAP Reconciliations

Operating Leverage (1)

($ MM)

Revenue(2) - GAAP

Taxable equivalent adjustment

Securities (gains) losses

Gain on redemption of noncontrolling equity interest

Gains on divestiture of certain businesses

Revenue(2) - adjusted

Noninterest expense - GAAP

Merger-related and restructuring charges, net

Gain (loss) on early extinguishment of debt

Incremental operating expense related to the merger

Amortization of intangibles

Charitable contribution

Professional fee accrual

Acceleration for cash flow hedge unwind

Noninterest expense - adjusted

Operating leverage - GAAP

Operating leverage - adjusted (3)

$

$

Sept. 30

2022

5,847 $

38

1

| |

Quarter Ended

June 30

2022

5,886 $

3,613 $

(62)

(90)

(140)

3,321 $

5,655 $

28

1

5,684 $

3,580 $

(121)

39

(117)

(143)

3,238 $

Sept. 30

2021

5,598 $

28

5,626 $

3,795 $

(172)

(191)

(145)

(30)

3,257 $

Year-to-Date

Sept. 30

2022

16,827 $

92

71

(74)

16,916 $

10,867 $

(399)

39

(409)

(420)

9,678 $

Sept. 30

2021

16,730

84

(37)

16,777

11,416

(610)

3

(556)

(431)

(200)

(30)

(36)

9,556

% Growth

3Q22 vs. 3Q21

4.4 %

(1) Operating leverage is defined as percentage growth in revenue less percentage growth in noninterest expense.

(2) Revenue is defined as net interest income plus noninterest income.

(3) The adjusted operating leverage ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, merger-related and restructuring charges, and other selected items. Truist's

management uses this measure in their analysis of the Corporation's performance. Truist's management believes this measure provides a greater understanding of ongoing operations and enhances

comparability of results with prior periods, as well as demonstrates the effects of significant gains and charges. These measures are not necessarily comparable to similar measures that may be presented by

other companies.

4.6 %

(4.8)%

2.0%

9.2 %

2.6 %

% Growth

Year-to-Date

2022 vs. 2021

0.6 %

0.8 %

(4.8)%

1.3 %

5.4 %

(0.5)%

TRUIST HH

A-14View entire presentation