AngloAmerican Investor Presentation Deck

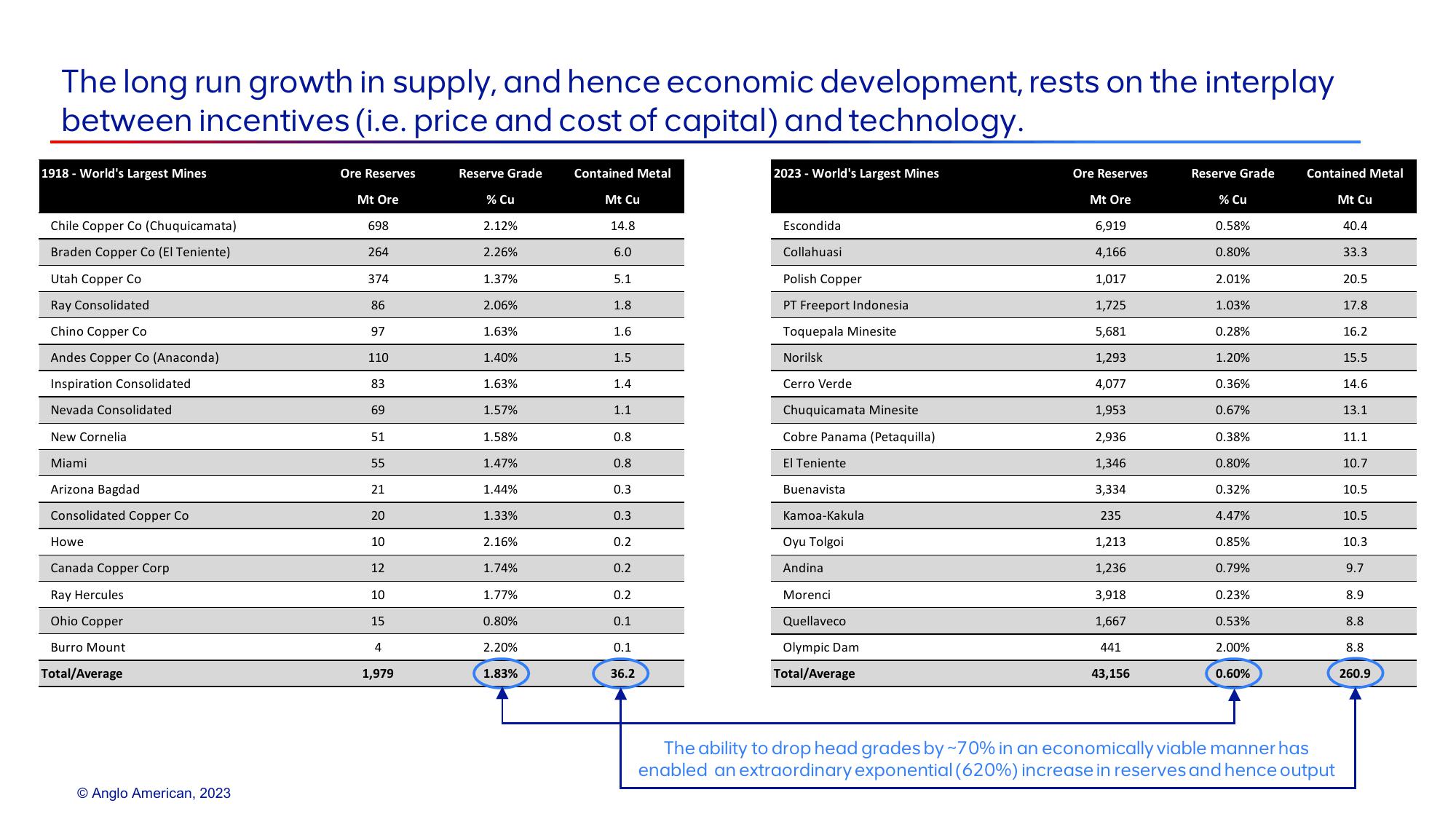

The long run growth in supply, and hence economic development, rests on the interplay

between incentives (i.e. price and cost of capital) and technology.

1918 - World's Largest Mines

Chile Copper Co (Chuquicamata)

Braden Copper Co (El Teniente)

Utah Copper Co

Ray Consolidated

Chino Copper Co

Andes Copper Co (Anaconda)

Inspiration Consolidated

Nevada Consolidated

New Cornelia

Miami

Arizona Bagdad

Consolidated Copper Co

Howe

Canada Copper Corp

Ray Hercules

Ohio Copper

Burro Mount

Total/Average

Anglo American, 2023

Ore Reserves

Mt Ore

698

264

374

86

97

110

83

69

51

55

21

20

10

12

10

15

4

1,979

Reserve Grade

% Cu

2.12%

2.26%

1.37%

2.06%

1.63%

1.40%

1.63%

1.57%

1.58%

1.47%

1.44%

1.33%

2.16%

1.74%

1.77%

0.80%

2.20%

1.83%

Contained Metal

Mt Cu

14.8

6.0

5.1

1.8

1.6

1.5

1.4

1.1

0.8

0.8

0.3

0.3

0.2

0.2

0.2

0.1

0.1

36.2

2023 World's Largest Mines

Escondida

Collahuasi

Polish Copper

PT Freeport Indonesia

Toquepala Minesite

Norilsk

Cerro Verde

Chuquicamata Minesite

Cobre Panama (Petaquilla)

El Teniente

Buenavista

Kamoa-Kakula

Oyu Tolgoi

Andina

Morenci

Quellaveco

Olympic Dam

Total/Average

Ore Reserves

Mt Ore

6,919

4,166

1,017

1,725

5,681

1,293

4,077

1,953

2,936

1,346

3,334

235

1,213

1,236

3,918

1,667

441

43,156

Reserve Grade

% Cu

0.58%

0.80%

2.01%

1.03%

0.28%

1.20%

0.36%

0.67%

0.38%

0.80%

0.32%

4.47%

0.85%

0.79%

0.23%

0.53%

2.00%

0.60%

Contained Metal

The ability to drop head grades by ~70% in an economically viable manner has

enabled an extraordinary exponential (620%) increase in reserves and hence output

Mt Cu

40.4

33.3

20.5

17.8

16.2

15.5

14.6

13.1

11.1

10.7

10.5

10.5

10.3

9.7

8.9

8.8

8.8

260.9View entire presentation